EastFruit analysts highlight unusually high import volumes of cucumbers and tomatoes in the 2022-2023 off-season. There are issues with the local high tunnels, which are key local suppliers during the off-season along with the greenhouses. Of course, the increased demand also contributes to the surge of imports.

Open-field production strongly dominates the market in only three months in Georgia. These are July, August, and September. October is a bit of a transition period, and then the market leans on the production from local greenhouses, high tunnels, and imports from Turkey.

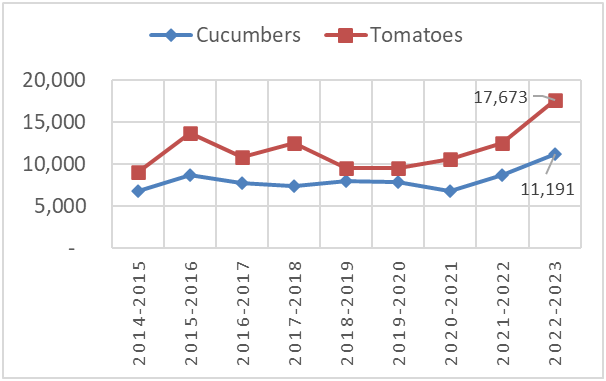

Imports of cucumbers and tomatoes in off-seasons, the sum of October-April, tons

Data source: Ministry of Finance of Georgia

So far, imports of cucumbers and tomatoes are peaking in the current off-season. Since the start of October 2022, Georgia has imported more than 11 thousand tons of cucumbers and 17 thousand tons of tomatoes. Practically all of the imports came from Turkey. Imported volumes in 2022-2023 October-April are 44% higher for cucumbers and 60% higher for tomatoes compared to the average import volumes in the same period of the previous 8 off-seasons.

EastFruit team discussed the issue with several owners of high tunnels from western Georgia, a region where this model was generally deemed to be profitable during the off-season. Every source mentioned that this time around the production volume from high tunnels has decreased. The outlook for tomato and cucumber farming this way does not look good.

It was noted that farming in high tunnels has become more costly. Farmers spoke of higher expenditures on plant care and raw materials. Higher costs have led to some farmers leaving the business.

The latter has resulted in another problem. Generally, the key to the profitability of high tunnels in western Georgia is the usage of cheap thermal water. In some cases, the costs of thermal water, which is fixed, are spread over several owners of high tunnels. When one quits, the others have to pay more. Thus, for some farmers, thermal water also got more expensive due to their partners quitting the business.

Another issue with the high tunnels are the winds. Georgian high tunnels are generally simple constructions covered in Polyethylene. Windy weather which damages farmers’ rather simple constructions from time to time is not a new issue, and it was still apparent in the latest off-season. Some farmers have become frustrated with the frequency of repairs and left the market.

Read also: Vegetable prices in Georgia declined by 6%: analysis of the reasons and price outlook

There are examples of farmers switching from tomatoes and cucumbers to completely different products to be profitable. The most prominent case would be the story of Temur Asatiani, owner of a 4,000 square-meter high tunnel, who quit producing tomatoes and cucumbers and has started growing blueberries instead. He planted blueberries in 2022 and has been selling his first harvest way before the start of the new season. For your information, the Georgian blueberry season usually starts at the end of May. The farmer found prices to be quite high in the off-season, he got GEL 50 ($19) for a kilogram! Mr. Temur thinks some farmers around him are likely to follow his example for the next year. He plans to increase his supply window for the next off-season.

So, on the one side, we have issues with the production of tomatoes and cucumbers in key market players in the off-season, but on the other side, the demand from the final consumers has grown. As mentioned by EastFruit numerous times, the influx of russian citizens to Georgia has significantly boosted the local demand for many products, and it would be a surprise if it did not for tomatoes and cucumbers. Logically, imports have shot up to fill in the gap between Georgian supply and demand. By the looks of it, local off-season production of tomatoes and cucumbers may reduce even further for the 2023-2024 season.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.