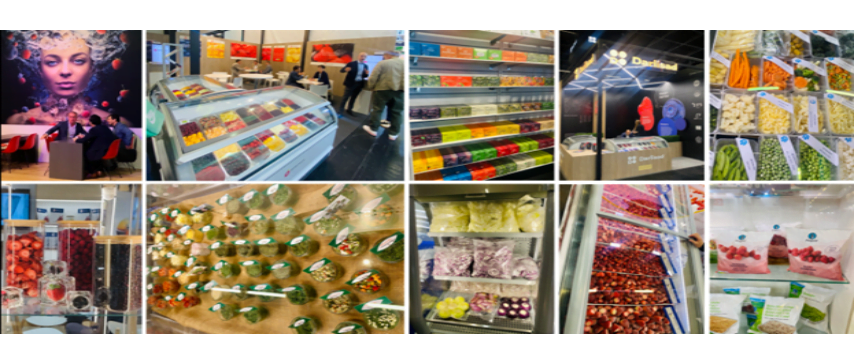

The most important event for the European market of frozen fruits, berries and vegetables took place last week in Cologne, Germany, EastFruit reports. Our colleague, FAO international consultant and a manger of Tiferet company from Moldova, Iuliia Tymoshenko, took an active part in the expo and shares her observations, impressions, and insights about key trends in frozen produce segment.

This was already the 37th international ANUGA exhibition dedicated to food products, which takes place every two years. The frozen produce segment was mainly presented in pavilion 4.2.

Many producers of frozen fruits and vegetables, traders, processors, and retailers discussed the market situation and the unprecedented challenges the industry has faced over the past two seasons. We described them in detail earlier in our publications, for example in the material “Why buyers of frozen fruits and vegetables are silent”. Against the backdrop of an extremely difficult season, companies became more loyal and friendly to each other. The participants actively discussed the decrease in purchasing power of consumers, which negatively affected demand, the reorientation of the market to new, more affordable segments, the difficulties in forming a raw material base at prices that would allow them to obtain at least a minimal profit, and a steep increase in production costs. The situation with frozen raspberries in the 2022-2023 season was a disaster for most companies. We described this situation in detail, starting in January 2023, and warned about the prospects for further price reduction, which almost no one believed. However, the traditional cyclical nature of raspberry pricing has once again proven to be a thing. Naturally, Ukraine was the focus of the discussions because it was here that prices for frozen raspberries were at record lows.

The situation with frozen raspberries in the 2022-2023 season was a disaster for most companies. We described this situation in detail, starting in January 2023, and warned about the prospects for further price reduction, which almost no one believed. However, the traditional cyclical nature of raspberry pricing has once again proven to be a thing. Naturally, Ukraine was the focus of the discussions because it was here that prices for frozen raspberries were at record lows.

In addition to raspberries, black currants also caused big trouble for some market participants. Many did not sell the stocks before the prices collapsed at the beginning of the 2023-2024 season.

Egypt was also discussed a lot. This country continues to hold the world leadership in frozen strawberries. Egyptian frozen strawberries continue their rapid expansion in the markets of the European Union, the USA and even Southeast Asia. The main reason is the incomprehensibly low-price level for this berry, which makes growing strawberries for freezing in Europe completely unprofitable for many companies.

At the same time, market participants noted a very high level of interest in frozen blackberries, sour cherries, and even pitted sweet cherries. The demand for frozen apricots and plums also remains high. However, while demand is high, for plums and apricots it is not easy to ensure profitable freezing, because the fresh market can offer a higher price for these fruits. Today, frozen “hand-made” half plums from Serbia are available at prices of 90-95 euro cents per kg and this price remains stable. And for apricots, there are offers from China and Turkey, which is currently holding back prices for this product.

At the same time, behind the scenes there was a revival of the market for frozen vegetables, which continued to grow rapidly.

However, the economic crisis led to a deterioration in payment terms for delivered frozen products. In particular, it is no longer realistic to receive an advance payment and it is increasingly common practice to request delayed payment upon delivery.

Market participants have begun to take a more rational approach to the certification of frozen fruits and vegetables. Since certification costs money and requires time, companies were mostly focusing on certification only if it really made it possible to expand to new markets or maintain the existing one.

Also quite unexpected was the decrease in interest in organic products in favor of conventional ones, because price became increasingly important. Naturally, logistics was also a focus, but this issue is always important.

Despite the difficult past and very difficult current season, both old and new companies in the fruit and vegetable frozen segment were represented at the exhibition both at stands and as visitors. So, the market continues to work, waiting for a change from a difficult period to a more favorable one and hoping for an increase in the profitability of this very promising segment of the produce business.

Despite the difficult past and very difficult current season, both old and new companies in the fruit and vegetable frozen segment were represented at the exhibition both at stands and as visitors. So, the market continues to work, waiting for a change from a difficult period to a more favorable one and hoping for an increase in the profitability of this very promising segment of the produce business.

Anuga exhibition, of course, was dedicated not only to frozen fruits and vegetables. The main areas of the exhibition included:

“Anuga Fine Food” (staple foods and delicacies)

“Anuga Gourmet” (specialties)

“Anuga Meat” (meat and sausage products)

“Anuga Bread & Bakery” (pastry, bread, hot drinks)

“Anuga Dairy” (dairy products)

“Anuga Frozen Food” (frozen food and ice cream)

“Anuga Chilled & Fresh Food” (fresh and chilled vegetables, fruits, fish)

“Anuga Drinks” (drinks)

“Anuga FoorService” (technology/equipment for companies in the HoReCa sector)

“Anuga Retail Tec” (technology/equipment for retail trade)

Packaging and related materials

In addition, Anuga 2023 was accompanied by various programs and discussion panels aimed at understanding and identifying current global trends. Particularly interesting was the format of Anuga HORIZON – an innovative platform for the food industry, within which conferences were held that combined theory and practice, experience, and expectations, as well as solutions and proposals for future industry trends.

For suppliers of fresh vegetables and fruits, this exhibition was not of great interest. Traditionally, they choose the Fruit Logistica and Fruit Attraction expos held in Europe.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.