EastFruit analysts receive many questions from market participants regarding the prospects for onion pricing. People ask what is better: selling onions now or storing them until winter or even spring?

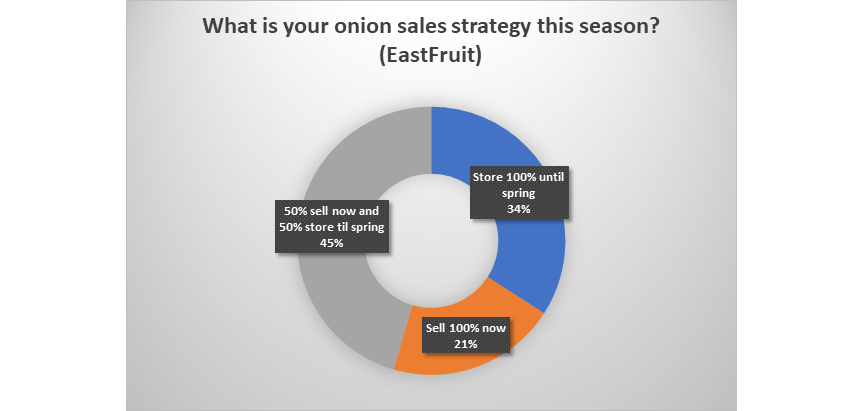

We will try to answer this question, since our team has people who have been analyzing the fruit and vegetable markets for more than 20 years and have encountered similar questions many times. We will break this question down into components, but we will start with the results of a survey about the intentions of market participants, which was posted in our Telegram channel. We asked, “What is your onion sales strategy this season?” and received the following answers.

Thus, if you trust the survey results, the bulk of the onions are stored – namely, 56-57% of the survey participants plan to store onions until spring in the hope of getting a higher price. Accordingly, a smaller share is sold now.

It should be noted right away that the situation may differ significantly in different regions and individual countries in the region. The survey was conducted among readers of our channel, most of whom are from the former USSR countries of Eastern Europe and Central Asia. Another important note – we will only talk about yellow onions here. Why this is important – see the section dedicated to the global onion market.

Market specifics of the onions

“Fresh onions are a product with a completely inelastic level of demand. In other words, if onion prices rise, its consumption does not decrease much, because there is absolutely nothing to replace onions in recipes with. Likewise, if onion prices drop to zero, no one will consume more onions as this wouldn’t occur to consumers. In fact, there are not so many similar products as onions arounds, and this is what makes them unique,” explains Andriy Yarmak, an economist at the Investment Centre of the Food and Agriculture Organization of the United Nations (FAO).

He notes that the lack of demand elasticity for onions has a negative impact on the risk level of this business. If suddenly production exceeds needs, then no one needs onions even for free. And if there is not enough onion, then there is no limit to the rise in onion prices.

What impacts onion prices?

All countries can be divided into onion exporting countries and onion importing countries. There are also countries with relatively balanced domestic production and consumption of onions.

Onion prices in importing countries are affected by the market situation in the countries from which onions are imported. For exporters, it’s the other way around – prices depend directly on the level of demand and prices in the markets of the supplying countries. Accordingly, the cost of logistics is also very important.

The most dramatic changes in onion prices occur in those countries that are turning from an importer into an exporter and vice versa. We saw this in the countries of Central Asia immediately after the damage from the frosts of the winter of 2023.

Global onion market

Global onion trade is about $4.2 billion US dollars or 9-10 million tons per annum. The largest exporters are India and the Netherlands. Each of these countries exports from one and a half to two million tons of onions annually.

However, there is an important caveat here – India predominantly sells red or purple varieties of onions, as well as white varieties. Yellow onions are much less popular here. Accordingly, when we talk about the global yellow onion market, India’s influence is rather low. That is why the reports about the limitations on onion exports from India this year will not have much direct impact on our markets.

Major onion exporting countries also include China, Mexico, Egypt, the USA, Spain, Peru, Afghanistan, Poland, Uzbekistan, and Turkey. By the way, Kazakhstan, which is also often called a large exporter, is actually a net importer of onions. The main volumes of onion exports from Kazakhstan are re-exports of Uzbek products.

The largest importers of onions are Sri Lanka and Bangladesh. And here, too, we need to make a reservation – these countries also import mainly red/purple and white onion varieties. These are the countries that buy onions mostly from India. Accordingly, their influence on the yellow onion market is also minimal. In the same category are other Asian countries that are among the top 10 largest global onion importers: Malaysia, Pakistan, and Vietnam. Although here part of the yellow onion is higher.

Major importers are also the USA, Great Britain, Japan, Poland, Canada, the Netherlands, and Germany.

