Moroccan exporters have every chance of setting a new record in avocado exports in the 2022/23 season (July-June), EastFruit reports. At the same time, representatives of the local industry of avocado growing and exporting are seriously concerned about its future due to the shortage of water in the country and the changing climate.

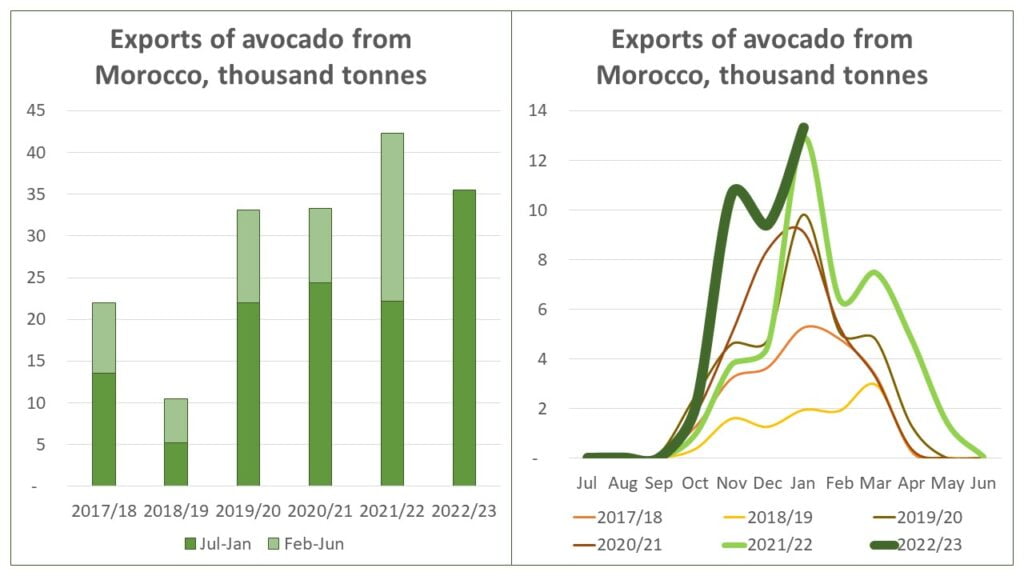

From July 2022 to January 2023, Morocco exported a record volume of avocados for this period – 35 500 tonnes, which is 60% more than in the same months of the previous season. Thus, before exceeding the total export of the previous season, Moroccan exporters have only 7 000 tonnes of avocados to export to foreign markets. Given the trends of past years, this goal is likely to be achieved almost seamlessly in the remaining months, and Morocco will indeed set a new record in exports at the end of the 2022/23 season.

It should be noted that over the past five seasons, the exports of avocados from Morocco have almost doubled, and in the 2021/22 season they were 42 300 tonnes. At the end of 2022, Morocco also became the ninth largest exporter of avocados globally, although it was the twelfth five years ago. Only some countries in South America (Peru, Chile, Colombia), Europe (Netherlands, Spain), and Africa (Kenya, South Africa) export avocados more than Morocco, while Mexico is the undisputed leader in global exports with an annual supply of 1-1,4 million tonnes.

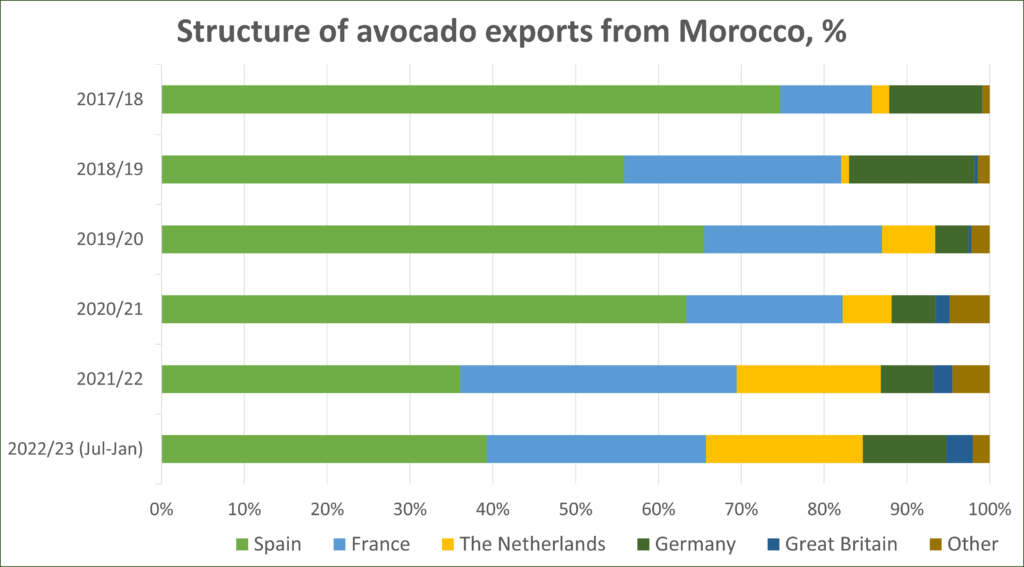

The geography of Moroccan avocado exports shows the same trends as other fruit and vegetable segments of the Moroccan market (blueberries or strawberries can be viewed as an example). About 75% of Morocco’s avocado exports in the 2017/18 season went to Spain, which is one of the largest investors in Moroccan agribusiness and Morocco’s most important trading partner.

