According to EastFruit analysts, after a bad year for sweet cherries in 2022, Uzbek farmers again note problems with the harvest of this most important stonefruit for the country.

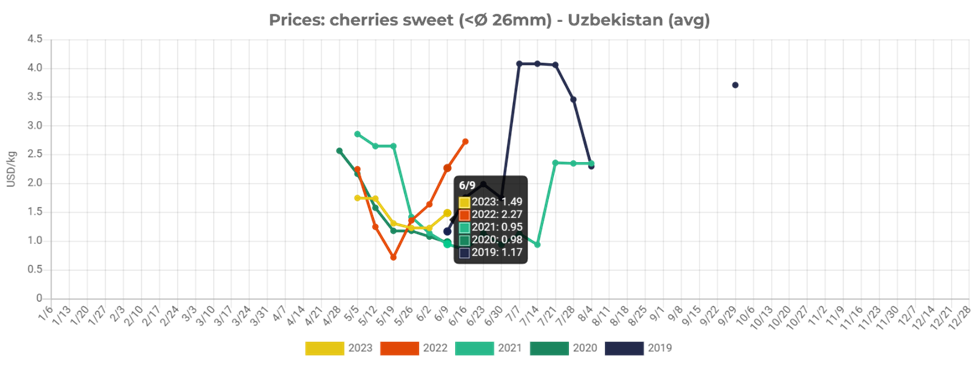

At the moment, prices for small size cherries (under 26mm) in Uzbekistan are more than double the usual levels and are starting to rise as the peak of the season is over. Presently wholesale prices for cherries are the second highest historically – cherries at this time of the year in Uzbekistan were more expensive only in 2022.

Large size cherries, i.e., over 26mm, are offered in very limited quantities and only hit the market two weeks ago. Prior to this, it was difficult to purchase large quantities of such cherries. At the moment, large-caliber cherries are sold in bulk in Uzbekistan at $2.36 per kg, which does not allow them to compete successfully in export markets, which are now dominated by the cherries from Turkey.

Large size cherries, i.e., over 26mm, are offered in very limited quantities and only hit the market two weeks ago. Prior to this, it was difficult to purchase large quantities of such cherries. At the moment, large-caliber cherries are sold in bulk in Uzbekistan at $2.36 per kg, which does not allow them to compete successfully in export markets, which are now dominated by the cherries from Turkey.

“Back in early April 2023, the expectations of market participants regarding the new cherry crop were quite optimistic, and the damage from the January frosts was estimated at no more than 10%. In reality situation turned out to be much worse. According to my estimates, in 2023 there is a lower percentage of large-size cherries in harvest, and the crop as a whole in the country is lower than in 2021 despite increased area. Comparing the harvest with the 2022, when about half of the potential sweet cherry production was lost due to the weaker, would be incorrect,” says Navruz Khurramov, a consultant at the Food and Agriculture Organization of the United Nations (FAO).

He also adds that exports of Uzbek cherries in 2023, despite problems with size and yields, are likely to be higher than in 2017-2020, but lower than the record export volume of 2021. The main reason is the constant expansion of areas under sweet cherries in Uzbekistan.

By the way, in 2022 sweet cherry exports from Uzbekistan were the lowest in the last three years, but exceeded the 2019 volume. Last year, an exports of Uzbek sweet cherries to China were also the lowest since the opening of this market.

Despite high prices, exports of Uzbek cherries are going wellpartly due to weather problems in Azerbaijan. “The rains in Azerbaijan led to a two-week delay in the harvesting of sweet cherries. But in Turkey, the sweet cherry harvest is stable, and export rates are very high,” says Fedir Rybalko, FAO international consultant and EastFruit expert.

Thus, it can be stated that for the second year in a row, bad weather has supported the exports of cherries from Turkey and allows both farmers and exporters of this country make good money. An additional stimulus for Turkish fruit exports has been the devaluation of the Turkish lira in recent weeks.

However, there is also the other side of the coin – a decrease in the level of demand for cherries in Russia – the main market for Turkish fruits. Russia continues to experience a decrease in the level of population’s incomes and a decline in the total number of consumers in this country.

Notably, harvesting of early sweet cherries has already begun in Moldova, and prices are rapidly declining. Generally speaking, wholesale prices for sweet cherries in Moldova are now even lower than wholesale prices in Uzbekistan, although the mass harvesting of sweet cherries will begin here only in the second half of June. By the way, it is in the second half of June that the maximum reduction in prices for sweet cherries is expected in Eastern Europe, because Georgia will also start exporting these fruits in the same period.

Fedir Rybalko also notes that prices for sweet cherries began to decline rapidly in Iran as well. At the moment, cherries in Iran are more competitive in price than in Uzbekistan.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.