Summing up the results of the outgoing year, we always want to give it some capacious description, add a sonorous epithet to it, describing its results in one or a few words. But this time it is a difficult task.

What was 2022 for Ukraine, its citizens, and the economy, and what epithet does it deserve? “Tragic” sounds too banal, “turning point” sounds too pretentious, and “extraordinary” does not convey all the horrors and hardships that it brought. “Gloomy” is also not suitable, because the country has not plunged into darkness, which some people dream of. It cannot be called “ambiguous” either, since for any sane person on February 24 everything became extremely unambiguous.

Perhaps the closest description of 2022 is “a year of losses, a year of hopes”. Someone lost a loved one this year, someone lost their business, and Ukraine lost a significant part of its territory. But at the same time, 2022 in Ukraine is the year of national unity, the year of a successful fight against the criminal aggressor, and the year when for many, the mood for life turned from “everything is lost” to a clearly tangible hope of victory.

What did the Ukrainian horticulture business lose in the outgoing 2022, and what hopes for the future did it bring to the participants of the market? Let’s remember everything from the very beginning.

January-February 2022 – winter that will never come back

Let us briefly recall how the fruit and vegetable business of Ukraine lived at the beginning of the outgoing year, what plans it made, and what it expected, and much of this now seems incredible and causes only a bitter smirk.

At the beginning of the year, Ukrainian exporters of many products were seriously talking about Belarus as the main importer of their goods, completely unaware that very soon this country would respond with rockets and a Russian tank invasion.

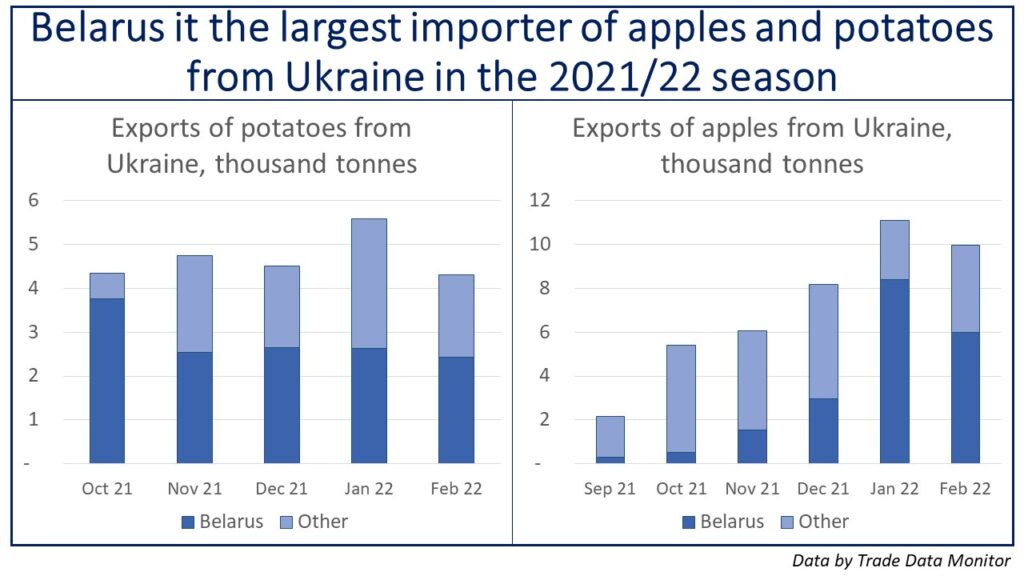

In January-February 2022, Ukraine exported record 9 900 tonnes of potatoes, 51% of which were sold to Belarus. In total, from October 2021 to February 2022, Ukrainian potato exports reached a record 24 000 tonnes, of which 14 000 tonnes (58%) were delivered to Belarus.

Belarus also remained a key export market for Ukrainian apples during this period. Although its share in exports was still smaller than in the potato segment, it was the Belarusian market that provided records for Ukrainian exports. So, Ukrainian exporters sold 21 000 tonnes of apples in January-February 2022, and exports from September 2021 to February 2022 reached a record 43 000 tonnes, with a share of Belarus of 46%.

