EastFruit analysts just came up with a very unexpected fact of the global berry market, which will have consequences in the upcoming season.

At the beginning of 2022/23, European traders, freezers and farmers accused Ukraine of dumping on the frozen raspberry market, believing that Ukrainian freezers sell berries too cheaply, which will lead to adverse consequences for their business. However, at the end of the season, it became obvious that the actions of the Ukrainian market participants were the most reasonable and far-sighted, and we will below explain in detail why it is so.

First of all, the 2022/23 season began with good prices for frozen raspberries – about 5 euros per kg. Expectations were such that it would be possible to sell this berry for no less than 4.5 euros, especially since in the previous season this berry was in a good demand in such large importing countries as the USA, Canada and Japan and prices were extremely high.

However, the prices for frozen raspberries declared by Ukrainian freezers for exports in August 2022, became a real shock for the market – 3.7 euros per kg – 18% below the lower limit of expectations of European freezers and traders, and they decided not to rush to sell, expecting prices to rise.

Why did Ukraine export raspberries at such a low price at that time? Foresight or chance?

“Experience shows that Ukrainian exporters, unfortunately, always try to compete primarily on price, and not on quality or effective marketing. And this is despite the fact that in Ukraine there are now quite a lot of high-quality raspberries, which can be sold no cheaper than competitors’ raspberries or even at higher prices due to very good BRIX levels. Nevertheless, in 2022, the decision to sell below the market was wise, far-sighted and correct,” said Andriy Yarmak, an economist of the Investment Centre of the Food and Agriculture Organization of the United Nations (FAO).

“First of all, due to invasion of Russian troops into Ukraine and the ongoing bombardment of the entire territory of the country with missiles attacks, Ukrainian producers of frozen berries and fruits were not confident in the possibility of long-term storage of their products. Secondly, the devalued hryvnia made it possible, without reducing the purchasing price of raw materials paid in the local currency, to sharply reduce costs in euros and dollars. This, in turn, made it possible to reduce the selling price without reducing the margin. Thirdly, local producers understood that the area under raspberries had expanded, and that there would be quite a lot of raw materials, so it was better to start selling it right away. And most importantly, almost no one expected further growth in prices for raspberries on the world market, because they were already high,” explains Andriy Yarmak.

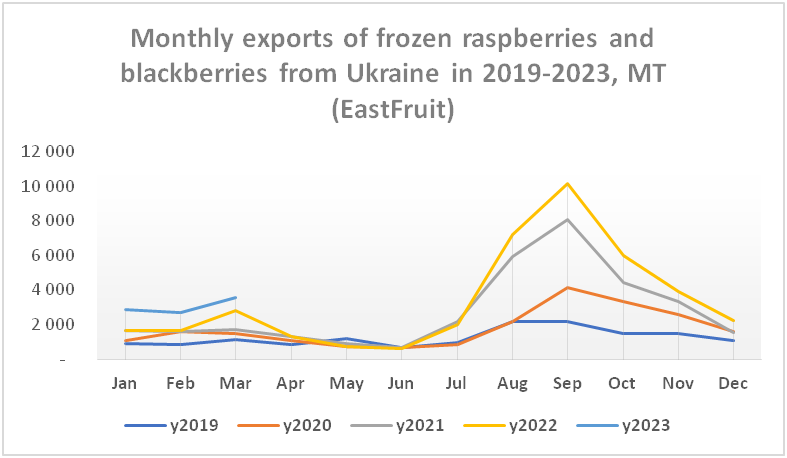

As a result, in the summer of 2022 and in September, Ukraine was practically the only country in Europe that actively exported frozen raspberries, while the main competitors of Ukraine: Serbia and Poland, were in no hurry to sell, fulfilling only pre-signed contracts. At this time, Ukrainian freezers actually earned only a little less on each kilogram of frozen raspberries than in the historically most profitable 2021/22 season!

In October and November 2022, it became obvious that prices for frozen raspberries on the world market did not show signs of growth, so Poland and Serbia, as well as other producing countries, tried to intensify sales at “Ukrainian prices”, but this only led to a further fall in prices for this berry as supply increased sharply. At that time, many offers of frozen raspberries appeared on the market at 3.3-3.2 euros, but the demand for it remained low. We posted a long analytical article about the frozen raspberry market in Ukraine, which you could read here to see how the situation on the frozen raspberry market evolved.

