Over the past three weeks, wholesale prices of onions in Uzbekistan have decreased by 18%, which is due to an increase in supply in the domestic market while external demand for Uzbek onions remains weak, EastFruit experts report.

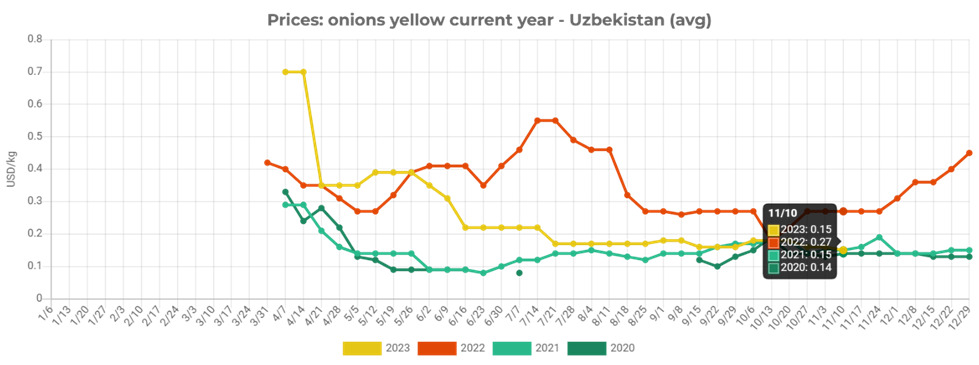

According to EastFruit price monitoring, from October 20 to November 10, 2023, the average wholesale price for onions in Uzbekistan decreased from 2,200 to 1,800 UZS/kg (from $0.18 to $0.15). Current wholesale prices are 1.7 times lower than last year’s levels and are almost the same as in 2021.

Relatively high prices for onions in October and November of 2022 were caused by unusually high demand in the foreign markets, specifically from Ukraine, where Russian aggressors have destroyed key onion production areas. For example, in October and the first ten days of November 2022, Uzbekistan exported 17.1 thousand tons of onions, while in the same period of this year the volume of exports of onions was 10 times lower. In 2021, when onion prices were approximately the same, exports during the same period were comparable to the figures of 2023 – around 1.5-1.8 thousand tons.

Read also: Onion prices in Azerbaijan have collapsed – what are the reasons?

On the other hand, according to traders, there are quite a lot of onions on the domestic market, and we can talk about the formation of a so-called “buyer’s market,” when the supply exceeds demand. In turn, this is due to the very high production of onions in Uzbekistan in 2023.

At the end of August 2023, EastFruit wrote that in 2023, Uzbekistan is highly likely to harvest a record onion harvest. Although estimates of the possible increase in onion harvest volumes varied greatly, the most pessimistic scenario assumed an increase by at least 30-40% compared to average annual production volumes. EastFruit analysts warned market participants then that there is a lack of obvious prospects to export the surplus production considering expensive logistics from Uzbekistan.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.