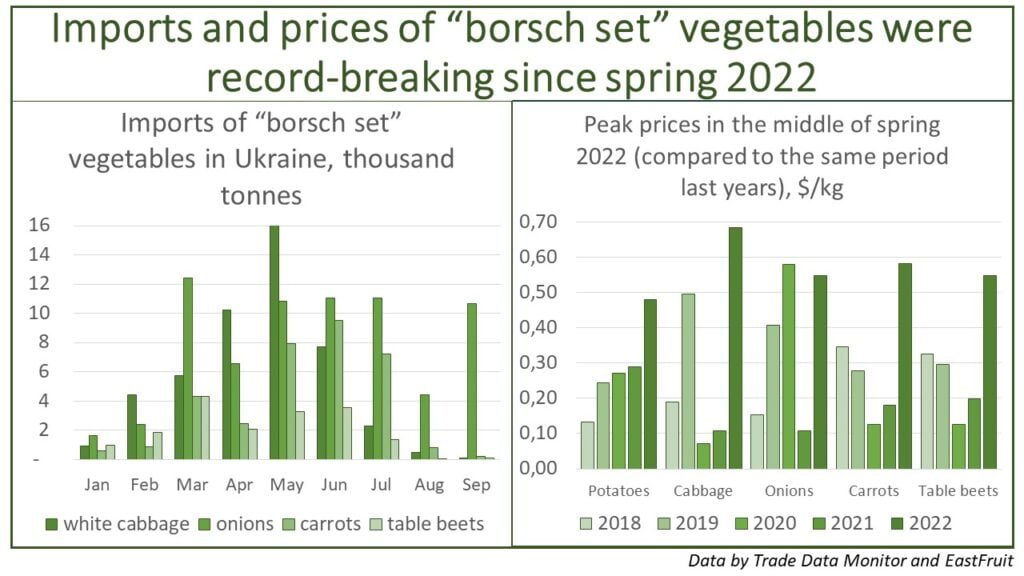

In turn, participants in the market for borsch vegetables have been gradually preparing for a slight increase in imports of high-quality products amid issues with local production in 2021. At the same time, they could not even imagine that since spring, imports would enter the Ukrainian market so firmly that they would form prices not only for onions, as it had happened several times before but also for other vegetables.

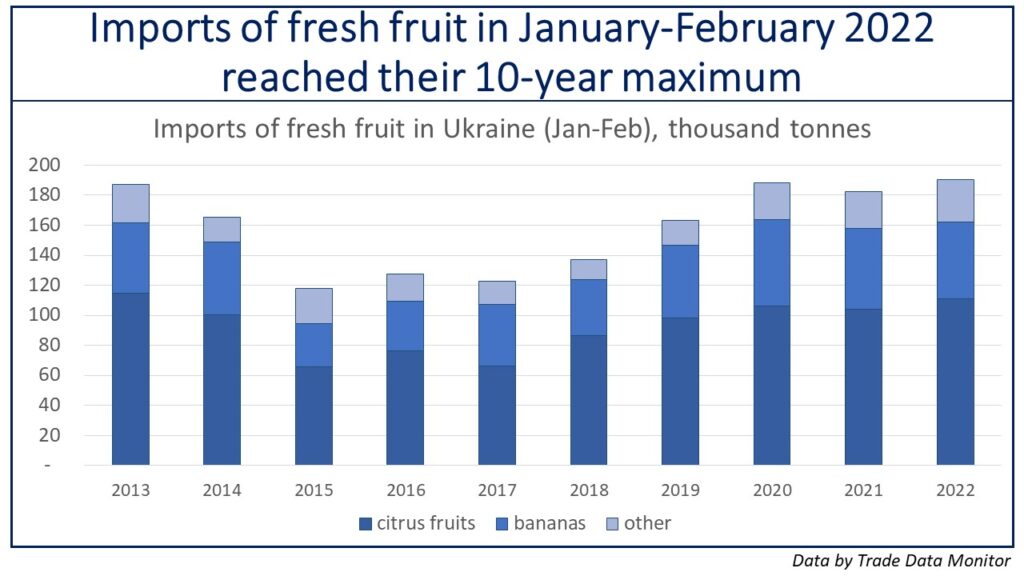

Fresh fruit importers kept up with their counterparts and took advantage of the recovery of the Ukrainian economy after COVID-19 and the increased demand for exotic and other fruits. As a result, imports of fresh fruits in January-February 2022 reached a 10-year high of 190 000 tonnes, while the share of bananas and citrus fruits in it decreased due to an increase in the share of more exotic categories.

