According to EastFruit analysts, onion prices in Ukraine continue to rise, and the average wholesale price has already reached 14 UAH/kg, which is equivalent to $0.48 US dollars. Thus, since the beginning of harvesting of the late onion varieties in August 2023, prices on the Ukrainian market have already increased by 40%.

Interestingly, prices are now growing faster than in the last season, when by spring onion prices in Ukraine set all historical records. At that time wholesale price for onions reached 48 UAH/kg or $1.31 US dollars, and retail prices were much higher.

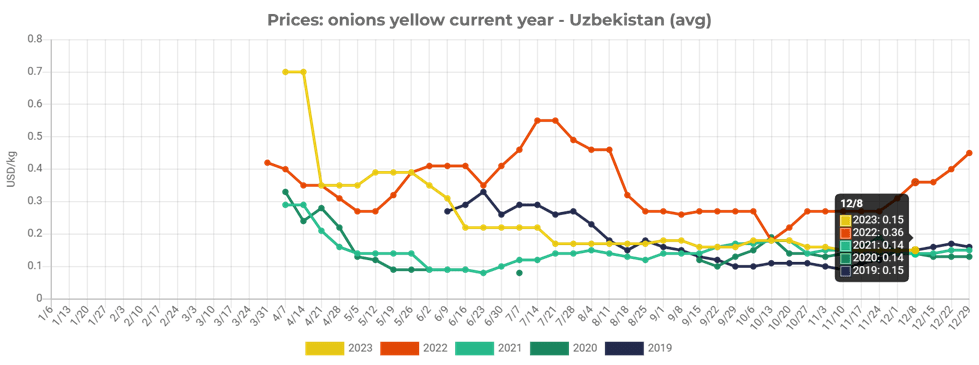

According to EastFruit weekly price monitoring, onion prices in the 2022/23 season increased by the end of the first ten days of December by only 25% in relation to prices at the beginning of harvesting. Thus, the rate of price growth then was almost 40% lower than now. However, the price level during onion harvesting in 2022 was significantly higher than in 2023.

What should Ukrainian consumers and producers expect in the upcoming months? Will onion prices set new records or, conversely, decline by spring?

“Unlike last season, when the prospects for rising onion prices were not in any doubt, this year the situation is radically different. And although the majority of market participants firmly believe that onion prices will rise by spring, very often it is the majority that is mistaken in their forecasts,” says Andriy Yarmak, economist at the Investment Centre of the Food and Agriculture Organization of the United Nations (FAO).

Let us recall what led to a sharp increase in onion prices in the previous 2022/23 season:

a) the destruction by Russian invaders of one of the largest onion production zones in the southern regions of Ukraine, which turned Ukraine from an exporter into a major importer of onions.

b) an unprecedented drought in Western European countries, which led to a sharp reduction in production in the main producing countries.

c) floods in Pakistan, which destroyed a significant part of the onion harvest of this country, which is one of the largest onion exporters in the region.

d) unprecedented frosts in the countries of Central Asia in January 2023, which destroyed a significant part of onion stocks, led to the transformation of such large exporters as Uzbekistan, Tajikistan and Kazakhstan into net importers of onions.

e) bans on exports of onions from Uzbekistan, Kyrgyzstan, Kazakhstan, and Tajikistan as a result of the above circumstances.

f) a ban on exports of onions from Turkey in order to maintain domestic prices at a level acceptable to consumers.

In January 2023, we described in detail the prospects for rising onion prices and our forecast then turned out to be absolutely accurate.

However, now, let us repeat, the situation is not near as obvious and forecasting the price trends is going to be much more difficult.

Let’s start with Central Asia. Uzbekistan, according to our estimates, in 2023 produced 500-600 thousand tons of onions more than needed for domestic consumption. Considering that the country can export about 200 thousand tons annually, and that in the last two months, onion exports from the country have been extremely low, and that the new onion harvest in Uzbekistan will begin to be harvested in three months, there is a fear that getting rid of this surplus of onions will be possible only with the help of weather disasters, similar to last year’s frosts.

It is also worth paying attention to price trends in this market. In 2022, onion prices in Uzbekistan doubled by December compared to the beginning of September 2022. In 2023 prices not only did not increase, but also dropped by 17%, which should serve as a warning for people who bet on re-selling onions at higher prices after storage.

