According to EastFruit analysts, Ukrainian suppliers again dominate the Belarusian watermelon market this year, despite less favorable export conditions than in Russia.

“For the first time since 2010, Ukraine has become the main supplier of watermelon to Belarus, displacing Russia. This is especially remarkable given an increasing cost of watermelon logistics from Ukraine to Belarus, a higher VAT rate on fruits in Ukraine compared to that in Russia and additional packaging costs of 3 cents per kg, which corresponds to the watermelon cost in Ukraine. Nevertheless, Ukrainian Kherson watermelons are now more competitive on the Belarusian market than Astrakhan watermelons,” Fedir Rybalko, consultant to the Food and Agriculture Organization of the United Nations (FAO) says.

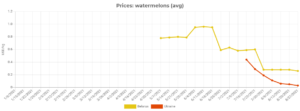

According to EastFruit price monitoring data, the difference in wholesale watermelon prices on the markets of Belarus and Ukraine has reached $ 0.22-0.23 per kg, 7. 5 times higher than the cost of watermelons shipped from farms. Ultra-low prices for watermelon in Ukraine fueled demand for it.

Accordingly, the exports of Kherson watermelons to Belarus is becoming very significant, despite the growing cost of transport. Belarusian importers are also increasingly interested in purchasing watermelons from Ukraine.

Let us remind you that Belarus is completely dependent on the import of watermelons. Belarus imports about 30 thousand tons of watermelon annually.

Traditionally, watermelons were purchased in Ukraine. However, subsidized deliveries by rail and no customs duties within the EAEU helped Russia oust Ukraine from the Belarusian market in recent years and supply watermelons from more distant Astrakhan at a competitive price.

For the same reason, watermelons from Kazakhstan became available on the Belarusian market last year, both of Kazakh production and re-exported from Uzbekistan. Kazakhstan, in turn, has started pressing Russian exporters in the Belarusian market, but it didn’t manage to export more than 1,000 tons.

In 2019 Ukraine set an anti-record for the exports of watermelons to Belarus – only 379 tons – almost 50 times less than in 2010, when Belarus imported almost 18 thousand tons. At the same time, Ukraine was developing exports of watermelon to the EU countries and in 2020 exported more than 33 thousand tons of watermelons.

Many market participants believe that despite lower prices on the domestic market, Ukraine will not manage to increase watermelon exports in 2021. The reason is that prices in the EU are also significantly lower than last year, and the sales season of watermelons will be shorter by more than two weeks due to late start. However, the opportunity to export to the Belarusian market, which has existed for more than two weeks, could help stabilize producer prices in Ukraine and increase exports.

Additionally, watermelon prices on the Belarusian market have already begun to decline. The main reason is a sharp increase in exports from Ukraine.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.