In other words, winter was a calm, quiet continuation of the 2021/22 fruit and vegetable season with a sufficient supply of most local products, stable growth in exotic imports, and recovering demand for such categories. But this was disrupted on February 24.

March-May 2022 – spring of losses

The rapid advance of the troops of Russian aggressors in Ukraine was stopped at the borders of the Zhytomyr, Kyiv, Poltava, Dnipropetrovsk, and Mykolaiv regions. In fact, almost a fifth of the territory of Ukraine was occupied at one point, although in April the Russian troops were driven out from the north, and the Kyiv, Chernihiv, and Sumy regions were cleared of the invaders.

However, this scale of occupation and fighting had long-term consequences both for the entire economy of the country and the fruit and vegetable business. According to the latest UN estimates, due to hostilities, about 8-9 million people left Ukraine and did not return, and the number of internally displaced persons in the country reaches 8 million people. For the fruit and vegetable business, this meant both a decrease in the total number of consumers and a decline in the average consumption rate, because mainly women and children left the country and there was a geographical shift in consumption from the capital and east to west.

Spring, and especially its first weeks, also brought the country a trade and logistics collapse and a fall in the real exchange rate of the Ukrainian hryvnia (UAH), to which the National Bank reacted with an official devaluation only in the summer. Broken distribution centers, warehouses, and shops (for example, only the ATB-Market chain lost 4 distribution centers since the beginning of the war) led to the partial destruction of the well-established system of internal logistics of vegetables and fruits.

In turn, the difficult situation at customs endangered Ukrainian exports, and imports, which were already expensive due to real devaluation, became even more expensive. The fuel crisis worsened the situation, reaching its climax in the spring. Given all this, the cost of internal and external logistics in the country in some areas has almost doubled.

As a result, the consequences of spring losses immediately affected both the current situation in the horticulture market and its prospects for the next few seasons. The inability to get seed and planting material, plant protection products, fuel, fertilizers, and other goods on time and in the right volumes had a disastrous effect on the local production sector.

