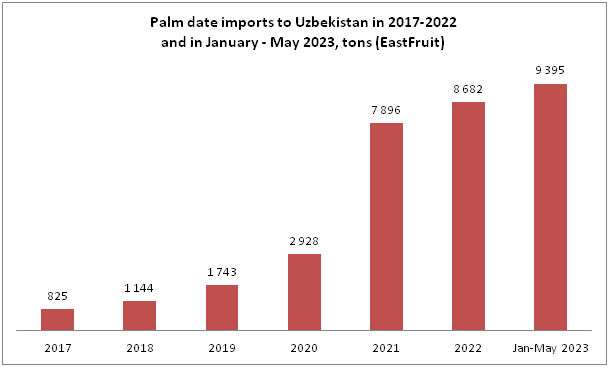

EastFruit analysts draw attention to an amazingly sharp increase in imports of palm dates to Uzbekistan in the recent years. From 2017 to 2022 Uzbekistan increased date imports from 825 tons to 8.7 thousand tons, i.e. more than 10 times! Considering that this product is not produced in Uzbekistan, its re-exports are negligible – all imports represent the volume of consumption.

What is the reason for such a rapid growth in date consumption in Uzbekistan?

Let’s start with the fact that dates are not the traditional food of Uzbeks and other peoples inhabiting Uzbekistan and are also not among the ingredients for any local traditional dishes. However, dates are a very special fruit for Muslims. During the holy month of Ramadan, the diet of every fasting person must include dates, which are eaten when breaking the fast and washed down with water.

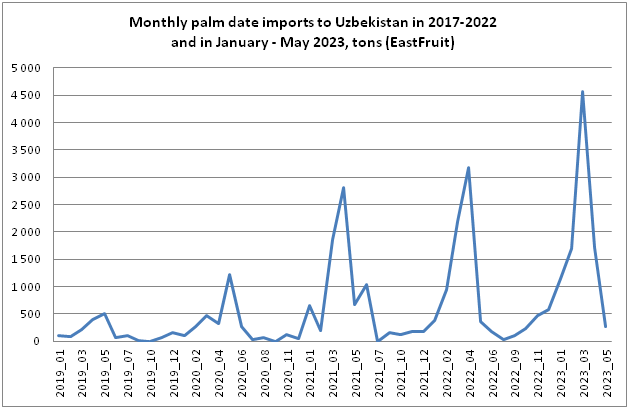

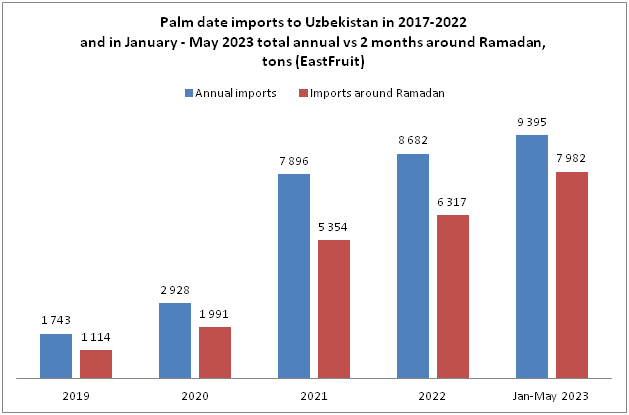

According to EastFruit analysts, from 60% to 75% of the annual consumption of dates in Uzbekistan occurs in 1/12 of the calendar year – the month of Ramadan. Consequently, such an impressive increase in date consumption is associated with two factors – a sharp reduction in the import duty on this product and a similar growth rate in the number of Uzbek citizens fasting during the month of Ramadan, according to EastFruit experts.

Annual import volumes and consumption of dates in the month of Ramadan

Until 2017 inclusive, the annual volume of imports and consumption of dates in Uzbekistan did not exceed 900 tons. But, starting in 2018, the volume of imports of this product began to grow. Moreover, a sharp jump is observed in 2021, when the imports of dates to Uzbekistan increased by 3.3 times compared to the previous year.

As can be seen from the data in the above chart, in the first 5 months of 2023 Uzbekistan imported a record volume of dates – 8% more than in the entire 2022.

At the same time, if we consider dates imports by month, the statistics show peak import volumes during one and a half to two months before the beginning of the month of Ramadan and during this holy month, the total share of which accounts for the vast majority of the annual import volume – from 60% to 75%.

As can be seen from the diagram, the growth in annual imports of dates to Uzbekistan is mainly due to the increase in imports of these products on the eve of fasting – 1.5-2.0 months in advance – and during the month of Ramadan.

A sharp reduction in import duties is an important factor in the formation of a growing trend

One of the main factors that ensured the steady growth in the volume of dates imported into Uzbekistan starting in 2018 is a sharp reduction in the rate of import customs duties on the import of these products. From October 1, 2017, the import duty rate for the import of dates into Uzbekistan was reduced (as well as for a whole range of fresh fruits and nuts) from 30% to 10% of the customs value of the goods, but in the amount of at least 20 US cents per 1 kg. Six months later, in April-May 2018, the import customs duty rate for the import of dates was completely lifted.

Further, an import duty rate of 10% on the import of dates was introduced and abolished periodically:

- from January 2019 to September 2021 – 10%;

- from October 2021 to April 2022 – 0%;

- from May 2022 to March 2023 – 10%;

- from April to December 2023 – 0%.

Is Iran displacing Saudi Arabia in the Uzbek date market?

Until 2021 inclusive, Saudi Arabia occupied a significant share in the total imports of dates to Uzbekistan – up to 41%. However, in 2022, the supply of dates from this country decreased sharply. In 2022 Saudi Arabia supplied only 29 tons of dates to the Uzbek market, which amounted to 0.3% of the total imports. In the first 5 months of this year, Saudi Arabia’s export volume was only 107 tons, which corresponds to 1.1% of the share of the Uzbek date market. At the same time, the reduction in supplies from Saudi Arabia to the Uzbek market occurs in the context of an increase in the total volume of imports.

Iran has been the main beneficiary of this rapid date market size increase in Uzbekistan. In 2022 Iran has more than doubled shipments of dates to Uzbekistan, and its share in total imports reached 93%. Approximately the same picture is observed in the first 5 months of 2023 with Irain being a dominant supplier.

We can also see a steady increase in exports of dates from Tunisia to Uzbekistan. Another country, which increased their presence on the market of Uzbekistan is Turkey. In the meanwhile imports of dates from Israel and Algeria has dropped.

If the current trend in stays on place, we can expect a further increase in the consumption of dates in Uzbekistan, which means that other countries could find their market niches at this promising and dynamically growing market. Egypt is one of the countries, which should watch the market of Uzbekistan closely as they are expected to sharply increase exports of dates in the upcoming years.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.