Egypt will export a record volume of garlic to the EU countries in 2023, according to EastFruit. However, the pace of export growth in this direction may slow down slightly this year, although the volume of exports for the first eight months of the year already exceeds its indicator for the whole of last year.

“Garlic exports from Egypt have been growing actively in recent years. Nevertheless, this year the volumes of Egyptian shipments for various reasons will only slightly exceed the 2022 figure. It seems that the country has so far reached a certain ceiling of its capabilities in the EU market, and overcoming it will be a serious challenge for Egyptian exporters from next year,” warns Yevhen Kuzin, Fruit & Vegetable Market Analyst at EastFruit.

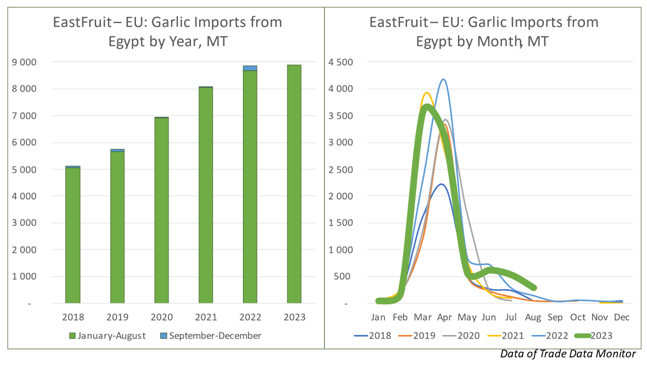

Thus, from January to August of this year, Egyptian garlic suppliers sent almost 9 thousand tons of this product to the EU countries. This is slightly more than 100 tons above the volumes for the entire calendar year of 2022. Considering that in September-December garlic from Egypt is hardly supplied to the EU, the final result of this year may change only slightly by its end.

Garlic exports from Egypt gradually increase from January, when the first small batches of fresh garlic appear on the market. The peak of fresh garlic exports falls on March-April. From mid-spring dry garlic also appears on the market and is exported until the end of the year. However, the largest volumes of dry garlic are exported from the country in late April – early June.

“Extending the export season and reaching direct consumers of garlic – these are the key tasks for the garlic industry participants in Egypt at the moment. China and Spain, as the largest garlic exporters in the world, are present on the export markets all year round, while Egypt is perceived more as a seasonal player. Moreover, Egypt supplies garlic to its consumers in the EU market not directly, but mainly through re-exporting countries,” emphasizes Yevhen Kuzin.

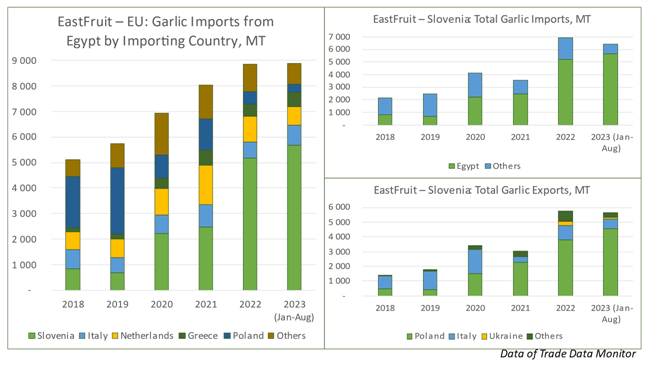

In January-August of this year, Slovenia accounted for almost two-thirds of Egypt’s total garlic exports to the EU. Meanwhile, Slovenia, annually growing about 1 thousand tons of garlic, is mainly engaged in garlic re-export. What is noteworthy, in 2018-2019 the volumes of Egyptian garlic exports to Slovenia did not exceed 1 thousand tons, and its main consumer in the EU was Poland. In January-August 2023, Poland imported less than 300 tons of Egyptian garlic directly from Egypt and more than 4.5 thousand tons of garlic were shipped to Poland through Slovenia, depriving Egyptian exporters of a huge part of their revenue.

In addition to Slovenia and Poland, the main importers of garlic from Egypt in the EU countries are Italy, the Netherlands, Greece, France, Romania, and Spain. Many of these countries are also on the list of major global garlic exporters, such as Spain, Italy, France, while the Netherlands are the largest re-exporter of all vegetables and fruits.

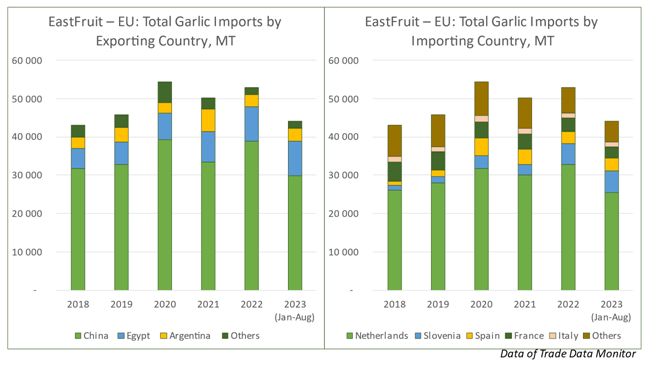

Despite the significant volumes of local production and the status of net exporter, the EU still annually purchases up to 55 thousand tons of garlic from non-EU countries. The overwhelming majority of such volumes are supplied to the EU market from China. Egypt and Argentina are respectively the second and third largest suppliers, and the rest of the import falls on smaller suppliers (Turkey, Albania, Mexico, Peru, etc.).

“Garlic imports to the EU are relatively stable and depend primarily on the level of local harvest and production in China. In such conditions, further growth of supplies from Egypt to the EU will not be able to rely on the general increase of imports on this market. On the contrary, it will be possible only within the existing volumes by replacing the share of competitors. And for this, usual approaches in the form of price competition will not be enough, and Egyptian exporters will have to compete in technological and marketing terms,” expects Evgeny Kuzin.

Read also: Melon & watermelon boom: Egypt’s skyrocketing exports to Saudi Arabia in 2023

Such new approaches may include both the already mentioned extension of presence in the EU market and the expansion of the range of supplied products. For example, in Egypt, farmers grow a unique local variety of garlic named Balady. It has a unique taste and a large number of small cloves in the bulb, reaching up to 50 pieces. This variety is widely popular in the local market, but is practically unknown outside it.

“Technological and marketing innovations can allow exporters from Egypt to enter a completely new segment of the market. In any case, presence on the market all year round or at least most of the year, supply of unique varieties of garlic, offering processed products (for example, packaged peeled garlic cloves) will be positively evaluated by large importers, working both with supermarkets and the HoReCa segment. This can also give a new impetus to the development of garlic exports from Egypt not only to EU countries, but also to other key directions,” says Yevhen Kuzin.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.