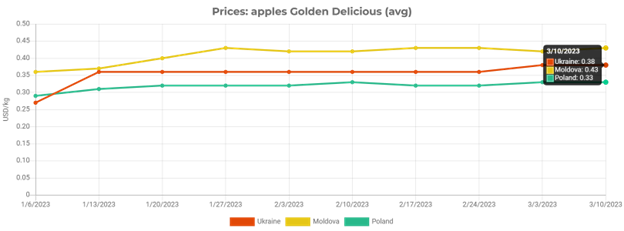

According to EastFruit analysts, prices for fresh apples of the most common variety Golden Delicious in Poland, Ukraine, and Moldova remain stable, showing no signs of recovery. The lowest prices are in Poland, which had a good apple yield in 2022. The price situation is very similar to all of the main fresh apple varieties.

Even farmers in Ukraine, a country blocked from its own seaports by the Russian aggressors, get higher prices than growers in Poland. Moldova, partly thanks to its relatively low apple production in 2022 and thanks to partial access to the Russian market, enjoys the highest price of the three. Yet, in all of these countries, prices are well below normal levels and far from being comfortable for growers.

“Considering the fast growth in the costs of inputs, energy, and logistics in 2022, current price levels, which are 20-25% below the average for this season, are threatening apple production sustainability in the whole region. Farmers in Ukraine and Moldova this winter were busy uprooting old orchards. Farmers in Poland have called the government to stop supporting new plantations and are supporting the uprooting instead to help reduce market disbalances”, says Andriy Yarmak, economist of the Investment Centre at the Food and Agriculture Organization of the UN (FAO).

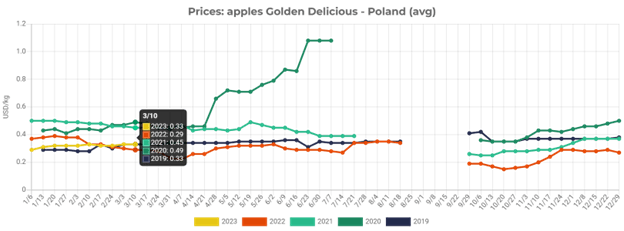

In Poland, fresh apple prices remain very low for the second consecutive season. Usually, at this time of the year, growers are selling Golden Delicious apples at $0.40-0.45/kg but in the recent two years, the prices were between $0.29 and $0.33 per kg, while costs have increased drastically.

In 2022/23 many growers were forced to sell apples faster due to inflated costs of apple storage caused by higher electricity prices. Consequently, current wholesale apple prices in Poland are even a bit higher than a year ago but still relatively low.

“Problems with apple shipments to Egypt from November 2022 and the sharp devaluation of the Egyptian pound in December and January continue to provide pressure on the Polish apple market, forcing Polish exporters to look for alternative markets in Asia as far as Mongolia and India. However, logistics to Asia are expensive, which does not help domestic prices. Consequently, average wholesale prices of apples in Poland have moved up only 1-3 cents per kg since they were put in storage”, explains the situation Andriy Yarmak.

