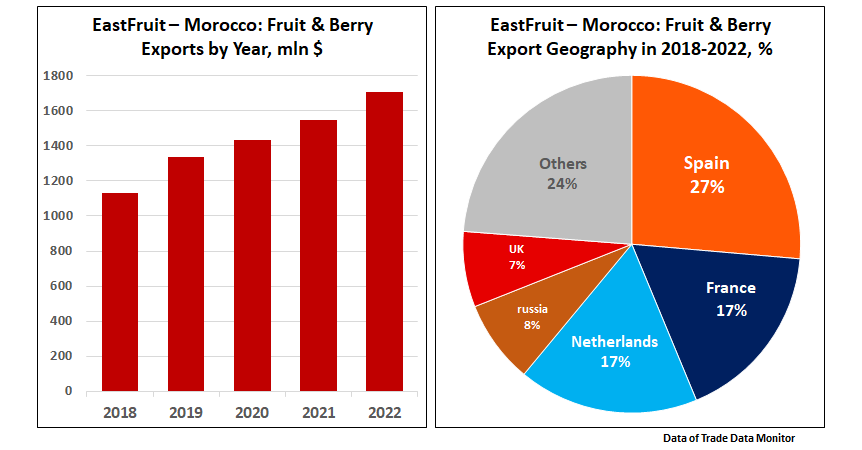

Morocco has been continuously increasing its fruit and berry exports, with France and the UK accounting for the most important part in this growth, as reported by EastFruit. In 2018-2022, Moroccan fruits and berries were available on the markets of 122 countries, with Spain, France, the Netherlands, Russia and the UK heading the list of key importers. Meanwhile, exports to France and the UK were growing, while Spain, the Netherlands and russia were importing less Moroccan produce.

Since 2018, the Moroccan fruit and berry export revenues have grown by almost a half. In 2022, they totaled $1.7 bln, and their cumulative volume over 2018-2022 amounted to $7.1 bln.

Read also: Moroccan vegetable exports revenues up by two thirds in five years

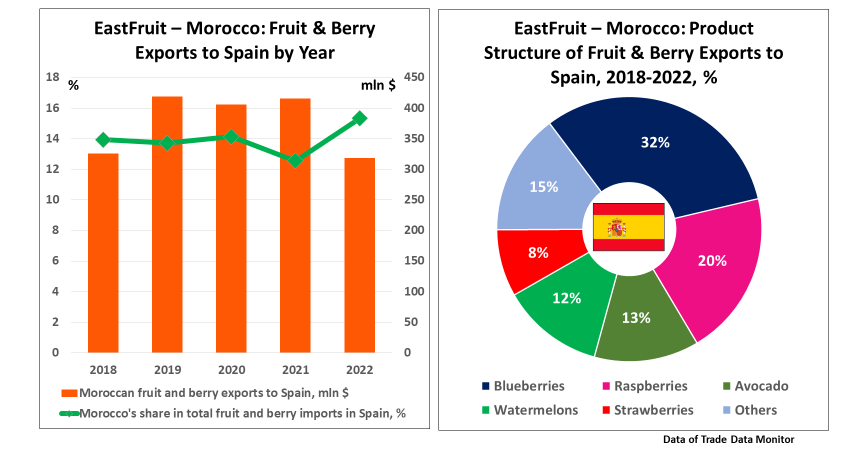

Spain is the biggest importer of Moroccan fruits and berries and accounted for about 27% of Morocco’s total exports in the past five years. Meanwhile, Morocco was the fourth largest supplier of fruits and berries to Spain in 2022 with the share of 15% in Spain’s total imports. Nevertheless, the revenues from the Moroccan exports to Spain fell by 23% compared to 2021.

Blueberries bring almost a third of Morocco’s total revenues from exports to Spain. A few years ago, the share of Spain in Morocco’s blueberry exports exceeded 90%, but then it was decreasing year by year, as previously reported by EastFruit.

In 2022, Morocco was the the fourth biggest exporter of blueberries globally, and Spain ranked third. Besides blueberries, Spain also imports Moroccan raspberries, avocado, watermelons, strawberries, etc. Partially these volumes are then re-exported by Spanish traders, which extends their own export season.

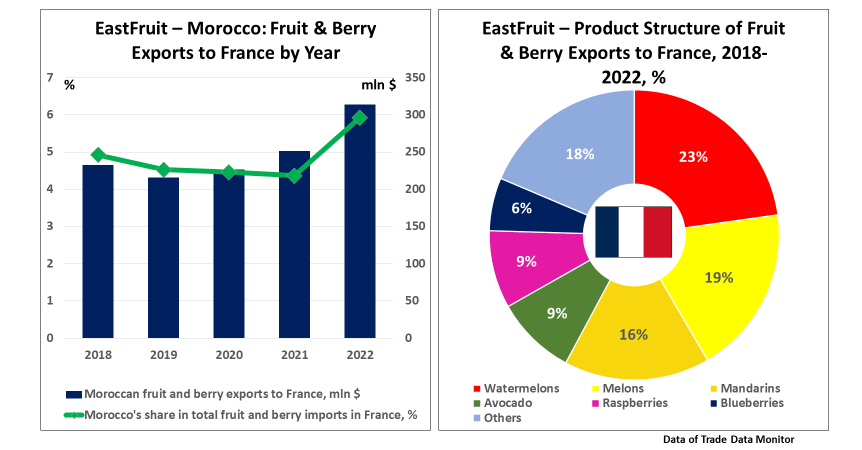

Fruit and berry exports to France brought $1.2 bln to Morocco in 2018-2022 (17% from the total revenues). In 2022, the share of Morocco in France’s total imports of fruits and berries reached 6%, and France gave almost the same revenues as Spain. Morocco is now the fifth largest supplier of fruits and berries to France, with the most active demand shown for Moroccan watermelons, melons, mandarins, avocado, raspberries, and blueberries.