It should be noted that this price was already unprofitable for many producers from the EU and Serbia, but Ukraine at this price continued to maintain about 1.2 euros of gross margin per kilogram, and in some cases even more. According to our estimates, the average purchase price for fresh raspberries for freezing in Ukraine in 2022 was 2 euros per kg, while in other countries freezers paid around 3.5 euros on average. Therefore, even further price reduction did not pose a threat to Ukrainian processors. See more about the history of prices for fresh and frozen raspberries and the price forecast for the 2023/24 season in the material “Raspberry price cycles”.

Of course, there were market players in Ukraine who expected higher prices and were in no hurry to sell. And yes, many Ukrainian freezers last season suffered significant losses on wild blueberries, which is the second most important source of income for them. However, in general, Ukrainian freezers are in a much better shape financially than their colleagues from Poland, Serbia, and other EU countries.

Let’s get back to where the situation at the beginning of 2023. In Ukraine, stocks of frozen raspberries were lower than usual, while Poland and Serbia were at record highs. By the way, part of the Ukrainian stocks of frozen raspberries “migrated” to Poland, which previously made good money on the resale of Ukrainian frozen berries. At the same time, Ukrainian companies continued to actively export frozen raspberries in January-March 2023, exporting a record volume for the first quarter.

In the first quarter of 202, Ukrainian companies exported 9.1 thousand tonnes of frozen raspberries and blackberries (the share of blackberries in this volume was minimal, but these items are not separated in trade statistics), which is 50% more than the same period in 2022, when exports, by the way, were also record high.

In the first quarter of 202, Ukrainian companies exported 9.1 thousand tonnes of frozen raspberries and blackberries (the share of blackberries in this volume was minimal, but these items are not separated in trade statistics), which is 50% more than the same period in 2022, when exports, by the way, were also record high.

Interestingly, even in the first quarter of 2023, when all European raspberry suppliers were operating at a loss, Ukrainian companies continued to profit from the exports of frozen raspberries.

By the way, from July 2022 to March 2023, the exports of frozen raspberries from Ukraine reached a record 40.6 thousand tons and were 29% or 9 thousand tons higher than in the same period of the previous season. Again, the industry has been generating profits all this time, although it has had a steady downward trend in prices.

Only now, Ukrainian producers, who still have stocks of frozen raspberries, are faced with the problems of selling them at no margin or even with a small loss. Thus, the season was really profitable for Ukrainian freezers as frozen raspberry stocks are close to zero now or very low.

But Polish companies that bought raspberries in Ukraine at 3.5 euros per kg in 2022, hoping to earn up to 1 thousand euros per tonne in the second half of the season when reselling, are currently trying to sell it at a loss of a thousand and more than euros per tonne, not counting the costs incurred for storage and reworking.

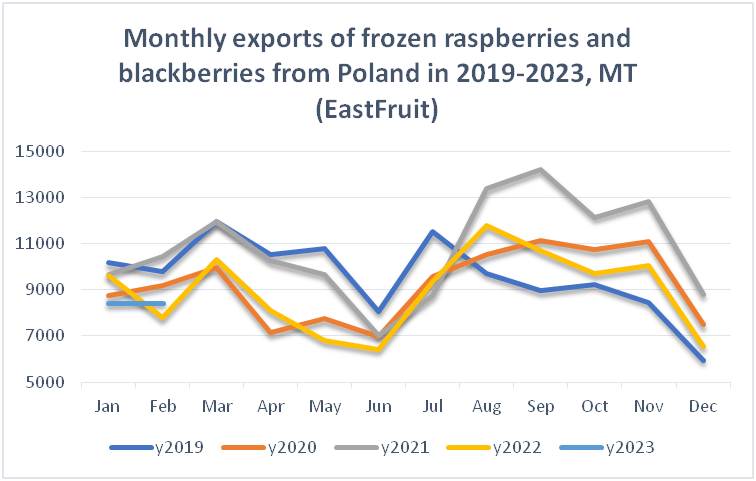

For comparison, let’s see the same statistics on monthly exports of Polish frozen raspberries. Where Ukraine updated monthly export records, Poland exported either record low volumes or close to record-lows.

From July 2022 to February 2023, Poland exported 74,000 tons of frozen raspberries, a record low volume for the past three years for this period of time. Export volumes were also 14% or 12.6 thousand tons less than a year earlier.