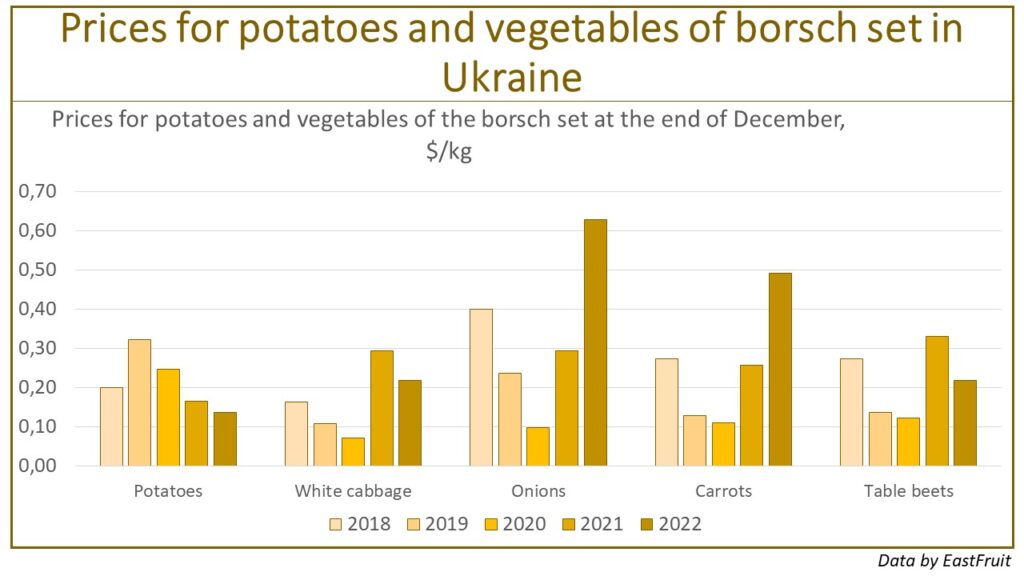

Active hostilities and occupation led to a shortage and an increase in prices for products that were put into storage in the fall of 2021. The prices rose not only for carrots or onions, for which it would have been expected anyway but even for potatoes – there were no prerequisites for a price rise, even despite active exports to Belarus.

We note that, although the situation was catastrophic, the issue of shortages was resolved by imports, although the price for this was a record high. Thus, the total import of vegetables of the borsch set in March-May 2022, compared to the spring of last year, quadrupled and reached a record 86 000 tonnes! These volumes initially replaced last year’s stocks in storage facilities that remained under occupation or suffered from hostilities, but over the course of spring, they began to make up for the shortage of new crop products.

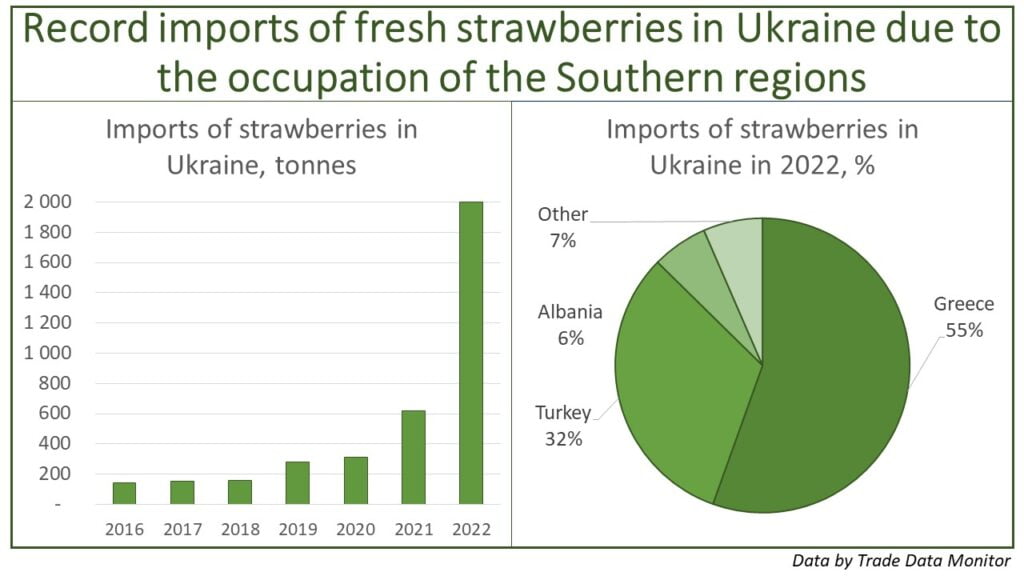

By the end of April, most of the districts of the Kherson and Zaporizhzhia regions, which are the center of the production of early vegetables and fruits in Ukraine, remained under Russian occupation. Their access to the Ukrainian market was almost completely blocked, which was an additional reason for such a sharp increase in imports and prices. Besides vegetables from the borsch set, this also led to a shortage of greenhouse products, as well as early berries. Thus, imports of fresh strawberries in March-May 2022 quadrupled to a record 1 800 tonnes, allowing suppliers from Turkey, Greece, Albania, and some other countries to make good money.

