Massive harvesting of blueberries will begin in Georgia in a week. In the last two seasons due to relatively cold weather and rains in producing regions, the beginning of the harvesting season moved to June. However, the early harvest is already sold on the local market. Growers avoid making a prognosis regarding the export prices yet. The volume of harvest is expected to increase significantly.

The 2023 season should become the season when Georgia slowly but stable will start exporting to European and Arab countries and reduces share of russian market in blueberry export, although russia will remain the major market this season too.

EastFruit contacted major blueberry growers in Georgia and found out their expectations for the upcoming season.

Local market developments

Most growers EastFruit spoke with, expect an increase in yields, largely because orchards are becoming mature. The five surveyed producers (Blue Bird, Georgian Blue, Blue-Berry, Agrolane, Green Valley) expect a total harvest of at least 480 tons in the 2023 season. At the moment, the wholesale price of one kilogram of blueberry on the local market varies between 20-30 GEL ($7,74-$11.61), although it is expected that the prices will fall from the next week. Export prices will be defined when traders will start buying.

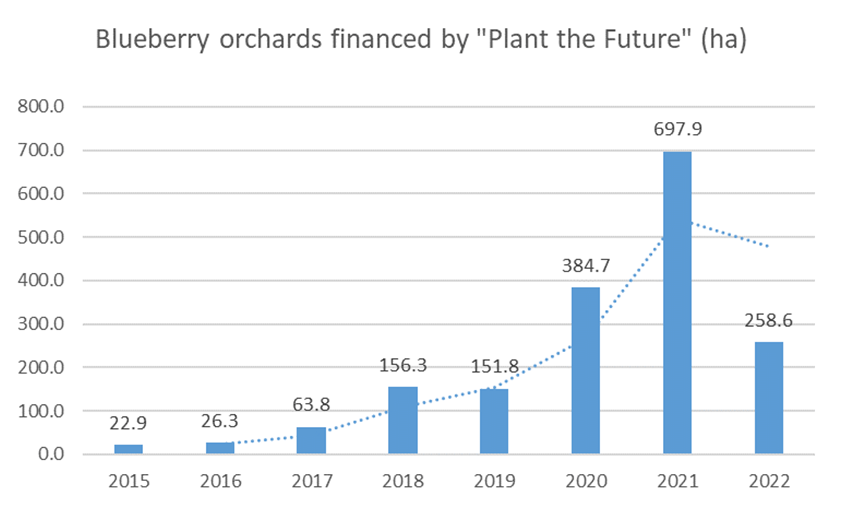

Source: Rural Development Agency

In the upcoming 2023 season, 63.8 hectares of blueberry orchards planted in 2017 will mature, and an additional 700 hectares will yield their first commercial harvest. A total of 1,762 ha of orchards of blueberries with drip irrigation system were planted within the “Plant the Future” program from 2015 to 2022, the peak area of orchards was financed in 2021, but in 2022 the financed area fell by about three times.

