At the beginning of 2023, EastFruit analysts published an article: “Will the free fall in prices in the EU frozen raspberry market stop?”, which has generated a lot of discussions in the berry industry.

It is now almost the middle of June 2023, but we cannot yet unequivocally answer this question in the affirmative. We can, however, say that the fall in raspberry prices has, at least, slowed down and prices have stabilized recently. All market participants: berry farmers, freezers, and traders – all froze in anticipation of the arrival of the first batches of new crop raspberries for freezing in Europe in order to form prices for it.

Recall that at the beginning of 2023, Poland lowered its price for whole frozen raspberries to 2.8-2.9 euros/kg. At the same time, exporters of frozen raspberries from Morocco began to enter the market with offers of 2.5-2.6 euros/kg. By the way, you can read more about the very rapid expansion of Morocco in this market in our analytical article “Morocco is catching up with Ukraine in the frozen raspberry market.”

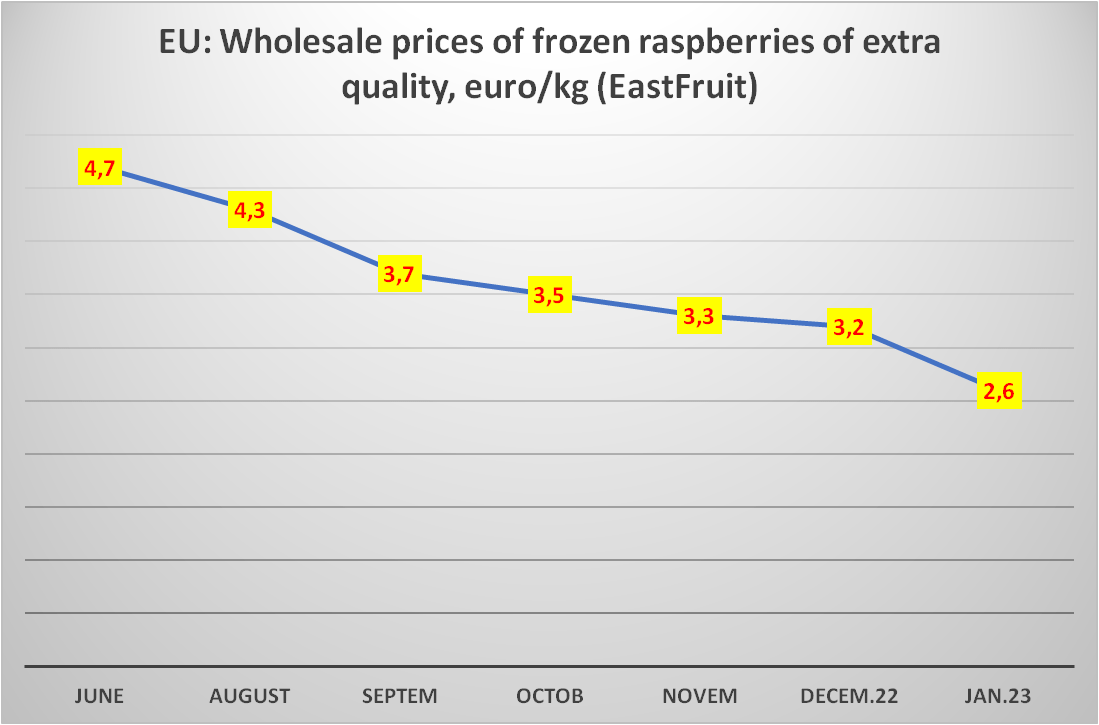

Below is an indicative price chart for extra quality frozen raspberries (95/5 and 90/10) that we provided in the January article.

After our review of the situation, which suggested that further decline in prices was possible, prices for frozen raspberries indeed continued to decline from January to May 2023. While prices of frozen raspberries declined, in Europe, there was still no demand for it.

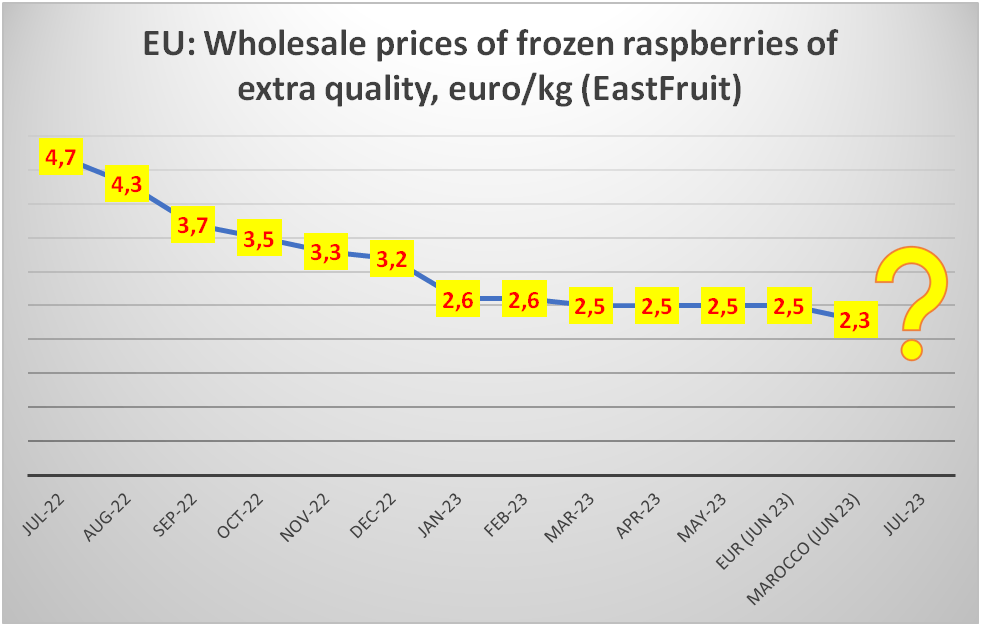

Already in February-March 2023, the price for berries from European countries leveled off with the price level for raspberries from Morocco and reached 2.50 euros/kg per extra quality grade. The Moroccan berry, however, fell by another 0.20-0.30 euro/kg in relation to its winter level and continued to remain competitive in price.