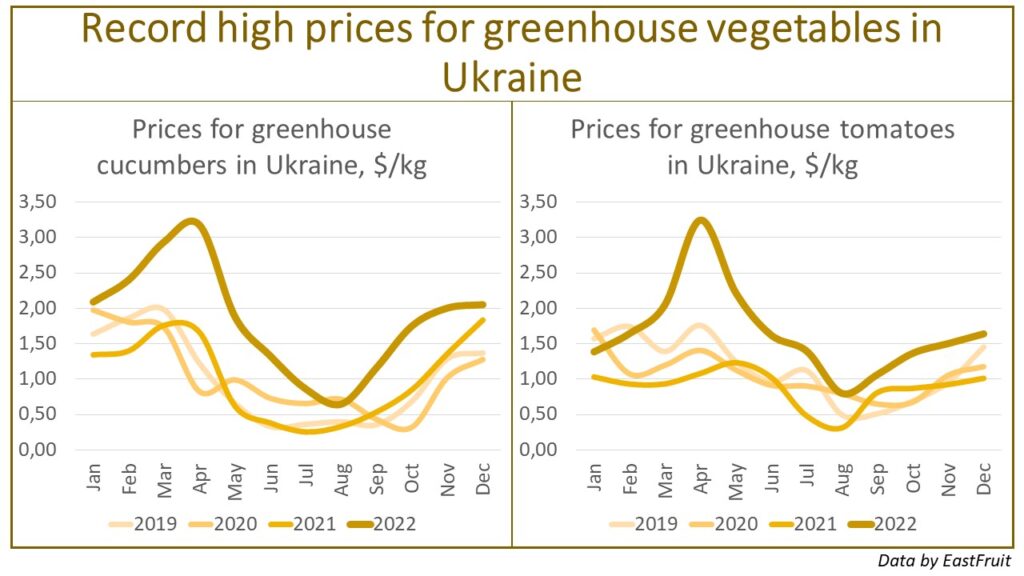

In addition to imports, the temporary withdrawal of southern producers from the Ukrainian market was compensated by farmers from non-occupied or liberated territories that could sell their products. Thus, greenhouse plants in the northern and western regions, both in the spring and summer of this year, could receive record prices for greenhouse cucumbers and tomatoes even in dollar terms after the devaluation of the Ukrainian currency.

June-August 2022 – summer of first victories

The spring shock and collapse in Ukraine gradually subsided by the summer, and the country and its economy, despite all the difficulties, survived and got the first tangible victories in the summer – maritime logistics was unblocked and most of the Kharkiv region was liberated. Nevertheless, the first victories were at the end of summer, and at its beginning, the situation in many segments of vegetables and fruits (especially seasonal ones) in Ukraine only worsened.

Prices for borsch vegetables of the new harvest remained at record levels despite record imports, and there were similar trends in the segment of greenhouse vegetables. In the meantime, there was a paradox in the stone fruit market: despite the loss of the production base in the south, prices in the non-occupied part of Ukraine were not record-breaking high and rarely exceeded last year’s figures. Moreover, given a real, and then official, devaluation of the UAH, producers of cherries, apricots, peaches, and plums from the free regions of the country ended up with bad results of the season.

Their colleagues in the occupied regions were content with even lower prices, which were shocking sometimes when compared to Kyiv or the western regions. The difference in prices in such cases was two, three, four, or even more times!

