Ukraine keeps setting new records in the export of apple concentrate, EastFruit reports. Despite all the difficulties of working in a warring country and problematic logistics, Ukrainian exporters of apple concentrate are strengthening their positions in the global market, with the EU and the USA remaining the key destinations for deliveries.

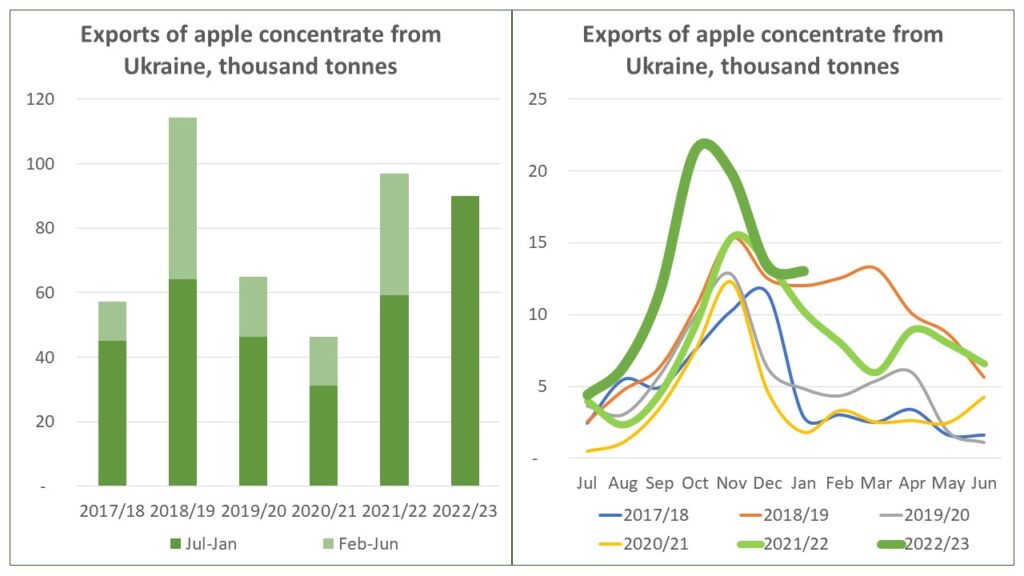

The exports of apple concentrate from Ukraine from July to January of the 2022/23 season reached 90 000 tonnes. It is a record volume for the period under review; furthermore, it exceeds total export volumes in some previous seasons! If even the volume of exports is minimal in the coming months, there are prerequisites to claim that Ukraine will set a historical record in exports of apple concentrate in the 2022/23 season.

This fully confirms the forecasts of EastFruit analysts on trends in the apple concentrate market published in early August last year. Even then, it was obvious that the global market for apple concentrate was recovering from the downturn caused by the COVID-19 pandemic, and a significant decline in apple production in China and the United States was expected. In addition, the market for fresh apples continued to shrink in Ukraine due to emigration, and the share of apples for processing should have grown significantly due to issues with processing in orchards, labor shortages, and rising energy costs.

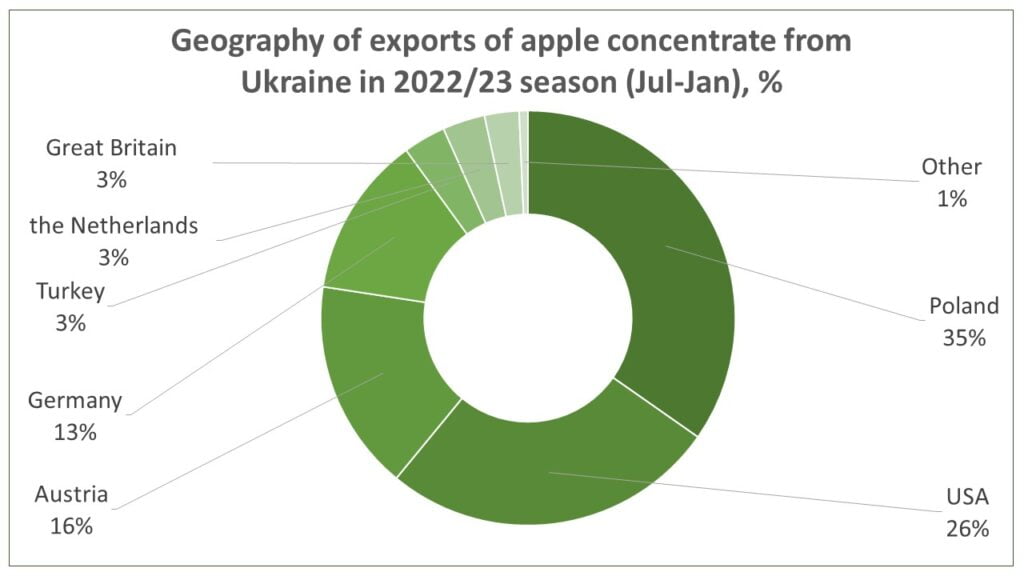

Notably, the EU and the USA remained the main markets for Ukrainian apple concentrate, and the latter directly imported about 25% of all exports from Ukraine in July-January of the 2022/23 season. Poland was still the first among the buyers – it used apple concentrate from Ukraine for its own processing and re-export to other EU countries and the USA.

At the same time, as expected, the recovery of the global market for apple concentrate and the sharp increase in Ukrainian exports did not mean high prices for industrial apples in Ukraine, which many growers hoped for. Recall that during the autumn peak of industrial apple supplies to processors, prices in Ukraine dropped to 1.80 UAH/kg ($0.05/kg).

Along with the narrowing of the Ukrainian market for fresh apples due to emigration and war, low prices for industrial apples will act as an additional factor in the accelerated uprooting of apple orchards in the country next season. Naturally, orchards of the least popular apple varieties on the foreign market that are not demanded by either Ukrainian supermarket chains or buyers from other countries will be uprooted in the first place. The hopes of such producers for the opportunity to get high prices from processors in the current season also did not come true, despite the record export of concentrate, so this category of farmers will be the first to exit the apple business in the 2023/24 season.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.