Further, the policy of diversifying avocado exports undertaken by Moroccan exporters has led to the fact that the share of Spain has already decreased to 39% by the 2021/22 season, and those volumes that were previously re-exported through Spanish wholesale companies began to be supplied directly to buyers from other countries.

France, another important investment and trade partner of Morocco in agribusiness, became second in the structure of Moroccan exports with a share of 26%. France was followed by the Netherlands (19%), Germany (10%), and the UK (3%). The list of smaller countries importing Moroccan avocados in the 2021/22 season included Russia (600 tonnes), Switzerland (300 tonnes), Belgium (200 tonnes), Portugal (100 tonnes), as well as some countries in the Middle East (300 tonnes) and Sub-Saharan Africa (200 tonnes).

The history of the commercial avocado growing industry in Morocco dates back to the 1950s. The country’s climate, with mild winters and the neighboring warm Gulf Stream in the Atlantic Ocean, proved to be almost perfect for successful avocado production. As a result, almost all of the world’s most important avocado varieties are now grown in the country, including Hass (a dark reddish-skinned variety) and many varieties of green-skinned avocados. Moreover, avocados ranked eighth in the list of fruit and vegetable categories with the highest export earnings in Morocco in 2021, bringing the country almost $90 million.

Despite this, the avocado production and export industry in Morocco is now entering challenging times. Growing avocados involves the use of a huge amount of water, which, due to its location, is a scarce resource for Morocco. Climate change and the effects of a severe drought in the summer of 2022 forced the Moroccan Ministry of Agriculture to take serious measures to limit the use of water in the country.

In September 2022, by the decision of the Ministry, the program for issuing subsidies for the irrigation of new plantations of several crops, including citrus fruits, watermelons, and avocados was canceled. Moreover, some environmental organizations in Morocco are calling on the government to stop growing watermelons and avocados in the country to limit the use of water.

As a result, further expansion of plantations of avocados or melons (another important category of Moroccan horticultural exports) in Morocco is under threat, because projects to grow them are meaningless without access to water resources.

Such trends not only threaten to halt the development of avocado exports from Morocco but may also affect the domestic market for avocados. Although avocado is not a traditional ingredient in Moroccan cuisine, in recent times it has been increasingly used to cook various salads or main dishes in Morocco. Smoothies and other drinks made with avocados are also popular in the country.

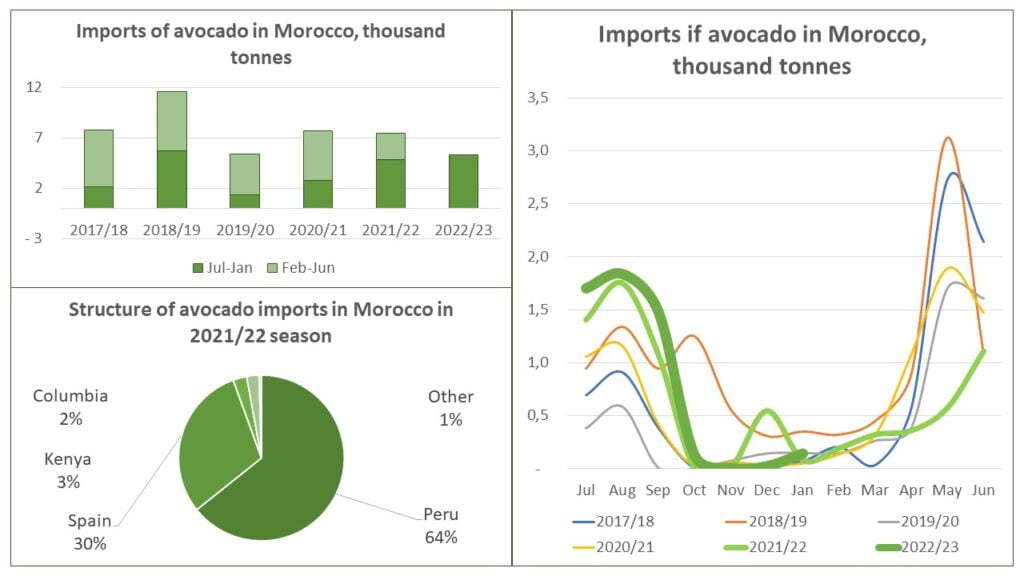

The rapid development of the domestic avocado market in Morocco is also confirmed by the rather active avocado imports. Depending on the season, Moroccan wholesale companies can import from 6 000 to 12 000 tonnes of avocados, and imports peak mainly during the months of lack of local products (spring-summer).

The most important supplier of avocados to the Moroccan market is Peru, which provides almost two-thirds of all avocado imports to Morocco. A little less than a third is imported from Spain, which either exports its own products to Morocco or acts as a re-exporter of avocados from Peru or other countries of the Southern Hemisphere. Relatively small volumes are imported from Kenya, Colombia, Tanzania, Mexico, and several other countries.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.