We also note that at the moment, wholesale prices for onions in Uzbekistan are comparable to the price level in other countries where this country usually exports onions, e.g Russia. Therefore, there is still no economic incentive for exports.

Also, for now, prices for onions in the EU are not high enough to cover the costs of transporting these products from Uzbekistan. To activate exports, Uzbek onions must fall in price by at least another 5 US cents per kg. However, such low prices for onions in Uzbekistan have never been recorded before, which does not mean that this will not happen in the current season. Another option would be an increase in onion prices in the EU, which is probably more realistic.

However, here we need to return to the most important issue of onion stocks in Central Asia. According to EastFruit, starting in the summer of 2023, many entrepreneurs in Uzbekistan, Tajikistan, Kyrgyzstan and Kazakhstan came up with a “brilliant new idea”. Most of these entrepreneurs had never previously been involved in fruit and vegetable trade, but nevertheless, being carried away by the sharp rise in onion prices in the previous season, decided to try their luck anyhow.

The basic idea of these businessmen was to find a storage facility, often without refrigeration or sufficient insulation, buy onions during harvest, store them, and at least double their investment by spring by selling the produce at a higher price.

“Since 2003, when I started monitoring the situation on the onion market, I have seen this rush for high profits at least 5 times. In the vast majority of cases, when onion “resellers” appear, they inflate onion prices during harvesting and maintain them high for a while as they try to hold stocks as long as possible. At the end of winter or in the spring, when they start opening storage facilities, they bring prices down in a hurry as they sharply increase the onion supply. As a rule, this ends in big losses for them, and onion prices by spring are lower than during harvesting,” Andriy Yarmak shares his personal market experience.

However, this season the prospects for a fall in onion prices by spring are also not obvious. Among the reasons that may help avoid a collapse in onion prices by spring, Andriy Yarmak names the following:

— Problems with the quality of onions in the EU, which can lead to greater than usual losses during storage, but overall onion production in the EU has increased due to the expansion of planting area.

— The impossibility of accurately assessing the volume of onion production in Ukraine and problems with product quality, because many newcomers have entered this sector without experience in growing and storing onions, including from the large enterprises that previously grew grains and oilseeds.

— Possible problems with storing onions in Ukraine due to onion production moving to the regions less favorable for this crop than before the invasion of Russian aggressors and the need for onion drying, which most growers do not have.

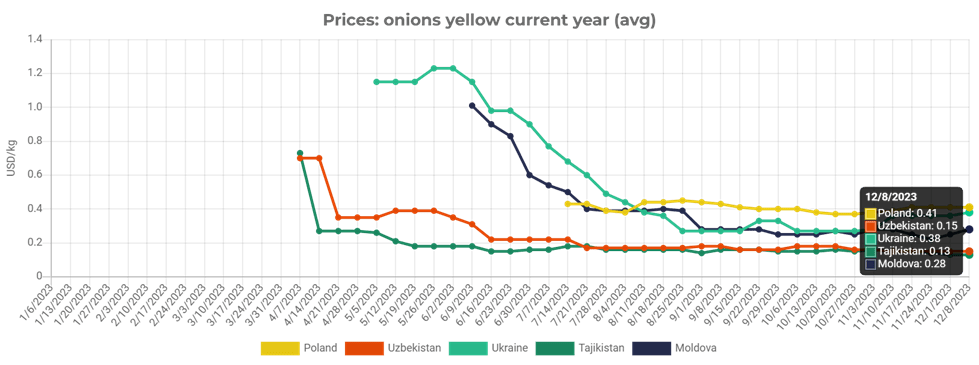

At the moment, onion prices are lowest in Central Asian countries, and highest in the EU. In Poland, the price of onions is mostly stable at around US$0.41 per kg, which is only 3 US cents higher than in Ukraine. In Moldova, prices are rising, but onions there are 10 cents cheaper than in Ukraine. Let us recall that Moldova, before the Russian invasion of Ukraine, imported onions from Ukraine.

In general, the price level for onions at the moment can be considered normal for this time of year, if we exclude seasons with obvious surpluses and seasons with obvious shortages of products. Therefore, current onion prices also do not give us any clues regarding the pricing outlook.

If there are no natural disasters, then we can assume that, most likely, the truth will be somewhere in the middle. It is possible that onion prices in the region, with the exception of Central Asia, may rise slightly, but their growth will most likely be lower than traders’ expectations.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.