EastFruit analysts continue to check up on the Georgian potato market. Prices spiked in September when it became apparent that the harvest volume in the central producing region Samtskhe-Javakheti (SJ) would be significantly low this season due to the drought. As the prices rose, imports became feasible and thanks to them, it looks like the market has stabilized.

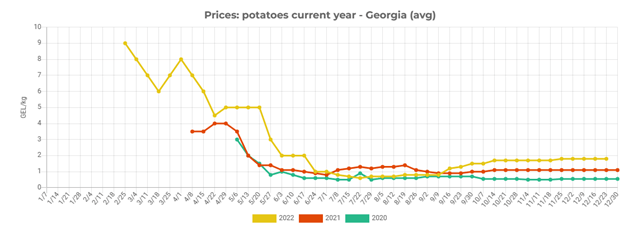

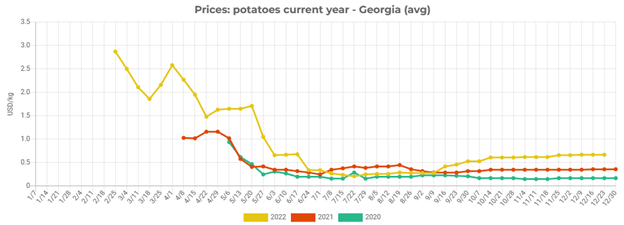

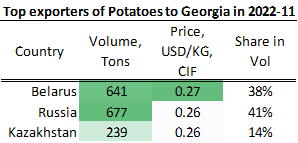

Potato prices on the Georgian wholesale markets are staying at around 1.80 GEL/kg ($0.67) for a couple of weeks now. Similarly to the Georgian Lari (GEL), prices are also stable in the US dollar. Halting of the growth was achieved by importing from abroad. Georgia imported 2 200 tonnes of potatoes in October and November 2022 – the highest volume in the last 5 years. What’s notable, the tables have turned this time around and the latest batches of imported potatoes were supplied mostly by Russia and Belarus. 80% of November’s imports came from these countries.

Data source: Ministry of Finance of Georgia

It is true that potato prices have stopped growing, but they are still way above the levels of the previous years. For example, last year this time, the average wholesale price was 1.10 GEL/kg ($0.36). The current prices are 63% higher than a year before. This means the current supply is much weaker compared to recent years.

Usually, with a bit of help from the imports, the supply from SJ is enough from September to May, a month when a new harvest begins in another producing region, Kvemo Kartli. Production volume in SJ in 2021 was around 154 000 tonnes and the imports from September to May amounted to 2 500 tonnes – about the same as the imports in October and November 2022. Thus, the Georgian need for imports is much higher this year, and there should be significantly more room for additional imports up to May 2023.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.