According to EastFruit analysts, rapid development of the greenhouse business in Russia led to the replacement of a significant part of imports and forced Russia to enter on foreign markets.

Russia became a net exporter of cucumbers in the first four months of 2020 when imports of greenhouse vegetables are traditionally high! The import of greenhouse tomatoes continued to decline rapidly, and their exports began to develop for the first time. Russia remained a net importer of greenhouse tomatoes, but the volume of imports decreased by 17% over this period.

“Perhaps the most striking news is the systemic exports of greenhouse cucumbers and the first ever exports of Russian greenhouse tomatoes to Poland in the first four months of 2021. At the same time, Poland is one of the main exporters of greenhouse vegetables in the European Union,” Andriy Yarmak, economist at the Investments Centre of the Food and Agriculture Organization of the United Nations (FAO) said.

According to trade statistics, Russia exported 579 tons of fresh cucumbers to Poland in January-April 2021, which made this EU country the second largest market for Russian greenhouses after Belarus, if we do not take into account the supply of vegetables to the temporarily occupied territories of Ukraine, where Ukrainian products are not supplied. Also, Russia became one of the five largest suppliers of cucumbers to the Polish market during this period.

It is notable that despite the ban on the supply of all food products from the EU and Ukraine to Russia, including vegetables and fruits, the European Union and Ukraine did not prohibit the supply of Russian food to the EU and Ukraine. Thus, Russia is currently protecting its market from fruits and vegetables from the EU and at the same time uses the opportunity to export its goods to this market.

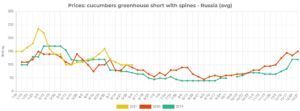

“The dynamic growth in the production of greenhouse vegetables in Russia, especially in the segment of greenhouse cucumbers, has led to an increase in price volatility in the market. During the period of growth in supply, prices for cucumbers sharply decrease and they begin to be actively exported, primarily to Belarus, which again leads to a certain deficit and a sharp rise in prices,” Andriy Yarmak explains.

Besides Poland, cucumbers from Russian greenhouses were also exported to Moldova, Estonia and Georgia. Exports to Moldova increased 2.6 times per year, to Estonia – by 75%, and greenhouse cucumbers from Russia had never been exported to Georgia before.

Export volumes of greenhouse tomato were modest, but the statistics are more interesting, as the first large exports of Russian greenhouse tomatoes in winter were made to Poland, Estonia and Georgia. Exports of greenhouse tomatoes from Russia to Belarus increased by 19% in January-April 2021 compared to the same period in 2020.

Despite the decrease in imports of greenhouse tomatoes to Russia in the analyzed period of 2021, there were also countries that sharply increased their exports to this market. Attention is drawn primarily to the growth in the export of greenhouse tomatoes from Turkmenistan to Russia. It became third in the rating of exporters, bypassing Kazakhstan, Uzbekistan and China and increasing supplies by 2.2 times. Uzbekistan also increased the export of greenhouse tomatoes to Russia but less dramatically – by 87% compared to the same period last year. It continues to increase the exports of greenhouse tomatoes to Russia, Kazakhstan and even Egypt.

Morocco which was one of the main exporters of greenhouse tomatoes to the Russian market left the market due to the frequent detection of the pepino mosaic virus in Moroccan tomatoes. This led to the urgent need to look for alternative sales markets and helped Turkey to maintain its leadership position in this business. At the same time, the volume of supplies of greenhouse tomatoes from Turkey to the Russian Federation remained at the level of the previous year.

Obviously, huge investments in state-of-the-art greenhouse complexes in Russia are starting to pay off. According to the experts of the greenhouse business, it is still a big question how economically successful these projects are and how stable they will be if the competition in the market is high.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.