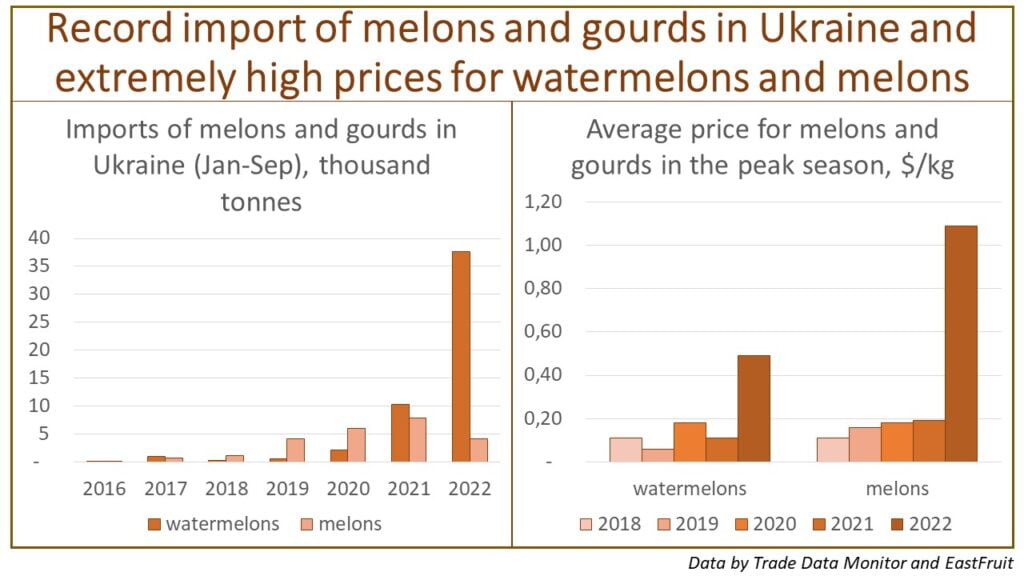

An example of melons is indicative. Farmers in the occupied regions had to sell their products for nothing if they could harvest them, but prices and imports in the rest of Ukraine remained extremely high. At the peak of the supply of melons on the Ukrainian market, the average prices for watermelons were almost 12 times higher than last year, and melons were offered 6-8 times more expensive! At the same time, Ukraine was forced to import 35 000 tonnes of watermelons and 2 800 tonnes of melons to compensate for the deficit. Interestingly, imports of melons were still lower than last year, while watermelon imports reached a record.

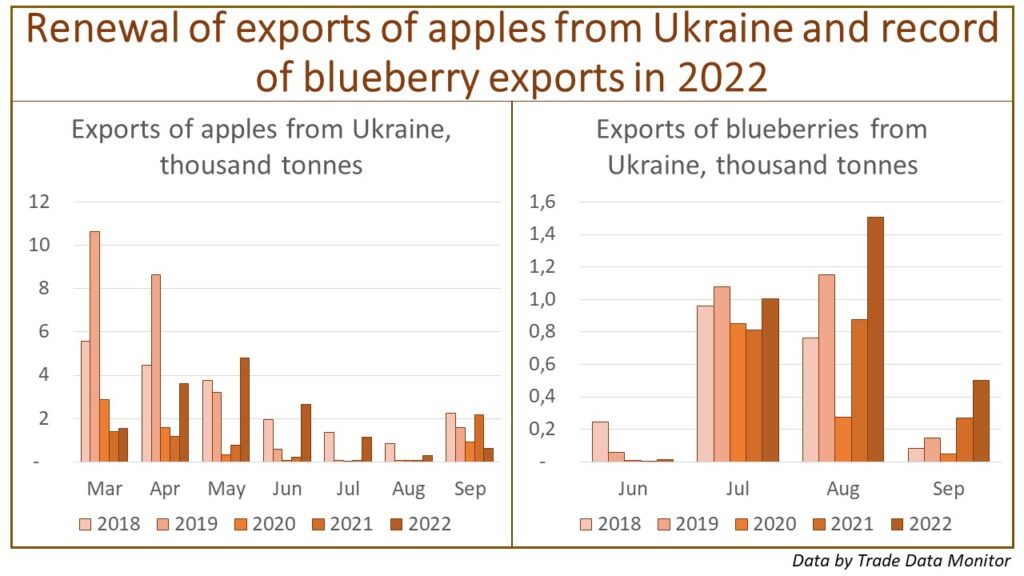

Naturally, Ukrainian exporters had to forget about the export of watermelons this season. Some other products still showed good export results despite the expensive logistics and economic downturn. Thus, the export of apples in the summer recovered in May after falling in March-April, and it almost reached a record in the summer months, amounting to 4 100 tonnes. Another export record was set by Ukrainian exporters in the supply of blueberries to the global market. In the entire export season (till the end of September), their exports exceeded 3 000 tonnes for the first time.

