EastFruit analysts report a general decline in onion prices across the region last week, a trend that defies expectations given the commencement of the new onion harvest in Central Asia’s southern territories and the persistent shortage of onions in Western EU nations.

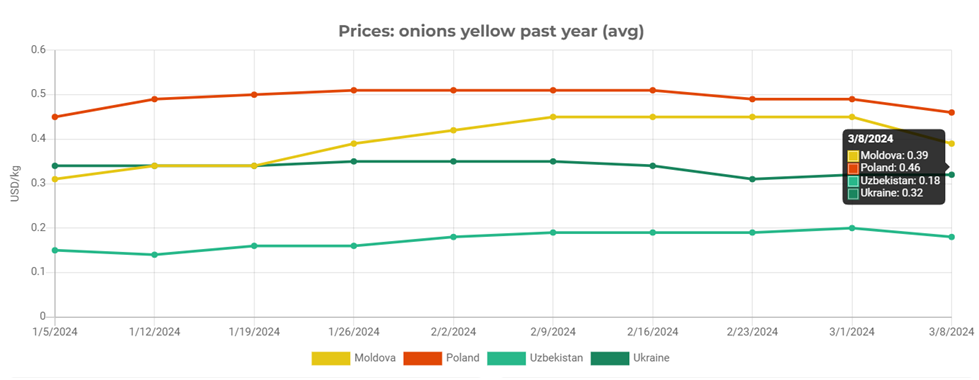

Last week, wholesale prices for onions dipped in Moldova, Poland, and Uzbekistan. Ukraine’s market remained stable in terms of average prices; however, the lowest price points saw a notable drop, attributed to an influx of lower-quality onions.

Andriy Yarmak, an economist with the Food and Agriculture Organization (FAO), sheds light on the market dynamics: “Onion pricing follows a cyclical pattern, common to many agricultural commodities. Typically, prices peak towards the season’s end, drawing attention and attracting newcomers to the market. These new entrants often opt for what they perceive as a simpler venture—purchasing onions at harvest to resell later at a markup, after a storage period of 4-5 months. They base their strategy on the previous season’s data, which can be a misstep, as this information alone is insufficient for informed decision-making.”

Yarmak further elaborates on the challenges faced by these resellers, particularly after a high-price season: “They encounter a quintet of setbacks:

(a) harvest-time onion prices are still relatively high, diminishing resale margins;

(b) a surge in demand from fellow resellers inflates purchase costs;

(c) storage rental rates escalate as more traders seek to stockpile onions, eroding potential profits;

(d) farmers, anticipating lucrative returns, delay sales, exacerbating price increases during and post-harvest;

(e) often, the onions sold immediately post-harvest are those less suited for long-term storage, a detail overlooked by resellers unfamiliar with cultivation nuances.

Consequently, the likelihood of profiting from onion resale in the spring diminishes significantly right from the acquisition stage,” concludes Yarmak.

EastFruit’s recent price analysis reveals that, as we approach mid-March, onion prices in Ukraine, Uzbekistan, and Poland have plateaued, mirroring those seen during the harvest season. Moldova stands as the exception, with prices hovering 10-20% above harvest levels, though they are on a downward trajectory. This price stagnation implies that onion storage has not been profitable this season, with storage losses seldom dipping below the 10% mark. The financial viability of onion storage also hinges on ancillary costs such as facility rentals, purchase financing, labor, and transportation, which further erode potential gains. EastFruit’s analysts estimate that to offset these expenses, onion prices would need to surge by at least 25-30% from the onset of storage.

Read also: Sheep feast on high-quality onions as demand plummets in Central Asia (video)

Yarmak points out that the real issue transcends the influx of opportunistic storage and resale entrepreneurs. The crux of the problem lies in the overproduction of onions, spurred by expanded cultivation areas. “Post high-price seasons, farmers often expand their cultivation areas, and many novices venture into onion farming,” Yarmak notes. “Yet, onions exhibit low demand elasticity; they’re a recipe-specific ingredient rather than a standalone food. Hence, low prices don’t significantly boost consumption, and high prices don’t deter it, leading to substantial price volatility.”

Does this pattern imply that post high-price seasons will always usher in low onion prices, or vice versa?

Not necessarily, according to EastFruit’s longstanding experience. Onion pricing is subject to a myriad of unpredictable elements, including climatic conditions, trade policy shifts (import and export bans), geopolitical conflicts, and economic upheavals. This season, for instance, onion prices have remained above the rock-bottom levels they might have hit, cushioned by factors such as Egypt’s export ban, the unprecedented summer drought, and an unusually wet autumn in the EU’s primary onion-growing regions, not to mention geopolitical tensions in the Red Sea.

EastFruit had foreseen such market fluctuations in June 2023, cautioning its readers in the article “Onion bubble – what will farmers do with all these onions from August onwards?”. Moving forward, however, such insights will be exclusive to EastFruit subscribers, with tailored content available in English, Russian, and Ukrainian. The subscription details will be announced soon on our platform.

For now, please feel free to download a sample of EastFruit Premium report on the markets of Egypt, the UAE, Turkey, Eastern Europe, and Central Asia. To learn more about the subscription and its advantages, please fill out a short form here.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.