The experts of the Moldovan table grapes associations hope that weather in 2021 will be more favourable than in the previous two years. This will impact positively the quality of products, the volume and structure of their exports. There are reasons for optimism: the situation in the fields (moisture reserves in the soil, development of bushes, phytosanitary background) in winter and March of this year was much better than a year earlier. Nevertheless, agronomists of the best vineyards believe that this season it makes sense to work “not for quantity, but for quality of production – this is the key to success.”

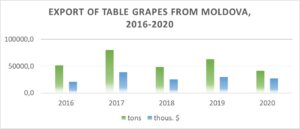

EastFruit reported earlier that in 2020, more than 48 thousand tons of grapes were exported from Moldova to 22 countries of the world. In 2019, local producers exported about 63 thousand tons of grapes to 29 countries.

At first it might seem that the last season turned out for Moldovan table grapes growers better than it was expected. Due to the drought, the grapes harvest in the country (from 17 thousand hectares) amounted to only about 70 thousand tons – this is the lowest result in the last five years (according to statistics, in 2019 – almost 112 thousand tons, 2018 – 126 thousand tons, 2015 – slightly less than 85 thousand tons). At the same time, in the 2020-2021 season the production/exports ratio was better and prices were higher than in the 2019-2020 season.

Thus, the average price of grapes for the 2020 harvest was about 11 MDL/kg ($ 0.65/kg), and for 2019 – about 8 MDL/kg ($ 0.47/kg). As a result, last year the quantity of exported table grapes decreased significantly, but in financial terms it almost remained at the level of the previous year: in 2020 – almost $27 million, in 2019 – about $29 million.

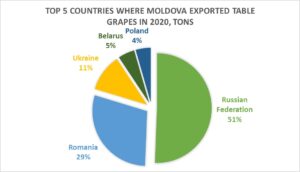

However, regarding the structure of Moldovan grape exports, the situation looks more tense. The export geography has narrowed – from 29 to 22 countries. The volumes of supplies to practically all “secondary markets” have decreased. In particular, the greatest decrease was observed in supplies to Belarus (from 5.4 thousand tons to 1.79 thousand tons), Iraq (from 2.11 thousand tons to 286 tons), Romania (from 18.65 thousand tons to 10.72 thousand tons), Ukraine (from 7.9 thousand tons to 4.2 thousand tons).

The export volume of Moldovan grapes increased, among the EU countries, only to Poland – from 1.58 thousand tons to 1.7 thousand tons in 2020. However, this is far from the best result of the last five years – more than 4 thousand tons.

In the lean last year, supplies of grapes from Moldova to Russia also slightly increased – more than 26 thousand tons (2019 – about 25 thousand tons).

In 2020, compared to the previous year, the share of CIS countries in the total exported volume increased from 62% to 70%, mainly due to exports to the Russian market (the share of the Russian Federation in the structure of Moldovan grape exports has never been less than 45-50%).

But, as the specialists of the fruit producers’ associations noted, this does not mean at all that the positions of Moldovan table grapes grower have strengthened in the markets of the CIS countries and Russia in particular. Many exporting traders of grapes from Moldova noted increased competition in the Russian market due to the intensification of similar quality (or even higher) table grape exports from Turkey, Azerbaijan and Uzbekistan.

Moreover, in the Russian market, as in the European one, consumer preferences are changing: buyers need a high-quality product, preferably seedless grape varieties. In Russia, the consumer still prefers red grapes and favors the well-known Moldova variety. However, some supermarket chains already require goods in modern consumer packaging – plastic bags.

Experts have been pointing out the need to reorient the table grape sector in Moldova to growing seedless grapes for several years, but in practice the process is slow and hard. Difficulties for local nurseries arose already at the stage of registration of well-known seedless varieties of grapes in the state register of varieties. Without an “official residence permit”, it is problematic to receive state subsidies and compensations for the establishment of new plantations. Apparently, the varietal modernization of the wine-growing sector in the country will extend over at least five years.

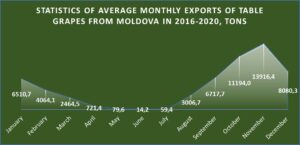

Apparently, in the short term, it makes sense for Moldovan table grapes producers to focus on “fine-tuning” the quality of the main exported table grapes variety “Moldova”, by improving the sorting and packaging. At the same time, they should ensure its presence in traditional markets – the Russian Federation, Romania, Ukraine, Poland during the period of optimal freshness from October to December.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.