Therefore, yellow onions are a fairly global crop. This means that it is always possible to find markets for onions – the only question is the price of logistics.

Key trends in the global onion market in the 2023/24 season

The main developments in the global onion market that affect prices on a global scale, according to EastFruit analysts, are:

1. Drought in the countries of Northern Europe, primarily the Netherlands and Germany, which had a negative impact on onion yields. And this is the second year in a row.

2. A ban on the export of onions from Egypt until the end of 2023.

3. Restrictions on the export of onions from India.

4. A ban on exports of onions from Turkey since November 2022, which has not been lifted. By the way, even frozen and dried onions from Turkey can’t be exported.

5. A sharp increase in the area under onions in Ukraine, Uzbekistan, Georgia, Kazakhstan, Moldova, and other countries in the region. According to our data, the area under onions has also expanded in EU countries.

6. Not yet verified reports of problems with the quality of onions among producers in the European Union – primarily in Poland and the North-West of the EU due to unfavorable weather conditions in the summer of 2023.

The history of onion prices – does it answer the question about the prospects for price development?

In 2003 (20 years ago!) Agricultural Marketing Project operating in Ukraine, which later transformed into Fruit-Inform, just began monitoring the market for onions and other vegetables in Ukraine. By that time, the situation on the onion market had been repeated annually for many years in a row: in the fall, onion prices were low, because onions came to the market en masse from households and from commercial producers, and from December prices began to rise and reached their maximums by the end of May. Often prices in May were 3-4 times higher than in the fall.

This was actively used by entrepreneurs who rented old, insulated storage facilities, often without refrigeration, purchased and stored onions there in the fall, and opened the storage facilities in the spring, hired people to sort onions and resold them with a huge margin. A whole generation of entrepreneurs grew up on this and quickly multiplied their capital.

However, in 2003, Fruit-Inform analysts noted that the situation had changed. First of all, a number of new large projects invested into onions production using modern technologies. Secondly, the first modern storage facilities were constructed at large farmers who previously sold onions after harvesting. And thirdly, the number of people wanting to double or triple their investment in onion storage in less than a year has grown sharply.

All this told us that the demand for onions during harvest could be unusually high, while there would be far fewer people than usual willing to sell onions at the time of harvesting and right after. This meant that Ukraine could enter the winter with record stocks of onions and in the spring the supply of onions could also be record high. This all spoke in favor of the scenario of unprofitable storage of onions and a high threat of a collapse in onion prices in the spring.

“I talked to many traders who said that we don’t understand anything about the onion market, because it has never happened that onions were cheaper in the spring than in the fall, which means this cannot ever happen,” recalls Andriy Yarmak who lead the Agricultural Marketing Project.

“As a result, as we predicted, prices for onions in the fall turned out to be record high even despite a record high harvest! However, traders were so confident that onions would rise in price even more that they actively borrowed money to buy onions and competed for the production contributing to the price rise,” says Andriy Yarmak.

After the onions were put into storage, their prices remained stable for a long time, and none of the market participants worried. No one was in a hurry to sell onions, but there was enough of it on the market anyhow, so by December prices even began to decline slightly. However, already in mid-January, having returned after the holidays, some traders began to worry – onions were even cheaper than in August-September, and a steady downward trend in prices appeared.

To keep the long story short, onion prices fell to minus values by May. In May nobody wanted to take onions even for free, and entrepreneurs who had invested millions of dollars in the purchase and storage of onions were forced to pay for services for disposal of the onions. Thus, according to various estimates, from 50 to 100 thousand tons of fresh onions went to landfill in Ukraine in that spring, and number of those wishing to make money by storing onions without growing them had noticeably decreased by the time the new harvest began. By the way, it was then that Ukraine exported quite significant volumes of onions for the first time.

However, people tend to forget and ignore other people’s negative experiences, so on average, once every three to four years, history repeated itself. After a season of high prices for onions in the spring, the number of people who wanted to either grow them or buy and resell them at a super profit in the spring always increased sharply. And this story has been repeated many times since then.

Such cyclicality in onion prices is typical for many countries with a large number of farmers and fragmented wholesale and retail produce trade, i.e. all countries in our region.

From this story we can draw a number of important conclusions that will help us further predict developments in the onion market this season:

1. Purchasing onions for storage for the purpose of resale at a higher price is not a business, but a typical gamble. You can win, but you can also lose literally everything.

2. Storing onions and other vegetables and fruits is not a separate business, but an integral part of the business of growing onions or other storable products.

3. A professional grower who grows and sells products must sell them rhythmically, ideally 12 months a year, because constant presence on supermarket shelves or on the wholesale market is the most significant market advantage. Therefore, the question for professionals about whether to store or sell products should not arise at all – they are always selling.

