EastFruit analysts made an in-depth analysis of the quality of hazelnuts in Georgia and its impact on exports, exporters’ revenue and even the country’s reputation. Although this material is devoted to Georgia and hazelnuts, many countries, exporters of fruit and vegetables in our region will be able to find analogies in it with other nuts, fruit and vegetable products.

Georgia is one of the TOP-5 exporters of hazelnuts in the world, although a few years ago it was its second largest exporter, but sharply deteriorated its position due to the invasion of the marble bug and increased competition from other exporters. By the way, we recently published an analysis of trends in the global hazelnut market – you can read it here.

Why hazelnuts became the main export position of the agricultural business in Georgia? Suitable soil and climatic conditions for growing hazelnuts, a favorable investment climate, trade agreements, in particular free trade regime with the EU, access to the sea and transport infrastructure have created excellent opportunities for the stable development of the sector. As a result, hazelnut cultivation in Georgia has become a lucrative business for both small producers and large international companies as Ferrero in 2007, Olam in 2016 and Camille Bloch in 2020 used these opportunities.

Domestic consumption of hazelnuts in Georgia is insignificant, therefore, production is aimed at international markets. In other words, the Georgian market directly depends on the world market, which, by the way, has recently seen a growing demand for quality.

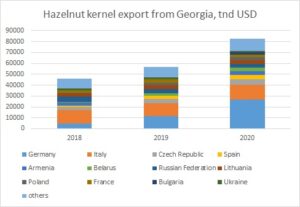

Data source: Trademap

Hazelnuts brought Georgia more than $80 million of export revenue in 2020, but it has significant potential for further development. Just a few years ago (until 2017), Georgia earned more than $170 million from the export of hazelnut kernels, but export volumes decreased due to the invasion of the marble bug, which the industry has been fighting for several years in an organized manner. More than 70% of Georgian hazelnuts is exported to the EU countries. At the same time, in 2020 we observed more than twofold increase in the export of hazelnuts from Georgia to Russia.

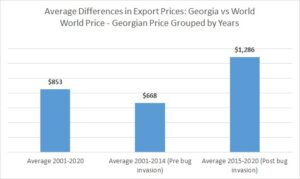

Despite the positive dynamics of exports, Georgia is one of the few leading exporters who consistently sell hazelnuts at prices below the average world price. Over the past 8 years, Georgia has exported hazelnuts on average 13% ($960 per ton) cheaper than the average world price. In comparison, a relatively new producer of hazelnuts on the world map, Chile, is already exporting hazelnuts at $2,000 per ton more than the world average.

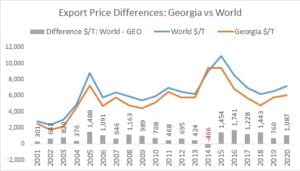

Data source: Trademap

The trend of relatively low export prices for Georgian hazelnuts has been observed for about 20 years – as we can see since 2001, the export price of Georgian hazelnuts was higher than the average world price only in 2014 (in the graph, the difference is calculated as the average world price minus the export price from Georgia).

The sector participants believe that the main reason for the low prices for Georgian nuts is the poor quality of hazelnuts, which was further exacerbated after the spread of the pest in 2016. Accordingly, the market reacted immediately – the gap between the prices of Georgian nuts in comparison with the average world price doubled after 2016.

Data source: Trademap

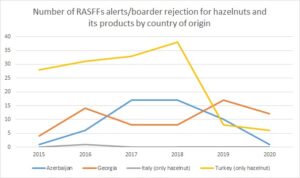

Latent rot, acidity and aflatoxins are the main problems Georgian exporters face. Georgia, which accounts for 8% of world exports, has already overtaken Turkey, which accounts for 65% of world exports, in terms of returns of hazelnut consignments from EU countries due to the high concentration of aflatoxins. Therefore, the situation is very alarming.

Data source: European Rapid Alert System for Food and Feed (RASFF)

Each return of an export consignment is not only a loss for the exporter, but also a threat to the country’s reputation, Maya Mikava, who has been exporting Georgian hazelnuts for over 10 years, said. In her opinion, testing for aflatoxin should be mandatory for all export consignments, on the same principle as the HACCP system for processing enterprises, which is mandatory since 2018. Now Georgian producers do such an analysis mainly at the request of European customers. The motivation for additional analyses of the exported hazelnuts creates the cost risks associated with the return transportation of the rejected lot, which the exporter must pay in case of return, not to mention the disposal of the entire lot. But despite it, four batches of hazelnuts have already been returned to Georgia from the EU in 2021.

