Last week, EastFruit wrote about a sharp drop in wholesale prices for mandarins in Uzbekistan. Prices for these popular citrus fruits dropped 38% in just one week thanks to the arrival of the first large quantities imported fruits from Pakistan. During the current week wholesale prices for mandarins continued to decline, reaching new record lows for this time of year.

According to EastFruit price monitoring, from December 8 to December 15, 2023, the average wholesale price for mandarins in Uzbekistan decreased from 10,000 to 8,000 sum/kg (from $0.81 to $0.65), i.e. by 20% over one week. Considering that over the past two months, wholesale prices for these products have been decreasing almost every week, the average wholesale price has dropped from 29,000 to 8,000 sum/kg (from $2.37 to $0 ,65), i.e. 3.6 times during this period!

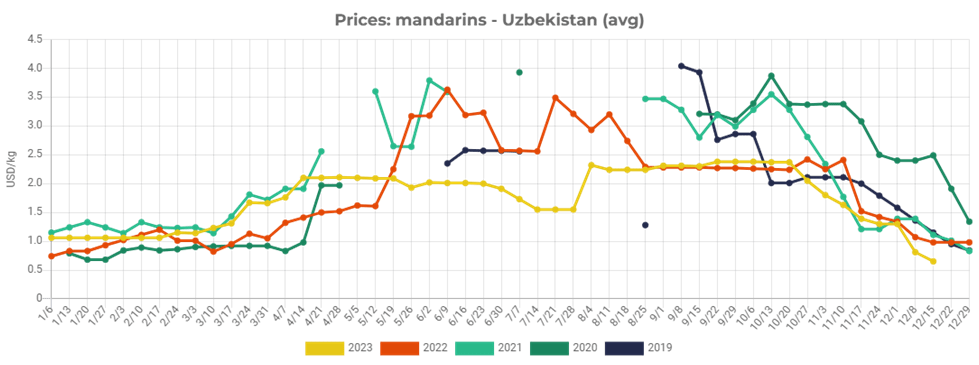

As a result of the freefall in prices, the gap between current wholesale prices and price levels for the same period in previous years has increased further. As of December 15, 2023, the average wholesale price for mandarins in Uzbekistan was 27% lower than on the same date last year and one third lower than on the same date in 2021.

Read also: Mandarin prices rise amid negative news from Turkey

Moreover, current wholesale prices for mandarins in Uzbekistan are the lowest among the countries where the international EastFruit team monitors wholesale prices for fruits and vegetables on a weekly basis. As of December 15, 2023, the average wholesale price for mandarins are as follows: Uzbekistan – US $0.65; Georgia – $0.67; Tajikistan – $0.91; Moldova – $1.23; Russia – $1.28; Poland – $1.34; Ukraine – $1.90.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.