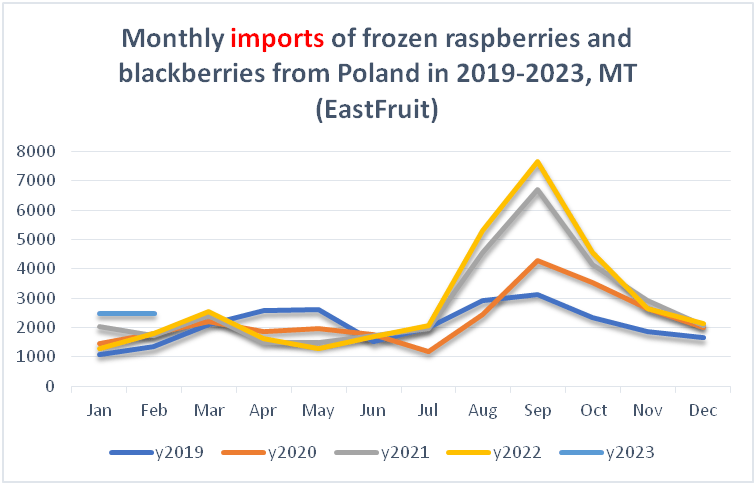

It is logical to assume that raspberry stocks in Poland at the beginning of March 2023 were record-high. However, it is important not to miss another important factor here – the factor of imports. As we emphasized many times, Poland is not only a major producer of frozen raspberries, but also a major re-exporter. Therefore, perhaps Polish companies imported less raspberries since there were problems with exports?

However, the statistics of frozen raspberry imports to Poland presents another surprise.

The imports of frozen raspberries to Poland in July 2022 – February 2023 inclusive were record high! It grew by 16% or 4 thousand tons compared to the same period of the previous season. Moreover, even in January-February 2023, Poland imported record volumes of frozen raspberries. By the way, imports were carried out mainly from Ukraine and Morocco. So, are our assumption about record high stocks of frozen raspberries in Poland confirmed now?

Not yet, as we need to take into account one more factor – the raspberry production in Poland in 2022. Polish official statistics show that the raspberry harvest in Poland in 2022 increased by 1% to 105 thousand tonnes.

Accordingly, if the domestic consumption of raspberries in Poland for some unknown reason did not increase, which is unlikely given the high prices for the berries, then we can confidently say that as of the beginning of March 2023, frozen raspberry stocks in Poland were very probably record high and probably exceeded 2022 stocks by approximately 20 thousand tons.

In other words, Poland, if the volume of raspberry exports from this country recovers to the average in April-June levels, will have enough raspberries by the beginning of the new harvest to export it without producing new volumes for another month and a half.

However, we know that exports even from Poland are always the lowest in June, which means that the situation for the exporters of this country in May became critical. And this situation will put pressure on the purchase prices of raspberries in the new season as stocks are still there.

One very important remark needs to be made here – part of the raspberries that are stored in Poland are raspberries that still belong to Ukrainian companies. There is a practice in the freezing business when one company does not have enough storage capacity, then it can turn to colleagues from another country to help with the storage of berries or fruits. At the same time, of course, an export contract is concluded in order to have grounds to take products out of the country, but, de facto, this is not an export.

In the 2022/23 season, many Ukrainian companies, amid terrorist attacks on their civilian energy infrastructure by Russia, used this practice because they feared interruptions in the electricity supply. There were definitely many such cases, more than usual, but we were unable to determine the share of such “fake” export contracts in the total export flow. Nevertheless, we can confidently say that some of the problems that market operators from Poland have now, are also, partly the problems of some of the Ukrainian companies.

According to market participants, although the stocks are record high, the share of high-quality frozen raspberries in these stocks is relatively low. However, at the end of the season, this the tuition is rather typical. It’s just that such large volume of low quality berries can have an even greater psychological impact on prices.

And if in 2023 in Ukraine the devaluation will somewhat alleviate the problem of purchase prices for raspberries, then in Poland it is just right to expect serious protests from farmers, who will definitely not be happy with the new price realities of the market. Add to this the rising cost of labor, and the situation for Polish berry growers is obviously becoming critical.

By the way, the situation with frozen raspberries in Serbia is perhaps even more complicated than in Poland. After all, Serbia exports raspberries, as a rule, in a more expensive price segment and in larger volumes than Poland, which means that the drop here was even more significant and it hurt growers and freezers even more.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.