“Uzbekistan holds the title of the world’s largest importer of ware potatoes for direct consumption, while Egypt ranks among the globe’s leading potato exporters. Despite this, a direct trade link between the two nations remains unestablished, even though Egypt possesses significant untapped potential within the Uzbekistani market,” stated Yevhen Kuzin, Horticulture Market Analyst and International Consultant at FAO, during an online training titled “How to export fruits and vegetables to Uzbekistan and Kazakhstan from Morocco and Egypt”.

This trading, a part of the joint FAO/EBRD Project “Diversifying and adding value to export markets”, drew upon a recent in-depth analysis of market prospects for Egyptian and Moroccan fruits and vegetables in Central Asia, particularly focusing on Uzbekistan and Kazakhstan.

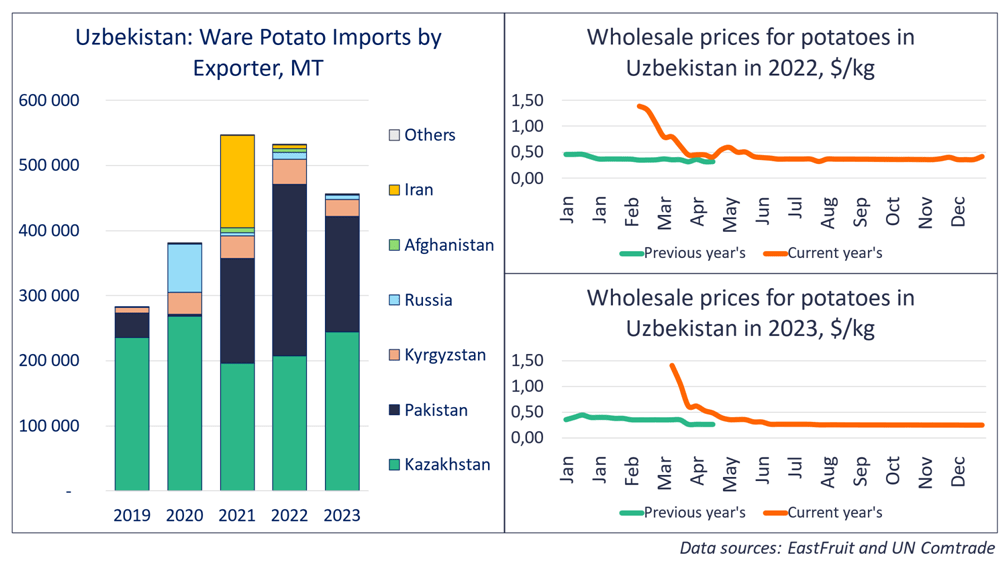

“Annually, Uzbekistan’s potato imports range from 400,000 to 550,000 tonnes, all destined for direct consumption. This volume surpasses that of notable importers like France or Germany. Interestingly, Uzbekistan’s need for potato imports dwindles to only three or four months a year – typically during summer and occasionally in September. Outside of these months, import demands surge, with monthly volumes sometimes exceeding 100,000 tonnes in March or December,” elaborated Yevhen Kuzin.

Predominantly, Uzbekistan’s potato imports come from Kazakhstan and Pakistan, with Kazakhstan supplying either locally-grown potatoes or those initially imported from Russia. Other minor sources include Kyrgyzstan, Afghanistan, Iran, and a few other smaller exporting countries. The Uzbek market exhibits specific pricing dynamics for potatoes. Between February and April, two distinct crops are available – last year’s potatoes, primarily from Kazakhstan, and the newly harvested crop commanding significantly higher prices, at times triple that of the previous year’s yield.

“This precise window presents an ideal opportunity for Egypt to penetrate the Uzbek market, targeting the premium segment with high-quality produce. Observing the potato quality on Central Asian supermarket shelves reveals a norm for post-Soviet consumers yet an anomaly for European shoppers. Potatoes are typically sold uncleaned or unwashed, even when packaged. Even the early domestic potatoes, priced four times higher than the loose ones from the previous harvest, are sold in an unappealing, dirty state. Egypt could capitalize on this segment, outperforming domestic, Pakistani, or Iranian suppliers with its superior-quality potatoes,” Yevhen Kuzin added.

We also extend an invitation to fruit and vegetable exporters from Egypt and Morocco to participate in the upcoming trade mission to Uzbekistan from May 20-22, 2024. This mission is a component of the FAO/EBRD Project: Food Security Package SEMED, designed to bolster export opportunities and diversify market presence for your products Detailed information about the mission is available here. To apply for participation, please register here.

Furthermore, EastFruit reminds stakeholders that full oversight of fruit and vegetable pricing across markets in Turkey, Egypt, Ukraine, Uzbekistan, Russia, Moldova, and beyond is achievable through a subscription to EastFruit Premium.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.