As it was expected, Russia introduced a complete ban on the import of vegetables and fruits from Moldova starting today, December 4, 2023, EastFruit analysts report. They used the usual vague pretext: “continuing systematic detection of quarantine objects in vegetables and fruits [from Moldova] that can cause multi-billion dollar damage to agricultural production [of Russia].” For some reason, the pocket organization “Rosselkhoznadzor” finds quarantine organisms exclusively in vegetables and fruits of those countries that are considered not too “obedient” to Russians. Just a couple of weeks ago, Russia did the same with its long-term friend and partner Armenia, which dared to accuse the Russian dictator of failure to fulfill obligations on Karabakh.

However, let’s return to the economic consequences of this decision for both countries – for Moldova and for Russia. What will each of them lose and will there be any good in this decision for either of them?

Let’s start with the numbers – Moldova’s largest revenue from produce exports to Russia was recorded in 2020 and amounted to US $112 million. This is quite an impressive figure, since this revenue was equal to 9% of all exports of Moldova and half of all revenues from the exports of fruits, nuts, berries and vegetables. If we discard nuts, which are traditionally exported mainly to the EU, then Russia’s share has already reached 75% of total revenue. However, since 2020, there has been a downward trend in the volume of fruit supplies from Moldova to Russia and an increase in exports to the countries of the European Union, the Middle East and to Asian countries as well.

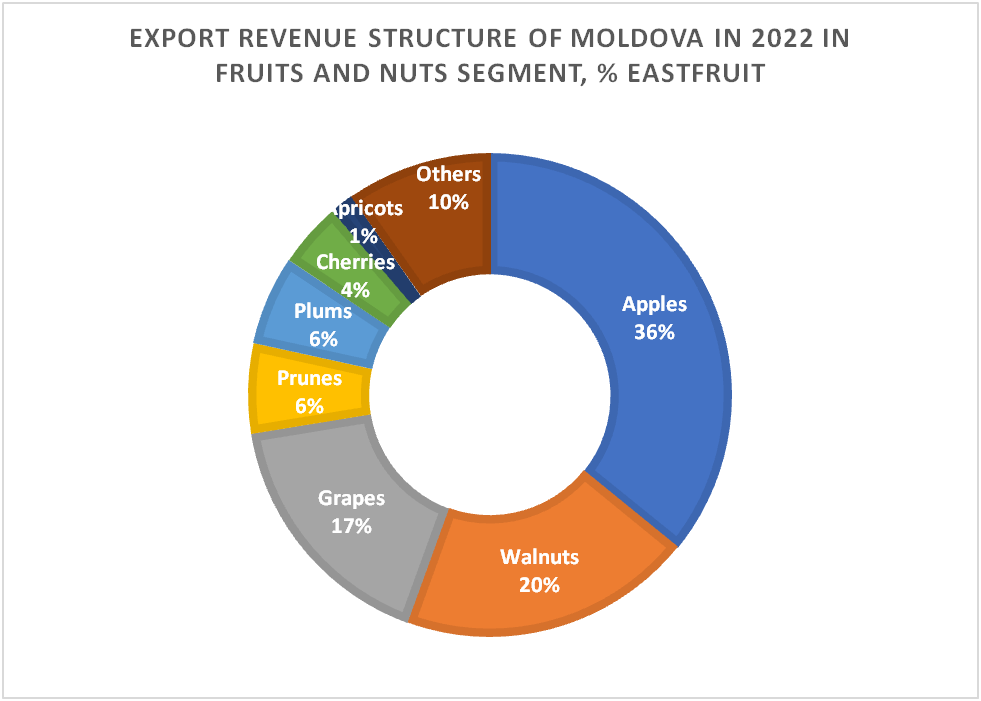

As we can see in the graph above, Moldova receives the main revenue, around 36%, in the fruit and vegetable segment from exports of fresh apples. Traditionally more than 90% of Moldovan apple exports are going to Russia. Therefore, this sector is the most vulnerable to the Russian ban. We are talking about US $70-80 million in export revenue.

As we can see in the graph above, Moldova receives the main revenue, around 36%, in the fruit and vegetable segment from exports of fresh apples. Traditionally more than 90% of Moldovan apple exports are going to Russia. Therefore, this sector is the most vulnerable to the Russian ban. We are talking about US $70-80 million in export revenue.

In second place are walnuts, but are traditionally exported mainly to EU markets, so we will it is rather safe. In the case of fresh table grapes, third largest export item of Moldova, the dependence on exports to the Russian market is much lower and amounts to about 25%. There is even less dependence on exports of the fourth most important item – prunes with only around 10% revenue from Russia. For the fresh plums, the percentage of exports to the market of the worst trading partner in the region is not critical – less than 20% although still significant.

Accordingly, the real problem of this ban could only be caused to the apple market segment of Moldova.

But here, too, Moldova was somewhat lucky in the current season – because on the one hand, there is an unusually high demand for apples on the world market in 2023/24 season, and on the other hand, prices for industrial apples for processing into apple juice concentrate have increased a lot.