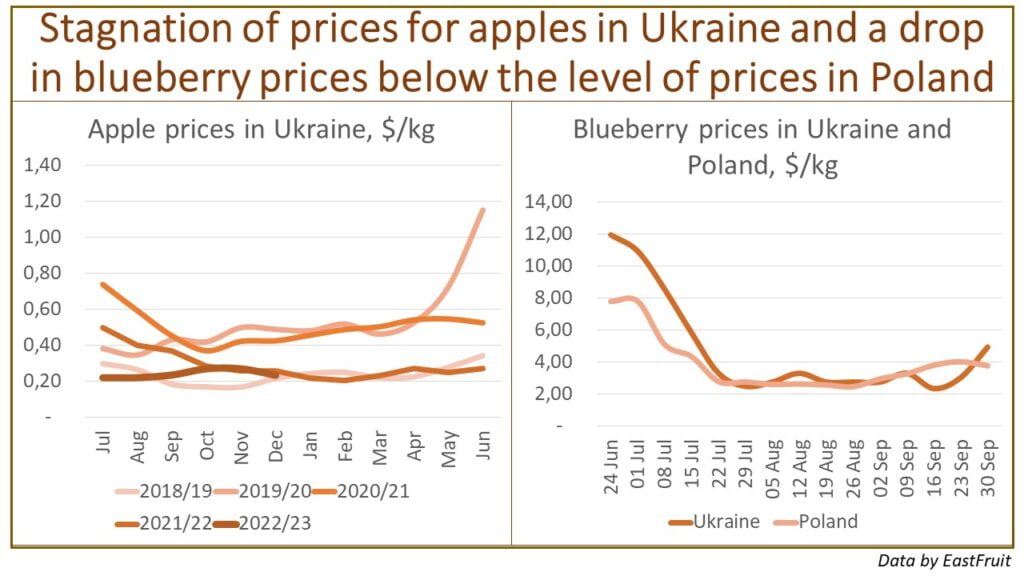

The exports of apples and blueberries were more of a forced measure for Ukrainian producers than a balanced and responsible decision. The sales on the domestic apple market, which had been stagnating after the departure of women and children abroad, fell even more. Similar negative trends were recorded in the blueberry market, where more and more new plantations began to bear fruit annually. By the way, Ukraine became the eighth in the world in terms of areas of blueberry plantations in 2022!

However, this fact did not bring good prices to the country, and due to the devaluation of the national currency, the average price for Ukrainian blueberries fell to a record low of $2.32/kg, and for some time in the summer, it was even lower than in the Polish market. Apples were also offered at record-low prices in the summer despite quite active exports from Ukraine.

September-December 2022 – autumn of hopes and new winter of new challenges

The summer successes of the Ukrainian army gave a feeling of an imminent victory, which, as it seemed, was very close, especially since the long-awaited liberation of Kherson in the fall. Although there is still a very long time before the final victory, it was autumn that returned confidence to the Ukrainians and made it possible to make further plans even in the current most difficult circumstances.

All the rumors about the impending food disaster remained rumors, although Ukrainian citizens still had to pay extremely high prices for vegetables. Even harvesting at the end of summer and autumn could not bring down the prices, which continued to beat records for cabbage, table beets, and especially onions and carrots. Plans for the relocation of enterprises from the occupied and affected regions remained just plans as it was not easy to quickly establish production and storage in the new conditions.

Some exceptions in the autumn were, to a lesser extent, table beets and, to a greater extent, potatoes. Unlike table beets which were only slightly cheaper at the end of the year than in the same period last year, potato prices fell to a four-year low even in UAH, not to mention their prices in USD after the devaluation. Many new inexperienced players entered the potato segment this year, and the areas of potato plantations in the households greatly increased. As a result, prices have fallen, the quality of potatoes has declined, and even the need to import high-quality potatoes, which flooded the shelves of Ukrainian supermarkets, arose.

Similarly, there were record prices in the market of greenhouse cucumbers and tomatoes. However, very few growers took advantage of these prices as the cold weather approached, as even their record-breaking performance rarely offset the increase in production costs due to the energy crisis.

As for apples, their real prices in USD fell to the 2018 level, and exports slowed down due to the closure of the Belarusian market, as well as a general decline in both the production of apples and their quality in the country.

