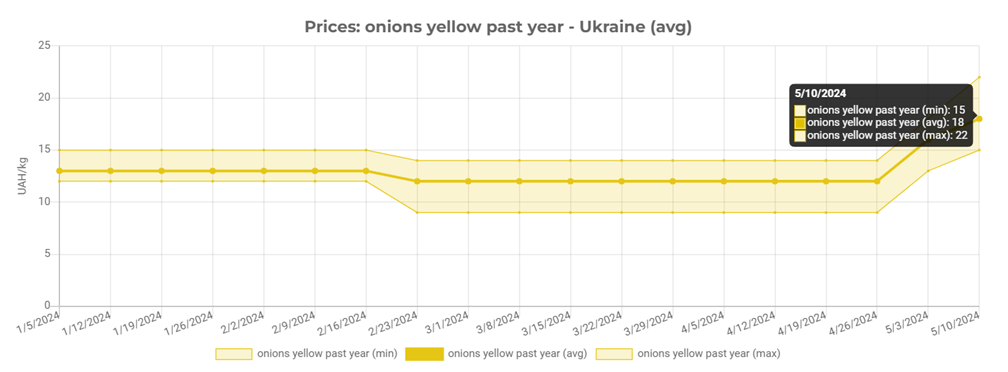

EastFruit analysts have observed a significant surge in the wholesale onion prices within Ukraine’s market sphere over the past week. The small wholesale average has escalated to 18 UAH/kg, roughly translating to 45 US cents per kg. Notably, the upper echelon of pricing has soared to 22 UAH/kg or an equivalent of 56 US cents, marking a 150% price inflation within a mere fortnight.

Market chatter over the weekend hinted at potential price points scaling up to 25-30 UAH/kg, approximately 63-76 US cents per kg. This speculation suggests an impending upward revision of price benchmarks and a hastened pace in market growth as the new week unfolds.

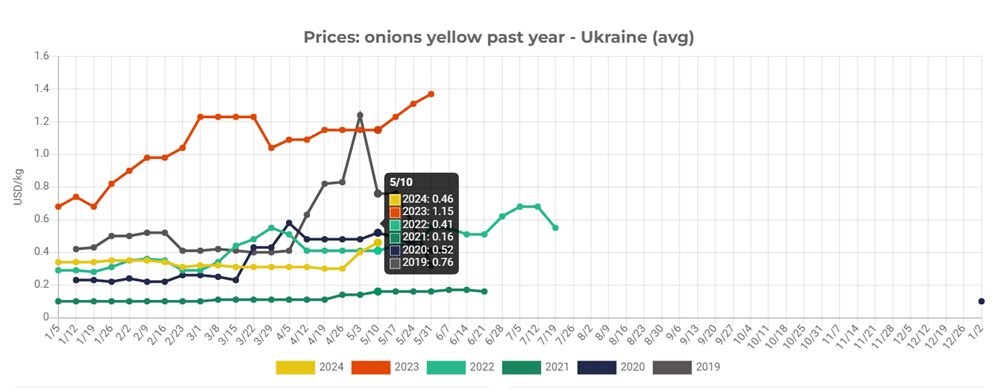

It is imperative to contextualize this price hike against the backdrop of the previous year’s metrics, where the current wholesale rates are still substantially lower – by a factor of two and a half – compared to the same period last year, aligning closely with the five-year average.

This inflationary trend in onion pricing is particularly telling, given the recent phase where producers and traders were compelled to distribute onions gratis due to an oversupply. The current deficit of premium onions has catalyzed a price uptick, aimed at incentivizing international suppliers to consider exporting their fresh produce to Ukraine.

Remarkably, this turnaround stems from what was once deemed an insurmountable challenge. Amidst wartime conditions, Ukrainian agriculturists have triumphantly reinstated vegetable production for the traditional borscht assortment, compensating for the devastated croplands and infrastructure in the southern territories of the Kherson region, presently under the occupation of Russian forces.

Andriy Yarmak, an economist with the Investment Department of the Food and Agriculture Organization (FAO) of the United Nations, notes, “While the onion harvest is reaching its zenith in numerous countries, Ukraine anticipates a month-long wait before the market welcomes new consignments. Additionally, the recent frost spells may have inflicted damage on the early onion yields, potentially bolstering market prices.”

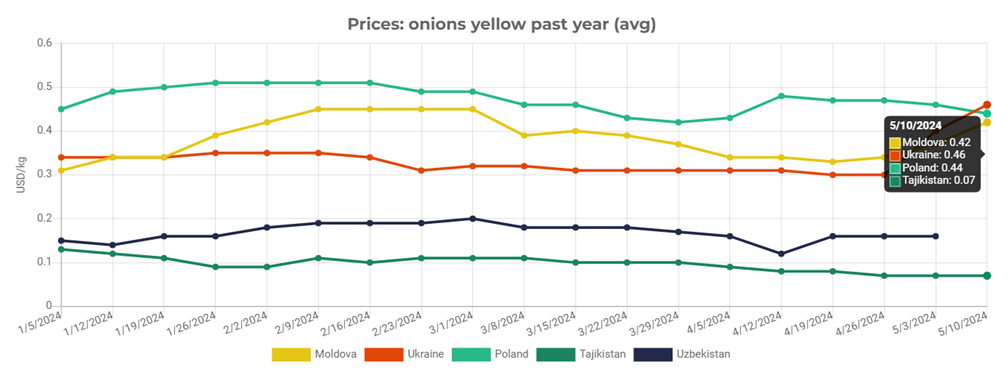

For the first time this season, onion prices in Ukraine have outstripped those in neighboring Poland and have consistently exceeded Moldova’s pricing for a fortnight—a notable shift given Ukraine’s exportation to Moldova just weeks prior. Despite this, the price variance among these nations remains marginal, precluding the prospect of reciprocal trade.

Conversely, the prospect of onion imports from Central Asia to Ukraine is gaining traction. Uzbekistan’s market is currently offering new harvest onions at 15-16 cents in small wholesale, with even more competitive rates available directly from growers. This presents an opportune moment for stakeholders to initiate negotiations for product shipments to bridge the gap until Ukraine’s new crop is ready for harvest.

Maintain full control over fruit and vegetable prices in Turkey, Egypt, Ukraine, Uzbekistan, Russia, Moldova and other markets subscribing to EastFruit Premium.