Egypt became the largest supplier of sweet potatoes to Scandinavia, one of the most premium consumer markets in the world, for the first time in history in the MY 2022/23 (July-June), according to EastFruit. Egyptian exporters were able to provide about a third of all sweet potato imports to Denmark, Sweden, and Norway in the past season.

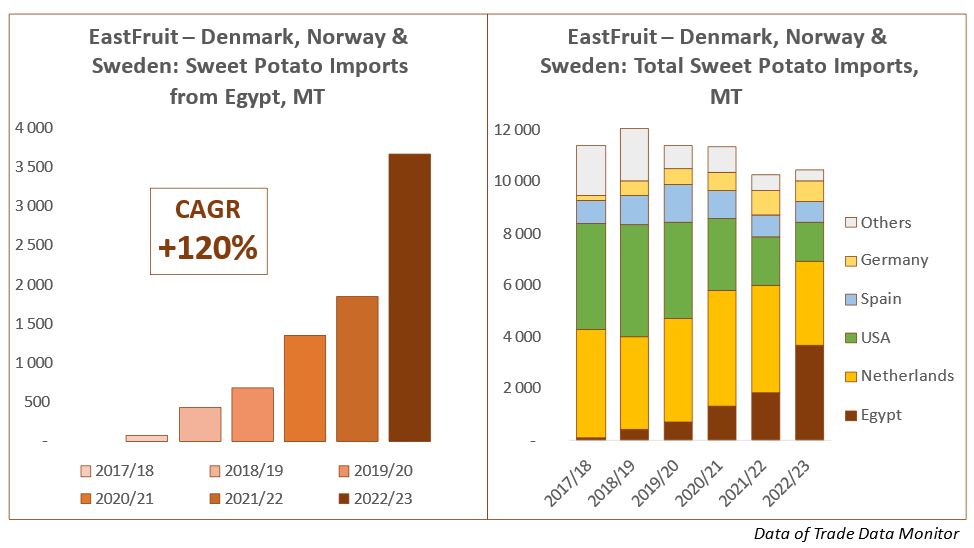

Egypt supplied a total of 3,700 tons of sweet potatoes to the markets of Denmark, Norway, and Sweden from July 2022 to June 2023, i.e. almost twice as much as the season before. Moreover, since the MY 2017/18, Egyptian sweet potato shipments to Scandinavia have increased 51 times, at least doubling year by year!

Moreover, Egypt ranked first among sweet potato suppliers to this market in the MY 2022/23. At the same time, the Netherlands, the United States, and Spain exported the smallest amount of sweet potatoes to Scandinavia in the last six seasons: 3,300 tons, 1,500 tons, and 820 tons, respectively.

“The past season of sweet potato exports to Scandinavia was a landmark for Egyptian suppliers. First, Egypt emerged as a leader in exports, significantly increasing its presence in one of the most interesting markets in the world. Second, Egyptian exporters were able to reduce their dependence on re-exporters from the Netherlands and significantly increase their own share of direct sales to Scandinavia. Third, here, as in many other European countries, Egypt continued to oust sweet potatoes from the United States,” comments Yevhen Kuzin, Fruit and Vegetable Market Analyst at EastFruit.

Scandinavia, due to its geographical location and economic development, is a fairly compact but at the same time extremely premium market for many products. “From season to season, 10,000-12,000 tons of sweet potatoes are imported into Scandinavia for sale to consumers who are oriented towards buying healthy lifestyle products, or a significant number of immigrants who use sweet potatoes to prepare various national dishes,” adds Yevhen Kuzin.

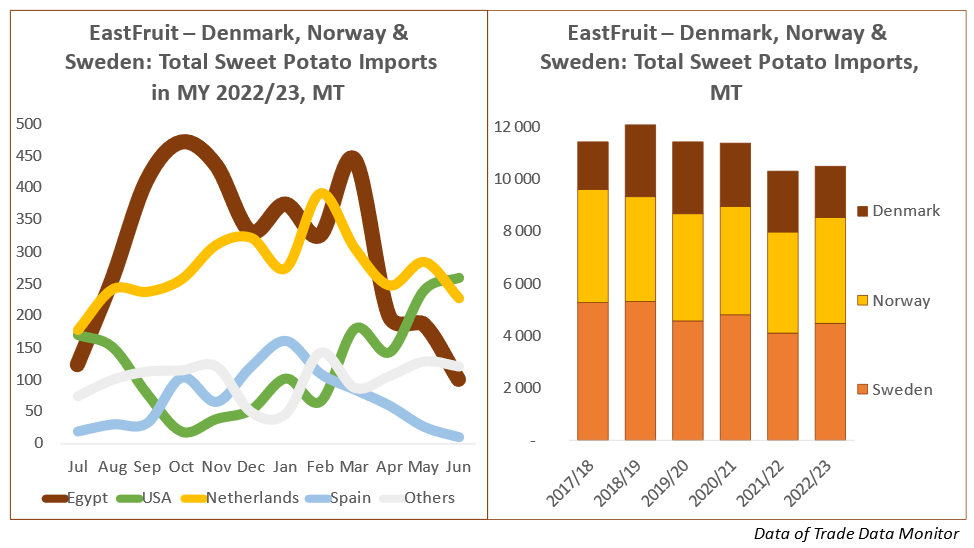

Sweden remains the key consumer of sweet potatoes in Scandinavian countries, with the share of 40-46% in the total imports. Norway consumes another 33-39%, and the rest is imported into Denmark. At the same time, in the last two seasons, the total imports of sweet potatoes to Scandinavia have declined slightly. “Global food inflation, especially accelerated in 2022-2023, did not bypass even such a premium market as Scandinavia,” explains Yevhen Kuzin.

Sweden remains the key consumer of sweet potatoes in Scandinavian countries, with the share of 40-46% in the total imports. Norway consumes another 33-39%, and the rest is imported into Denmark. At the same time, in the last two seasons, the total imports of sweet potatoes to Scandinavia have declined slightly. “Global food inflation, especially accelerated in 2022-2023, did not bypass even such a premium market as Scandinavia,” explains Yevhen Kuzin.

Meanwhile, the most serious changes have occurred among the geography of supplying countries. A few seasons ago, Egypt here practically did not compete with suppliers from the USA. Then, already in the MY 2022/23, Egyptian exporters supplied sweet potatoes to the Scandinavian market almost all year round. At the same time, the USA now dominates only in May-July.

“The conquest of the Scandinavian market by Egyptian sweet potatoes is another example of a successful strategy for diversifying Egypt’s fruit and vegetable exports. Moreover, for Egyptian exporters this is also a unique opportunity to test their strength in one of the most premium sales markets in the world,” concludes Yevhen Kuzin.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.