According to EastFruit analysts, most of the largest plum growers in Eastern Europe are now selling their products cheaper than last year. However, it does not mean that all growers are dissatisfied with prices. Moreover, the market situation differs in each country. For instance, the plum season in Ukraine is the worst growers had in recent years, but for other countries it is one of the best.

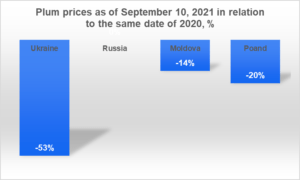

Given the challenging weather in the key EU plum-producing countries in the spring of 2020, as well as the record high prices in 2020, market participants hoped that prices in 2021 would not be lower than last year. However, only in Russia the average wholesale price for plums today roughly corresponds to last year’s level, while in Moldova, Poland and Ukraine, prices are lower than in 2021.

The most notable decrease of wholesale prices for plums, more than one and a half times, was in Ukraine. Last year, the price was higher, as a large part of the harvest was lost due to frosts. The areas planted with plums in Ukraine tended to expand, since plums are in good demand in the European Union. Thus, in 2021 the plum harvest in Ukraine has grown sharply and prices have fallen.

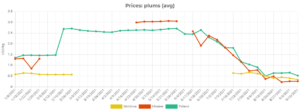

In Ukraine, plum prices are now at their record lows, despite a slight increase in the last couple of weeks. Two weeks earlier, they dropped to $ 0.22 per kg, and now they are at about $ 0.26 per kg. These are the lowest plum prices in the past four years.

For Ukrainian growers, unlike Moldovan ones, plums are still an additional niche business line. Therefore, cultivation and processing technologies, long-term storage, not to mention trade contacts and exports experience in Ukraine are not as well developed as in Moldova. Hence, given production growth, there is a considerable decrease in prices compared to previous years.

By the way, now plums can be bought in Ukraine much cheaper than in Moldova. However, there is no growth in demand from importers, since Ukrainian suppliers are inactive in promoting their product in the EU countries.

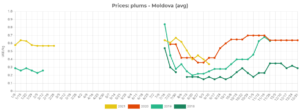

The situation in Moldova is much better than in Ukraine. Here, both exports and processing are better developed. Therefore, it was only last week that plum prices in Moldova became lower than last year for the first time. Prior to that, growers were very satisfied with the price level, since it really exceeded that in 2021. However, for two weeks in a row, prices have been falling rapidly, although seasonal price increases normally start at this time. There are three reasons for this. Firstly, the plum harvesting season in 2021 was delayed by a couple of weeks, so the supply peaked in mid-September, not at the beginning of the month. Secondly, the plum harvest in Moldova, obviously, will not be lower than last year, as expected, and possibly even higher. Third, there are quality issues due to rains, leading to the sale of a large part of the harvest for processing. The prices of processors are relatively high, so growers do not mind saving on storage costs and selling plums of poor quality right away.

It should be reminded that Moldova is the largest exporter of plums in Eastern Europe, selling 45-50 thousand tons for export annually. Moreover, it is one of the five largest world exporters of fresh plums and has been actively developing exports to the EU countries in recent years.

In Poland, price developments are similar to what we see in Moldova. Generally, growers are satisfied with prices and only last week they fell below the level of 2020. At the same time, the absolute price level is one and a half times higher than in Moldova and two times higher than in Ukraine. By the way, Poland exports 6-8 times less plums than Moldova – about 6 thousand tons per year.

Ukraine exports on average about 300 tons of plums, and only in 2017, when a lot of favorable factors coincided, it managed to export more than 8 thousand tons. However, this suggests that Ukraine has a considerable unrealized potential for exporting fresh plums, as well as growing them for further processing. In addition, as the experience of Moldova shows, plums can be well stored until the New Year holidays and even longer. Since Ukraine has a large domestic sales market, keeping plums for long-term storage with subsequent sale out of season can bring good profit to growers.

On the contrary, Russia is the world’s largest importer of plums, purchasing up to 80 thousand tons annually, mainly from Moldova, Turkey and Uzbekistan. Also, Georgia, Iran and Azerbaijan have been increasing the supply of plums to Russia in recent years. Serbia, instead, is reducing the export of plums to the Russian Federation.

Plum prices for exporting to Russia are usually the highest in the region. However, this is natural for the world’s largest importing country. Plum prices in Russia were lower than usual, so growers are unlikely to consider this season as a good one. However, plums in Russia are a lucrative business given the relatively high price level.

It should be noted that the local production of plums is growing. It means that each season will bring price equation with other countries and a decrease in the profitability of supplies to the Russian market for Moldova, at least during harvesting and sale of plums in Russia.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.