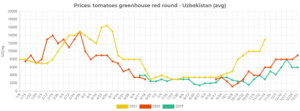

Prices for greenhouse tomatoes in Uzbekistan are breaking records: the average wholesale prices for red round tomatoes have grown by 30% over the past week, and by 3.7 times over the past two months! The current prices are several times higher than those recorded on the same date in previous years, EastFruit analysts note.

The dynamics of prices for greenhouse tomatoes in September-November 2021 differs significantly from that in the same period in 2019 and 2020. In previous years the increase in prices for greenhouse tomatoes began in the second half of October and early November, but in 2021 the average wholesale prices for greenhouse tomatoes started to grow on the 20th of September. Subsequently, the growth trend continued in October and November 2021 at a much higher pace than in previous years.

As of November 19, 2021, the average wholesale price for greenhouse red round tomatoes in Uzbekistan is 13,000 UZS/kg ($1.21), which is 2.2 times higher than on the same date in 2020 and 4.3 times higher than in 2019.

Moreover, the current wholesale prices for red round tomatoes are significantly higher than the pre-New Year prices in previous years: 44% higher than on December 31, 2020 and 2.2 times higher than on December 31, 2019.

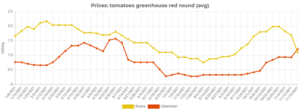

In mid-October 2021, EastFruit already wrote about the rapid rise in prices for greenhouse tomatoes in Uzbekistan and showed a correlation between their price dynamics in Uzbekistan and Russia. Russia is the largest importer of Uzbek tomatoes – it imported about 52% of the total volume of fresh tomatoes exported from Uzbekistan in 9 months of 2021. At the same time, the potential for growth in tomato prices in Uzbekistan has not yet been exhausted, since prices on the Russian market then grew faster than on the Uzbek market.

The upward trend in prices in the Russian market continued until the end of October 2021, but then the average wholesale prices for greenhouse tomatoes began to decline. They fell by 33% over the last week while in Uzbekistan prices are still growing. Opposite price dynamics for greenhouse tomatoes and their sharp decline on the Russian market over the past week have led to narrowing the gap between prices in Russia and Uzbekistan, and to the average wholesale prices being higher in Uzbekistan than in Russia.

Such a ratio of wholesale prices suggests that the influence of the Russian market on the further dynamics of tomato prices in Uzbekistan is reduced to zero. Thus, further price fluctuations will be based on the ratio of supply and demand in the domestic market of Uzbekistan and the price level of greenhouse tomatoes in other major markets – in Kazakhstan, Kyrgyzstan and Tajikistan, which together account for about 48% of Uzbek tomato exports.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.