Market analysts from EastFruit report a clear-cut predominance of Turkmenistan’s greenhouse tomatoes within Tajikistan’s wholesale venues. These tomatoes, notable for their superior quality and contemporary packaging, are also priced competitively. Notably, Turkmenistan’s produce has entirely replaced the Uzbek greenhouse tomatoes, underscoring the ongoing challenges within Uzbekistan’s greenhouse sector – a topic we have extensively covered in the past.

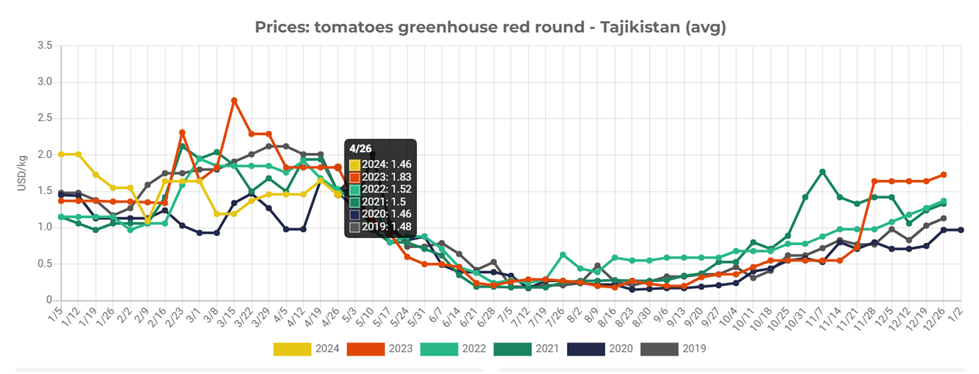

Despite this season’s production hurdles faced by Tajikistan’s greenhouse complexes, tomato prices have plummeted to unprecedented lows for the period.

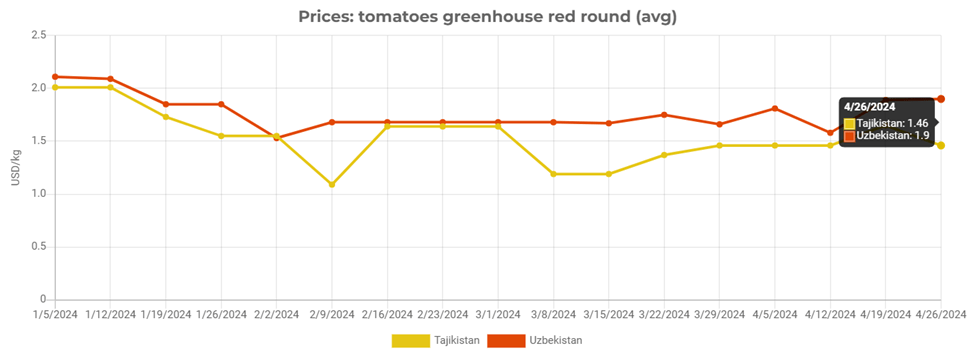

The average wholesale price is currently at an all-time low of $1.46 per kg, with projections indicating a potential decline in the near future. In a remarkable twist, Tajikistan – which predominantly imports its greenhouse tomatoes – now boasts prices substantially lower than those in Uzbekistan, despite the latter’s status as a significant exporter.

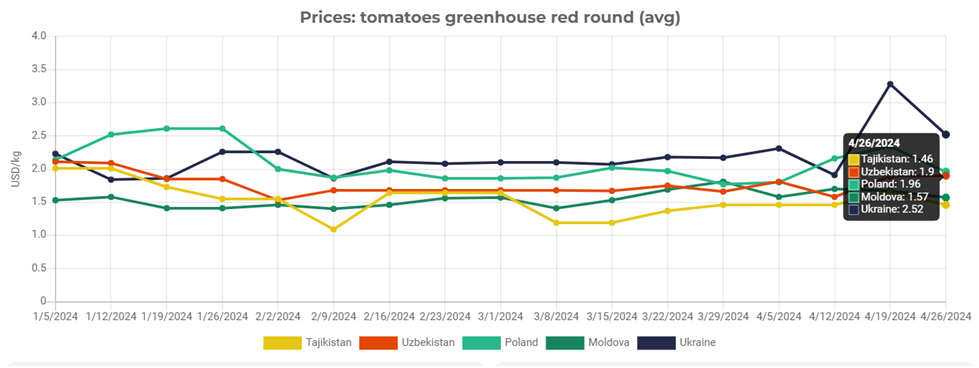

It’s also noteworthy that greenhouse tomato prices in Central Asia are not considerably lower than those in Eastern Europe, which suggests limited prospects for export growth in that direction.

Read also: Greenhouse business expansion of Turkmenistan continues: tomatoes are now exported to Uzbekistan!

For instance, Moldova’s wholesale tomato prices—largely influenced by imports from Turkey—are now more competitive than Uzbekistan’s and are comparable to Tajikistan’s. Similarly, the price parity between Poland and Uzbekistan for greenhouse tomatoes is striking.

The advancement of energy-efficient greenhouse technologies is evidently enabling nations with cooler climates to sustain a high degree of market competitiveness. Moreover, consumers in these regions typically show a willingness to pay a premium for the freshness and flavor of greenhouse-grown vegetables.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.