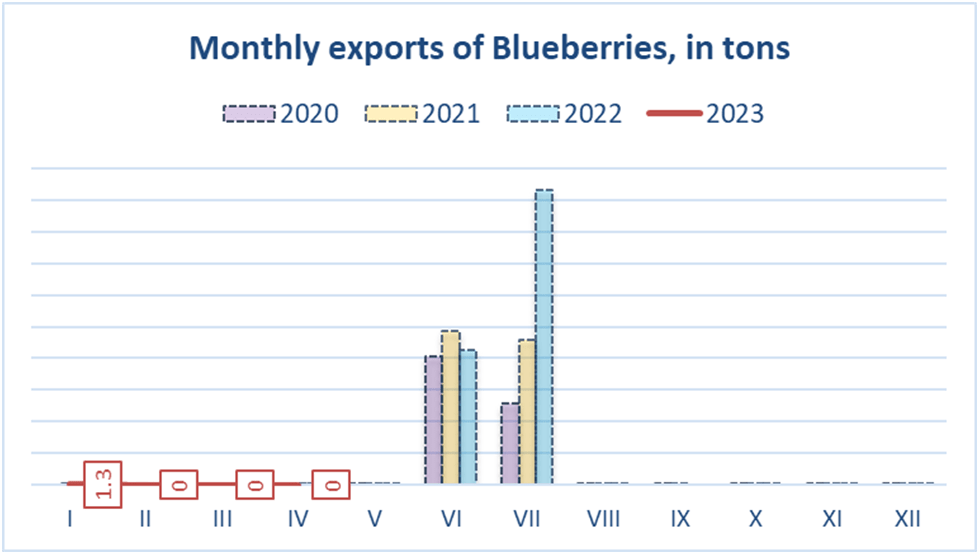

Source: Ministry of Finance of Georgia

Georgia’s blueberry exports have been steadily increasing, with the 2022 season witnessing the export of 1,360 tons of blueberries, resulting in a revenue of $8,200,000 USD. The annual growth rate of blueberry exports between 2020 and 2022 ranged from 43% to 44%, and it is expected to be even higher this year. According to the head of the blueberry growers’ association Tornike Panjavidze, in the upcoming 2023 season, Georgia is projected to harvest at least 3,000 tons of blueberries, indicating a significant 50% increase compared to the previous year. Expanded harvest creates opportunities for the diversification of export markets.

Blueberry growers unite to export on new markets

Officially Georgian blueberry growers’ association was registered in Aprils 2023, but growers are working together for several months. The main goal of this union is to produce, harvest, and export high-quality blueberries in European and Arabic markets.

At the moment, the association has 18 members, but from June the number of members will increase to 22. In total, 22 companies own 900 ha of blueberry orchards and expect a harvest of 800-1000 tons this season.

In a conversation with EastFruit, the head of the Association of Blueberry Producers, Tornike Panjavidze, said that the members of the association already underwent training from the Chilean consultant on the transportation and cooling of berries after harvest. This season’s goal is to export up to 400 tons of blueberries to Germany, Poland, and Dubai. Export to Europe is planned by land transport, while in Dubai appointment of a cargo flight is expected from Georgia, negotiations about it are already underway.

From orchards to export markets: how processes will be organized

The main challenge is the timely transportation and cooling of berries, although association has specific plan for it. According to Panjavidze, their members are scattered in several regions, in Samegrelo, Guria and Imereti, in total five cold storages are available for members in these regions where the harvested berries will be cooled. For timely communication between the farmer and the storage, association organized local groups. Such groups are necessary because the picking depends on the weather and the cooling storages must be informed the day before farmer starts picking to ensure space for the berries.

Below is a step-by-step summary of the process, from before harvesting to export:

Before harvesting: quality certification

Before the harvesting process begins, it is required for all association members to obtain a quality certificate from a laboratory. This certificate confirms that the berries have been tested for pesticide content, ensuring their safety for consumption.

After harvesting: quality check

At the orchard, berries are not immediately sorted. Instead, their compliance with export requirements is verified at the cooling storage facility. Among these requirements is a minimum caliber of 12mm, prices vary based on different calibers. Additionally, factors such as firmness and sugar content are assessed to determine the berries’ transportability.

After harvesting: temperature control

Within two hours of harvesting, the berries are promptly placed in cooling chambers, where they are cooled down to a temperature range of 9-10°C and then stored at a temperature of 1°C for 24 hours, ensuring optimal conditions before leaving the cold storage facility. For transportation from the orchard to the storage facility, special care is taken if the travel time exceeds one hour, requiring temperature control at 18°C. However, for shorter distances, temperature control may not be necessary.

After harvesting: packaging and traceability

Berries are picked and transported to cooling storage in reusable plastic boxes certified for use in the European market are utilized. At the cooling storage, for export purposes, the berries are carefully packed in certified 500-gram plastic containers before being stored at 1°C for 24 hours. Each pallet is assigned a unique batch number, facilitating traceability throughout the supply chain.

Export: ensuring quality until reaching the final consumer

To maintain the berries’ quality during export, transportation at a temperature range of 0.5-1°C is required. Upon arrival in importing country, the wholesale buyers sort and repackage the berries to meet specific market demands ensuring that the berries are presented in the best possible condition on retail shelves.

Why export diversification is crucial for Georgia’s blueberry sector – opinion

According to Panjavidze, Georgia has around 3,000 hectares of blueberry orchards that will eventually yield up to 30,000 tons of berries. To ensure stability, it is crucial for Georgia to diversify its markets instead of solely relying on the Russian market, which is known to be unpredictable. Panjavidze suggests that Russia’s market share should decrease to 25%-30% in the future, with only small producers remaining to sell there who don’t have the possibility for post-harvesting.

In the long run, the Russian market is not profitable for Georgian producers due to fluctuating prices. The Russian market offers high prices only during the first two weeks of the season, but prices drop significantly when the harvest is abundant. On the other hand, the European market provides consistent prices throughout the season.

For instance, a farmer working in the Russian market might receive $14 per kilogram in the first two weeks, an unrealistic price in the European market, but prices may drop to $2-$3 afterward. In contrast, the European market may offer $6-$7 per kilogram throughout the season.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.