What is happening to onion prices in the markets of the main onion importing countries?

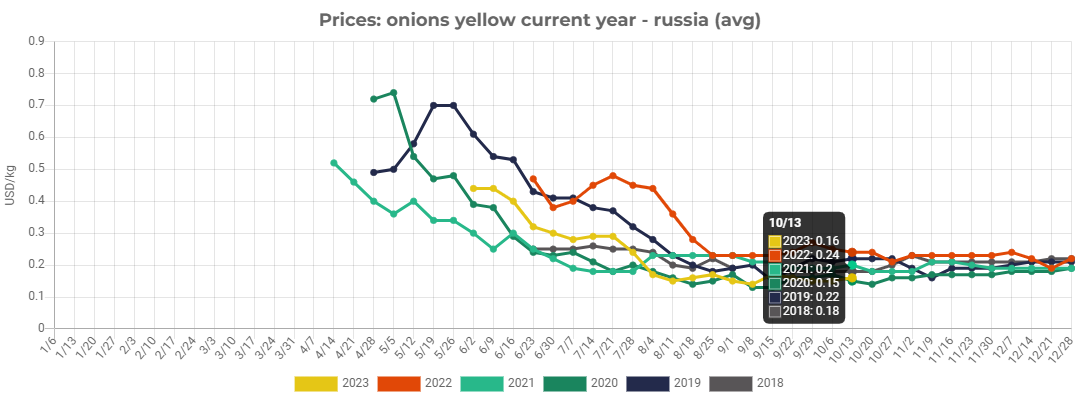

In our region there is only one major importer of onions – Russia. The European Union is both a major importer and a major exporter of onions, and the requirements for the quality of onions in this region are quite high.

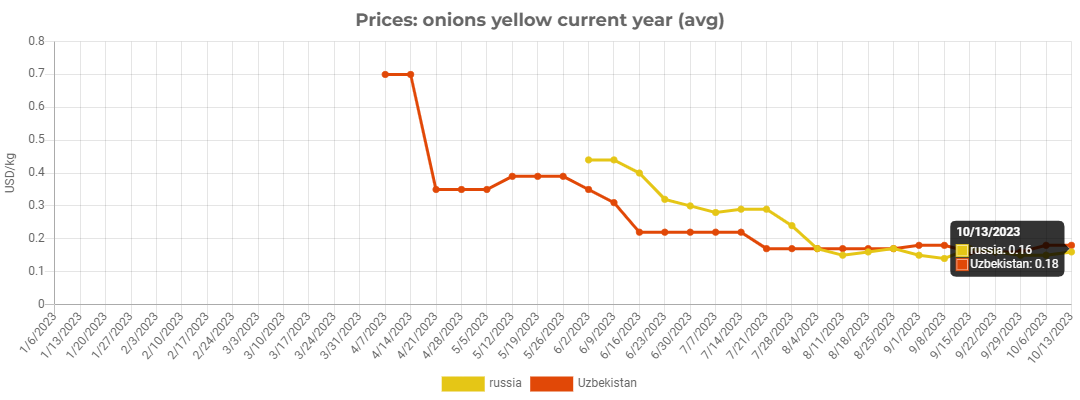

Onion prices on the Russian market are now at an all-time low. Moreover, they are even lower than in Uzbekistan. Therefore, we are not talking about exports from Uzbekistan yet. Moreover, it is possible that producers from Russia will have to look for foreign markets for their onions themselves in order to avoid huge losses on onions in the current season, since they are very well equipped with storage facilities, and these are also reportedly full.

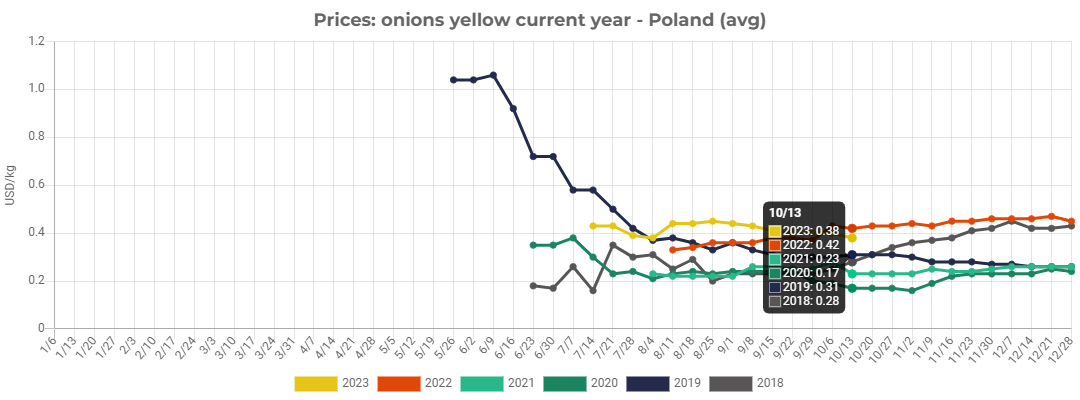

At the same time, onion prices in the European Union remain at a relatively high level, although they are lower than last year and tend to decline.