Below is an indicative price chart for extra quality frozen raspberries (95/5 and 90/10) from the beginning of the season to June 2023 inclusive.

If someone thought that the freefall in prices of frozen raspberries in 2022/23 was something special, this person is probably new to this business. These price cycles repeat themselves all the time. You can read more about the cyclical nature of raspberry prices here, and about how lucky Ukrainian freezers and exporters were in 2022/23 in this analytical article.

Let us briefly explain these traditional price cycles for frozen raspberries. When prices for raspberries soar to high levels, as they did in the 2021/22 season, when they were sold at 5 euros per kg or more in wholesale, the food industry continues buying it for a while, because it is used in its recipes. At the same time, farmers who profit a lot from growing raspberries are massively expanding areas under this crop around the world.

However, then representatives of the dairy, confectionery, bakery and other industries look at their economics and realize that raspberries have alternatives in recipes – for example, one could buy frozen strawberries for only 1.5 euros, which is more than THREE TIMES cheaper than raspberries! We’re not even talking about even cheaper alternatives like frozen plums, which can be bought 8 times cheaper! Consumers and restaurants are also noticing this and are also starting to buy other fruits instead of raspberries. Thus, the demand drops.

Accordingly, a wave of raspberry substitution by large consumers begins, which leads to what we saw in the outgoing 2022/23 season – prices keep declining but the demand does not recover because the decision to replace raspberries has been already made and big buyers are noy looking for them anymore. Since such decisions are made by large consumers only once per year, the price reduction does not affect demand in any way – raspberries have already been crossed out, or they have been severely curtailed, and they simply become no longer needed in such volumes.

And here comes the new season, in which the production of fresh raspberries continues to grow, but the freezers are still “sitting” on last year’s stocks, and do not know what to do with them. Therefore, they stop buying raspberries or buy very small volumes, which collapses the price of this berry – after all, it is extremely difficult to sell a large volume of raspberries at the fresh market.

Accordingly, two years of low prices lead to mass uprooting of raspberry plantations by producers, and the food industry in the meantime begins to again look at this berry thanks to its affordable price and include it in their recipes. At some point, an equilibrium is established in the market, when prices suit everyone. But this equilibrium rarely lasts more than 1 season, after which prices rise again, and the cycle is completely repeated.

The average duration of a full raspberry cycle is 4-6 years, but it can be accelerated or lengthened, depending on other factors. For example, the world is now seeing the first signs of a global recession, which could extend the cycle of low raspberry prices. Also, weather cataclysms, especially in the leading producing regions such as Serbia, Poland, or Ukraine, could make a significant impact on these cycles. Thus, predicting it with 100% precision long-term is impossible.

So, let get back to present time, which is the middle of June 2023.

What is happening with the prices of frozen raspberries today?

First of all, in Central Asia, the season for harvesting “summer” raspberries has already ended. As we predicted, the freezers practically did not buy this berry for freezing as they still have stocks unsold from 2022.

In Eastern Europe, Moldova’s freezers could receive the first raspberries already in June. Farmers understand that processors are not ready to pay a high price for raw material this year, but it is still difficult to say at what price real transactions will be carried out.

Processors expect that prices for a whole frozen berry will be formed at the level of 2.30-2.50 euros/kg. However, there is no complete certainty in this although the price is approximately two times lower than a year ago.

As for the demand for broken frozen raspberries, at the moment it is completely absent and it is rather difficult to form a price for it. It is possible that proposals for 1.2-1.4 euros per kg will appear on the market and will be of interest to some of the small consumers, because this berry must be sold in any case and at any price. In 2018 we saw prices for low-quality raspberry leftovers fall down to 1 euro per kg, so this development of events should not be ruled out either, especially since now the stocks of this product, by all indicators, are significantly higher than in the spring of 2018.

Every year before the start of the season, customers contract a certain volume of frozen raspberries for urgent shipments, which is not observed this season. Demand has fallen sharply for sure. There are still plenty of frozen berries on the market, as well as raspberry purees and concentrates made in 2022, so customers probably won’t be in a hurry to make new deals.

According to our estimates, the stocks of frozen raspberries in Poland (some of which belongs to Ukrainian firms) at the beginning of March 2023 were 20 thousand tons higher than a year earlier. This corresponds to almost two months of raspberry exports from Poland, and we know that global demand for raspberries did not increase from March to May 2023. So, the situation with stocks has probably not improved, and, possibly, even worsened.

Accordingly, the situation just before the start of the summer raspberry harvesting season in Serbia, Moldova, Ukraine and Poland remains extremely tense and extremely negative in terms of the prospects for the price formation.

Just to remind you, the prices for raspberries of non-premium quality for freezing in Ukraine in 2019 dropped to an incredible 10 US cents per kg. High-quality summer raspberries were then bought by freezers at 20-30 cents per kg max, and by autumn the price of remontant raspberry varieties rose to 40-50 cents per kg. Even the highest of these prices sounds shockingly low for today’s market realities.

Whether raspberry prices will drop to such levels this year is still difficult to say. But the fact that the pricing trend remains extremely negative is an indisputable fact.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.