With the onset of cold weather, the problem of constant shelling of the Ukrainian energy infrastructure by Russian troops was added to the issue of the record-high cost of electricity. As a result, many greenhouse complexes in Ukraine have decided not to enter the winter period of production. Many owners of fruit and vegetable stores did the same, preferring to sell their products either in autumn or after the onset of the first cold weather.

What is going to happen next?

Thinking about the future and making long-term forecasts is a useless task, especially in such difficult conditions in which Ukraine is now. Much depends on whether there will be a real blackout in the country, how soon the remaining occupied regions will be liberated, whether victory will be imminent, whether the conflict with Russia will have to be frozen, whether most of the emigrants will return to Ukraine, etc.

Some conclusions can be drawn now, although, of course, they will be corrected over time.

The sector of potatoes and vegetables of the borsch set will most likely remain the “vegetable casino”. The current low prices for potatoes may kill the desire of this year’s newcomers to continue the potato business, while the record prices for vegetables of the borsch set, on the contrary, will attract the attention of those who want to make a quick profit. The limiting factor here will be something that many potato and vegetable growers forget about – Ukraine is only a part of the global fruit and vegetable market, so the import factor can never be discounted!

The greenhouse sector, which has been in crisis for many years, will most likely continue to deteriorate, and only those who can successfully compete with cheap imports will remain among its players. At the same time, not only plants that can offer a price lower than the imported one will be successful, but also enterprises relying on the quality, refinement of their products, and uniqueness of the offer. The state program to support the greenhouse industry should also not be discounted, although its results will be clear only by the end of autumn 2023.

The absence of the Belarusian market has become a heavy blow for the apple sector in Ukraine, and the situation can only get worse next season. According to rough estimates, it will take two or three seasons to replace the volumes that Belarus previously consumed. This means that, in the absence of any weather or trade disasters and while maintaining the current structure of apple consumption in the country, there will most likely be no price increases. Moreover, the uprooting of apple plantations in Ukraine will accelerate due to increased competition in the domestic fresh market.

Some apple producers will be able to take advantage of the recovery in the global apple concentrate market after the COVID-19 crisis, but there will be little pleasure for them. Since the concentrate is a relatively cheap product, the Ukrainian processors will shift the increase in the costs of its production and logistics to the producers of raw materials. Nevertheless, there is still no catastrophe in the Ukrainian apple market, but those who can efficiently control their spending and offer good-quality apples, including those for exports, will be able to have a decent income.

Quality and the possibility of exporting will be key components of the success of stone fruit producers. During the active expansion of plantations of stone fruit orchards to the north, a decrease in the number of active consumers in Ukraine, a constant threat of imports, and a crisis in processing, it will be hard for Ukrainian producers to find their place on the local market. Nevertheless, it will still be early to talk about the active development of stone fruit exports in the coming seasons, which means that the work is most likely not to be rosy for such producers.

Processing is likely to remain a key driver for the development of the berry market in Ukraine. The path that Ukrainian strawberry (to a lesser extent) and raspberry (to a greater extent) freezers have done will serve as a good help for the further development of the berry sector. Nevertheless, and unfortunately, much will depend on the situation in the leading countries of the market (Mexico, Spain, Morocco, Egypt, Serbia, Poland), many of which have much more attractive working conditions than Ukraine. As for blueberries, Ukraine will most likely be forced to develop processing in the coming years, as blueberries are tending to become cheaper than raspberries, which happened on the global market a long time ago.

The nut business remains a tough nut to crack in the horticultural sector – despite the decline in exports in physical terms, export earnings did not decrease in the 2021/22 season. Further business prospects are still unclear since much will depend on the global market, which is sensitive to various economic crises, and on the ability to offer good-quality products, which was problematic for Ukrainian nut growers in recent years.

Processing is most likely not to recover from rising electricity prices and the loss of a production base in the south of the country soon. For example, exports of tomato paste in January-September 2022 fell almost to the level of 2015 and slightly exceeded imports: 14 100 tonnes against 8 400 tonnes. For comparison, Ukraine exported 37 500 tonnes and imported only 2 800 tonnes of tomato paste in January-September 2021.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.