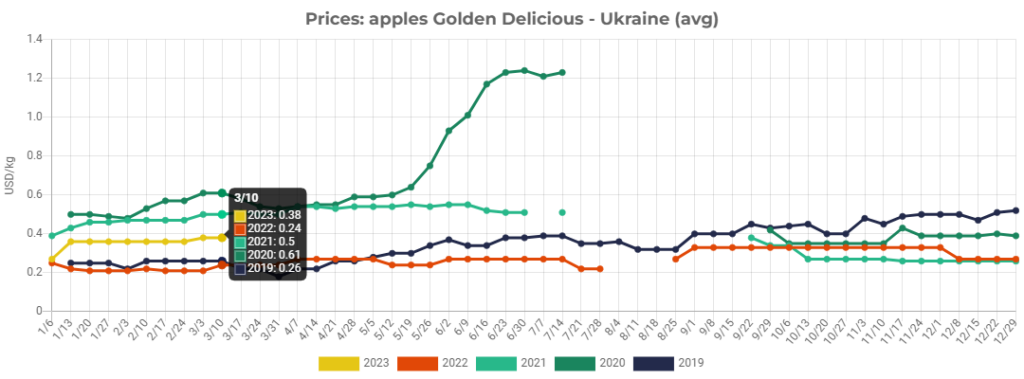

Prices for apples in Ukraine are also generally stable. The stocks of high-quality apples are lower than usual due to the problems caused by Russian terrorist attacks on the civilian infrastructure. While prices are higher than a year ago and in 2019, when Ukraine experience the first apple price shock caused by abundant harvest in all countries of Europe, it is only around half of the usual price levels in Ukraine for this apple variety in March. We expect apple prices to slightly recover in the remaining months of the season responding to the domestic demand for good quality apples.

“Ukrainian traders and farmers managed to find logistical solutions to boost exports of fresh apples beyond the already oversupplied EU market, which helps maintain the sustainability of the most efficient growers. Consequently, in the current season, the main export markets for Ukraine’s apples are UAE, Turkey, Iraq, Saudi Arabia, and Uzbekistan. Turkey is obviously only a transit point to export to reach some of the markets where direct access for Ukraine is limited”, says Andriy Yarmak.

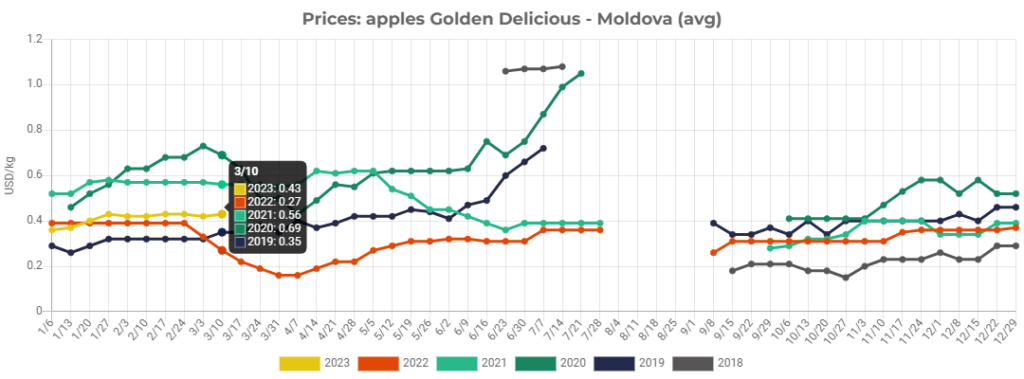

Moldova also has relatively low apple stocks, which should support the price of apples. Lower stocks in Moldova are caused by lower than usual harvest, a sharp increase in the price of electricity, which made farmers think twice about whether to store apples and the decision of Russia to ban imports of all fresh produce from Moldova at the beginning of the season, which was later eased a bit.

Thus, current price levels for apples in Moldova are not so bad – prices are almost 60% higher than a year ago at this time and 23% higher than in 2019, when Europe was oversupplied with apples. However, a year ago prices were affected by the Russian war, which basically blocked Moldova’s exports to Russia logistically, and thus, it can’t be a good basis for the comparison.

Industry sources in Moldova are saying that the wholesale price of apples is not covering the costs of production, storage, and PHH, which forces Moldovan farmers to step up uprooting the older non-irrigated orchards.

One may wonder why the fresh apple wholesale price of $0.4 and more does not cover the costs of production. In Moldova most of the apple orchards are not irrigated, technologies are rather outdated and productivity and, most importantly quality is very low. Of the 200-250 thousand tonnes of apples Moldova exports yearly, only around 10% could potentially be suitable for exports to demanding markets such as the EU, Middle East, and Asia. Consequently, the costs of growing such apples are generally higher than in the EU or in Ukraine.

We can conclude that the apple area in Poland, Ukraine, and Moldova might decrease very sharply in 2023 – faster than ever in the recent 15-20 years.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.