We also note that onion prices in Middle Eastern countries such as the UAE and Saudi Arabia are at a relatively high level, primarily because they are directly affected by bans and export restrictions imposed by Turkey, India, and Egypt.

Therefore, at the moment, this region is the most attractive market for onions, provided that the logistics allow for delivery to meet the wholesale purchase price, which ranges from 65 to 85 US cents per kg for yellow onions.

Will onion prices collapse or, on the contrary, rise by spring in the 2023/24 season?

If we start from the facts, we see record or sharply increased volumes of onion production in 2023 in almost every country in our region: Moldova, Ukraine, Georgia, Uzbekistan, Tajikistan, Kazakhstan, and so on.

Also, we are seeing increased interest in renting storage facilities for storing onions. Moreover, both farmers and those who have never grown or stored onions tend to store onions rather than to sell them. Let us immediately note that storing onions involves many nuances, and often for beginners who have purchased onions that seem to be of excellent quality for storage, they completely rot within two or three months.

Onion prices have not yet collapsed, partly because there is this demand from intermediaries, who even now continue to purchase onions and put it into storage hoping to resale in the spring. This trend is going on a mass scale and involves significant resources.

As one could see from the chart above, exporting onions from Uzbekistan or Tajikistan, for example to Moldova or Ukraine simply makes no sense, because the difference in prices does not cover logistics costs. We already noted but let us repeat it that in Russia onion prices are even lower than in Uzbekistan – basically they are the lowest in the whole region!

These are all very negative factors for the onion market.

On the positive side, it should be noted that Egypt and Turkey are absent from the market, as well as the relatively low yield of onions in EU countries and quality problems, which may negatively affect the possibility of long-term storage of onions. However, a remark needs to be made about the EU – a decrease in onion yields does not mean a decrease in production – after all, the area under onions has reportedly expanded in 2023. Therefore, most likely, the total volume of onion production in the EU countries will be higher than a year earlier.

Egypt usually exports the bulk of onions from February to June, so its absence on the market is not a critical factor now. The impact of the restriction on onion exports from India, as we explained above, remains minimal.

Conclusions

1. Onion stocks in storage facilities in the countries of Central Asia and Eastern Europe remain high and, in many countries, close to records.

2. Entrepreneurs are in no hurry to sell onions, which only strengthens the prospects for an abnormal increase in the supply of onions on the market in the winter-spring period.

3. We cannot objectively assess how much “extra” onions are now in Ukraine, Moldova, Uzbekistan, and other countries in the region. However, in the analytical article “Will Uzbekistan be able to avoid a collapse in onion prices”, we estimated the surplus of onions to be close to 600,000 tons. And this is only in one country!

4. It is impossible to predict what officials from Turkey and Egypt will decide, but we assume that these countries will open onion exports as early as January 2024. Simply because both countries really need foreign exchange revenues, and because, according to our information, onion production has also increased significantly in both countries. This means that the supply of onions may increase sharply in January 2024 already.

5. In February-March 2024, the first batches of onions from Iran will arrive on the market. A little later, at the end of March, onions harvesting will begin in the southern regions of Tajikistan and Uzbekistan, and a new season will also begin in Egypt. Therefore, in fact, there are only about 4 months left for the sale of onions from last year’s harvest without the arrival of new volumes from competitors. That’s a very short time for such a large stock!

6. It is possible that if onion prices in the countries of the region begin to fall in January 2024, many entrepreneurs will react with a reluctance to sell, which will further worsen the prospects for a sharp increase in supply in February-March 2024. At this time, an increase in air temperature will begin, which will force the onion sales which are stored without refrigeration, which is a common practice in Central Asia.

7. The only really positive factor in the market, which has not yet been confirmed, is the possibility of reducing onion production in the EU countries, but even then, expensive logistics to the EU will not allow the Central Asian country to significantly increase prices, but it can help suppliers from Ukraine and Moldova if, of course they can ensure the quality of the onions.

Of course, there may be various weather and political disasters that cannot be predicted, and which can make significant changes to the market situation. Let us also repeat that for each country the situation may be slightly different. For each country and each individual enterprise, it is necessary to calculate logistics, inventories, consumption, and other factors to derive conclusions. And in this article, we tried to provide all the facts that will help in to improve the quality of such decisions.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.