Mamuka Beriashvili, the owner of NutsGe, explains the current situation by the inexperience and weak organizational structure of some exporting companies that do not have qualified quality specialists. Trying to make pennies on one-off batches, these companies risk everything, including the reputation of the whole country: “There is fierce competition for high-quality raw materials among nearly 200 processors who work in Georgia, but despite this, all nuts are sold. This does not motivate farmers to achieve better quality indicators. I think that Georgian hazelnuts can be sold at a higher price, but because of not knowing market mechanisms, we reach a stalemate. There are very few Georgian exporters who track world market trends and not only for hazelnuts, but also for other nuts – almonds and cashews, which are competitors of hazelnuts.”

According to Mr. Beriashvili, such a strategically important industry should be better regulated like wine production, where the state carefully monitors the origin and quality of raw materials and controls the compliance of the final product with the highest standards. “I believe that focusing on quality, not quantity, should be a fundamental strategy for the development of the industry. There are examples of neighboring countries that monitor the quality of hazelnuts at the state level. In addition to control, the introduction of quality standards should be stimulated by financing, so that banks offer better lending conditions to export companies that have, for instance, the ISO 9001: 2015 system,” Beriashivili continues.

Due to the inability to ensure consistent product quality, Georgian producers are forced to work mainly with intermediaries who diversify the risks of suppliers from Turkey, the world’s main producer. Thus, Georgian exporters cannot influence the market and are forced to agree to the terms and relatively low prices.

As a result, Georgia loses millions of dollars in potential export revenues. If exporters could establish business relations directly with European customers which would be possible by ensuring high quality, even considering current export volumes, the additional revenue from the kernel exports would bring the country’s economy more than $12 million. If according to the estimates of the Georgian Hazelnut Growers Association (GHGA) the annual exports of hazelnuts can be increased to 100 thousand tons over the next three years, the revenue would amount to more than $630 million. And this is in the case of exports at an average world price. But one could aim at a higher price, given the access to the markets of both Russia and the European Union!

However, if things move as they do now, Georgia is likely to lose $81 million, with its 100 thousand tons exports, due to the poor quality of hazelnuts. This is a very conservative estimate that does not take into account the factor of a constant decrease in the demand for low-quality hazelnuts and an increase in the supply of high-quality hazelnuts. As we have already mentioned, Chile is actively increasing its exports. The USA is even more actively involved in this market, also focusing on premium quality products.

Therefore, when planning to increase the production of hazelnuts, Georgian producers and processors must take into account the new realities of the world market.

For reference:

The quality indicators of hazelnuts are determined by the internationally recognized food quality and safety standards OECD, CODEX (Codex Alimentarius) and UNECE (United Nations Economic Commission for Europe). The latter has two standards for hazelnuts – the DDP – 03 standard for inshell hazelnuts and the DDP – 04 standard for hazelnut kernels. According to these documents, the minimum quality requirements can be summarized as follows: intact, clean, sufficiently developed, free from stains, live pests, damage, mold, rancidity, moisture and foreign odor; humidity should not exceed 6.0%.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.

3 comments

In addition to the quality, I think one of the key factors of lower prices from Georgia is limited working capital of Georgian Companies. After the crisis, exporters have very limited funds, so they have to find clients who are giving advance payments and of course, if you receive money in advance, they ask for lower prices.

So, not only the quality is the problem.

Deep analyses need to investigate what happens to the goods which are rejected because of aflatoxins. The goods come back to Georgia, its sealed, re-sampled and re-checked in acredited european Labs. Most of the time, analyses show that the goods were miss-rejected and goods are re-exported to EU without any problems.

Thanks for the nsightful comments.

thanks, interesting article. Indeed, as Levan Kardava said, the (publicly available) figures on revenues of processors show that the profit margins are so slim that they clearly have not much capital, and not much margin of error. This is a very good article, thank you!