However, diversification of fruit exports is not a very easy task for Moldova, like for any other country that previously supplied the bulk of its products to the Russian market. The quality requirements for fresh fruit in the EU and the Middle East are much higher than in Russia, so to diversify exports, producers have to improve technologies of growing, storing, post-harvest handling, sorting and packaging of products and learn a lot of tricks about long-distance logistics. They also need to invest into marketing, which was not necessary if you exported to Russia.

The most difficult task is in front of the fruit segment where consumers are guided by varieties. The fact is that in Russia it is still possible to sell outdated, not the most delicious varieties of fruits, but in other countries it is no longer possible to sell such varieties. In this case farmers have to uproot the old varieties and plan new ones, which is very costly indeed.

As we noted above, the biggest problem is with the apple segment in Moldova. So-called “semi-intensive” orchards without drip irrigation with outdated varieties of apples are already being actively uprooted in Moldova. However, those who do have intensive orchards and who have already been able to export the first volumes of fresh apples to the countries of the Middle East and Asia understand that they can earn much more on these markets than on the Russian market.

Ukraine is a shining example for Moldova. After Russia invaded Crimea and the Donbass in 2014 and banned imports of fruit from Ukraine, farmers of Ukraine adopted very fasted and actually sharply increased exports of fruits and berries, raised the quality of products and revenue from sales, and found truly profitable segments for new investment. The Ukrainian fruit market, having access to the Russa, was in the stage of permanent stagnation and exports were declining. After the loss of access to the Russian market, exports of fruits and berries from Ukraine began to grow sharply as demonstrated in this article!

By the way, most likely, exports of Moldovan apples to Russia will continue through the mediation of traditional re-exporters, such as Belarus and Kazakhstan. Just like the case with Poland, which continues to deliberately feed the aggressor and make money on apple exports through the mediation of these countries.

In other words, if in the short-term Moldova farmers may experience some difficulties, in the long term of 3-5 years the fruit and vegetable business of Moldova will become much stronger and more sustainable and resilient, product quality will increase, and exports will be more diversified.

What will Russia lose by banning itself from buying fruits from Moldova?

Before the start of Russian aggression against Ukraine, Moldova was the 7th largest supplier of fruits to the Russian market and the largest supplier of fresh apples. Apples, plums, cherries, apricots, strawberries, table grapes were the most important fruits and berries supplied from Moldova to this market and they always were in a good demand in Russia.

Today, Russia, despite loud statements about “successful import substitution”, does not have any serious success in increasing the share of domestically produced fruits on the fruit market.

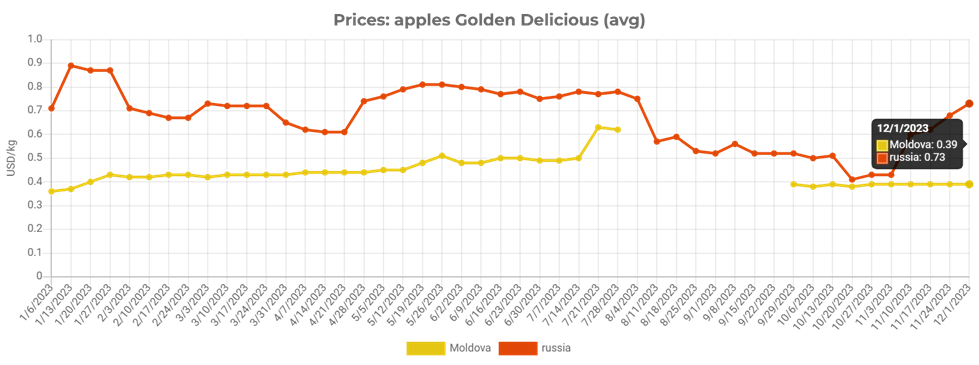

For example, wholesale prices for apples in Russia are currently almost twice as high as in Moldova. Accordingly, the Russian consumer is already forced to pay a lot more for the ordinary apples. By the way, average salary in Russia and Moldova are now almost the same, while before the invasion into Ukraine Russian consumers used to earn a lot more than consumers in Moldova.

In fact, Russia does not have the opportunity to replace Moldovan apples, because supplies from all major apple producing countries in the region are already banned from exporting to Russa. Accordingly, Russian consumers will soon be forced to come to pay even more for their apples! Thus, Russian already rather poor consumers will be the ones who pays for the decision of Russian dictator.

Also, Russian importers will now have to compete much harder to source apples from Turkey and Serbia. Turkey earns much more by selling apple to India and Serbia also prefers to sell high quality apple to the EU, UK, Middle East and Southeast Asia rather than to Russia. Accordingly, Russia will be able to buy only apples of lower quality categories from these countries, which are not suitable for exports to developed countries.

The absence of grapes from Moldova on the Russian market may also be quite noticeable. The fact is that these were the cheapest grapes that Russia could import. In Uzbekistan, Tajikistan, and other countries of Central Asia, which previously supplied grapes to the Russian Federation, there is a huge shortage of these fruits due to the recent grape disaster caused by unusual winter frosts. This industry in Central Asia will not recover soon and Russian consumers will have to make do without affordable grapes.

In general, it seems that the ban on imports of Moldova’s fruits to Russia will bring Moldova much more benefit than harm. Russia, as usual in such situations, will make its own citizens to pay a dear price for the political stupidity of their dictator.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.