According to EastFruit analysts, in 2023 Uzbekistan could collect a record onion crop. Estimates of a possible increase in onion production volumes vary greatly, but the most pessimistic scenario, voiced by market participants in Uzbekistan and local experts shows a yield increase of at least 30-40% compared to the average annual indicators, although there are those who believe that production can even double.

With an average production of 1.2-1.4mn tons of onions per year, according to FAOSTAT, a 30% increase means additional 400,00 tons of onions, which is a lot. Please bear in mind that Uzbekistan exports on average 200,000 tones of onions per year and in case of pessimistic scenario, it will have to push 600,000 tons of onions out of the country in 2023/24.

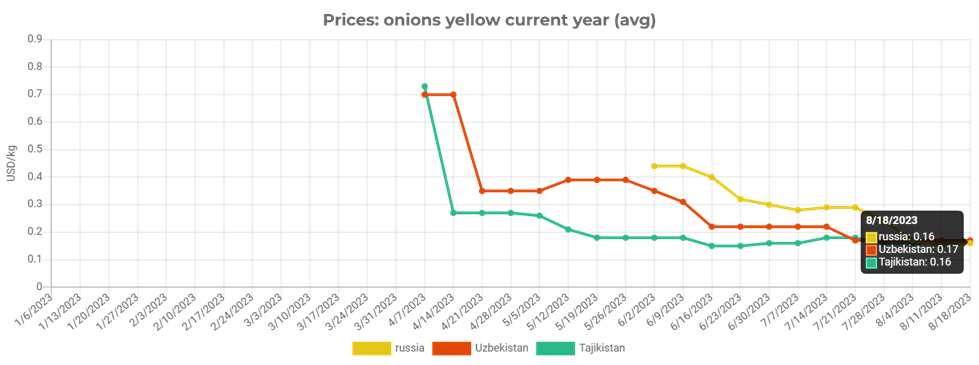

Is such an increase in onion prices noticeable now?

As one can see in the chart above, there is no definite feeling of a record harvest from the price level yet. Moreover, prices have been fairly stable for about five weeks in a row. This is explained by the incredibly high rates of onion exports after the export restrictions have been lifted and until the end of June at least. As we already wrote, in March-June 2023, at least 222 thousand tons of onions were exported from Uzbekistan, which was a record figure for such a short period of time.

However, at that time, onion harvesting had not yet begun in countries with a colder climate. Now the situation is completely different. Onion prices are now collapsing even in the Ukrainian market, which has lost more than 80% of its traditional onion cultivation areas due to the blowing up of the Kakhovka Dam by Russian invaders and the destruction and looting of irrigation systems, storage facilities, sorting lines, agricultural machinery and other elements of production technologies in the temporarily occupied territories of Kherson and Zaporizhzhia regions of Ukraine. At the same time, the main onion crop in Ukraine and other large onion-producing countries in Europe, such as Poland, the Netherlands and Germany, has not yet been harvested. Therefore, the pressure on onion prices is just beginning.

But let’s get back to the situation in the Uzbek market. The first sign of problems with the demand for onions for us was the massive appearance in various Telegram-channels advertisings with false information about the prospects for rising prices for onions in Uzbekistan due to the restriction of onion exports from India.

Let us explain why this is not true and can’t be true. Although India is a major exporter of onions, firstly, it has never supplied any onions either to the market of Uzbekistan or to the market of any of the countries where Uzbekistan traditionally exports onions. Secondly, India exports mostly red and white varieties of onions, while Uzbekistan grows and exports almost exclusively yellow onions. Accordingly, the impact of the situation on the Indian onion market on the situation in Uzbekistan is going to be close to none.

Why did traders in Uzbekistan try “disperse” the panic through obviously false messages about a possible increase of onion prices in Uzbekistan? The following graph gives a clear answer to this question.

Presently prices for onions in Uzbekistan are even higher than in Russia and they have been this way for three weeks now. In Russia harvesting of onions of the new crop has already started and areas have expanded there as well. At the same time, it is Russia that is the main market for onions from Uzbekistan, even if these exports are carried out through the mediation of Kazakhstan and Kyrgyzstan. By the way, onion prices in Kazakhstan are also comparable to onion prices in Uzbekistan.

Taking into account the dynamic price situation in the market of Ukraine and other countries of Eastern Europe, within a week or two, onion prices there may drop down to the level of price observed in Uzbekistan. Therefore, onion supplies from Uzbekistan towards Eastern of Western Europe can be forgotten in the near future, because the cost of logistics will be several times higher than the cost of the onion itself.

Pakistan, which sometimes buys onions in Uzbekistan, does not have much demand for onions this year, and onion prices there are no different from prices in Uzbekistan. Afghanistan has also never been a major importer of Uzbek onions. We do not really see any other viable options for exports, do you?

It is obvious that Uzbek traders have not been able to sell all the “spring” onions, and now the harvesting of autumn onions is already beginning, which, as a rule, provides up to half of the annual onion crop of Uzbekistan. Harvesting will be carried out through the end of September, just like in Europe. Accordingly, given the significantly larger expected volumes of the harvest, there is still no clear understanding of where it can be sold.

Therefore, it is not at all surprising that Uzbek vegetable traders, who have stocks of onions and see the beginning of a new crop of onions entering the market, are now trying in every possible way to get rid of them. Because there are no obvious prospects for growth in demand for onions from Uzbekistan yet.

External demand for this product can appear only if the price is so low that, taking into account the cost of logistics, the supply makes sense. However, as we know, Uzbekistan is far from the markets and logistics are expensive. Therefore, it is quite possible that a collapse in onion prices in Uzbekistan will not be possible to avoid, if, of course, the estimates of the volume of production growth were correct.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.