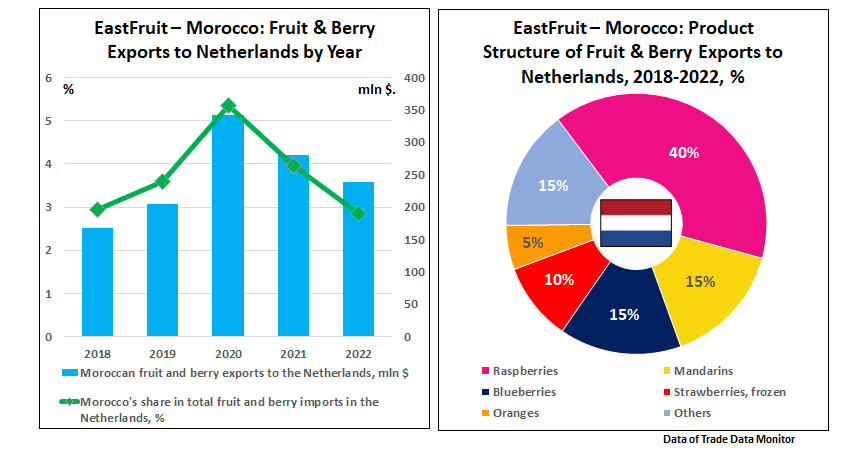

The Netherlands brought 17% of Morocco’s total revenues from fruit and berry exports: $1.2 bln. However, exports to the Netherlands were declining since 2020. Raspberries account for about 40% of Morocco’s total exports to this market, and the Netherlands, along with Spain, is the key importer of Moroccan raspberries. Growing raspberry exports resulted in Morocco to have become the third major exporter of raspberries globally. In the Dutch market, Morocco is the tenth biggest supplier of raspberries.

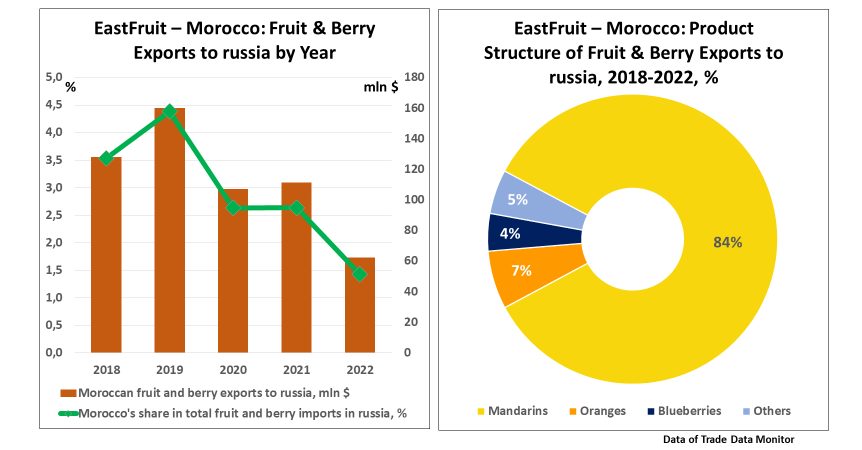

The Moroccan fruit and berry exports to russia show the most negative trend. Over the past five years, Morocco’s share in the Russian market has more than halved, and exports in 2022 took just a half of those in 2018. Morocco also descended to the 16th position in the ranking of russia’s biggest suppliers. Mandarins are still the most exported category in Moroccan exports to russia and account for 84% of total revenues.

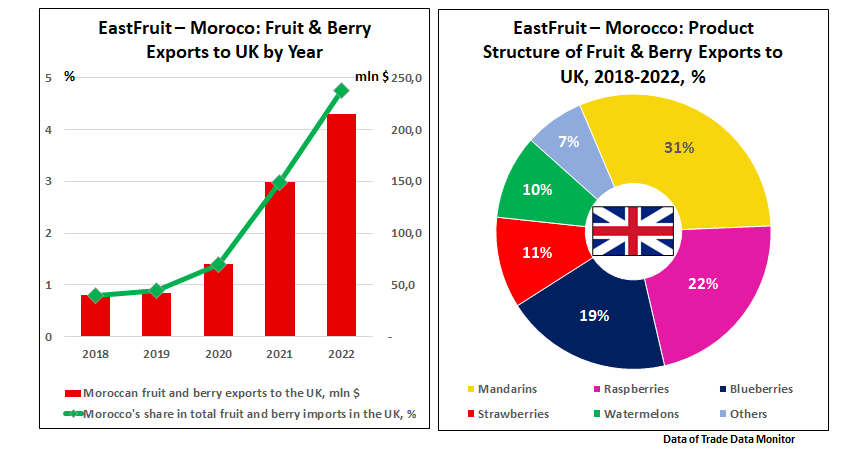

Meanwhile, the Moroccan fruit and berry exports to the UK showed the most active growth rates in 2018-2022. As previously reported by EastFruit, the UK-EU trade became more complicated after the Brexit; therefore, alternative suppliers improved their positions in the British market. The share of Morocco grew sixfold, exports to the UK quintupled, and Morocco ranked fifth in the list of the UK’s biggest suppliers of fruits and berries.

Importers from the UK are especially interested in Moroccan berries, with blueberries, raspberries, and strawberries accounting for about a half of total exports to the British market. Watermelons are as well exported, and mandarins account for the share of almost a third. By the way, mandarins are the most exported fruit category in Morocco, and the country ranks fifth in the global ranking of mandarin exporters.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.