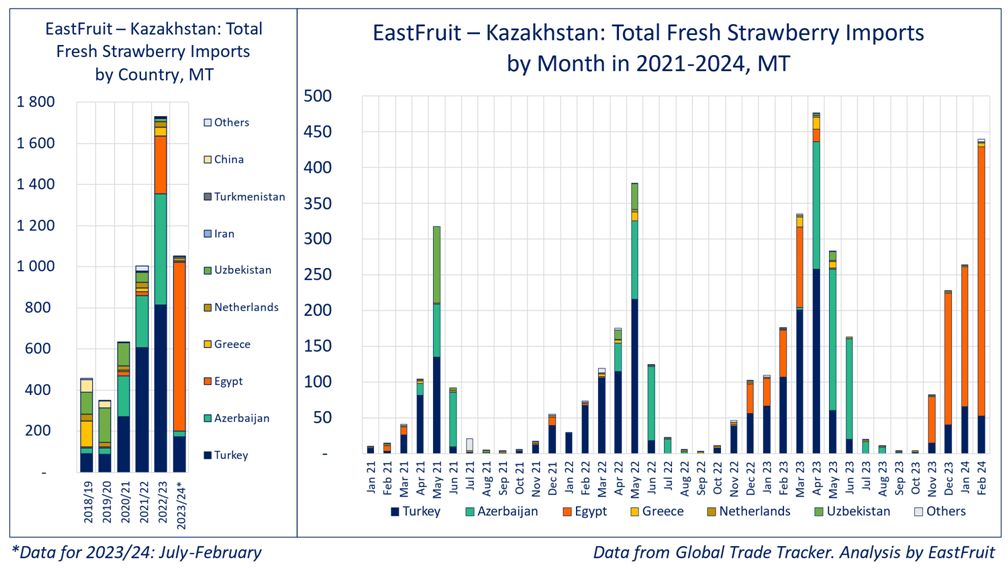

In the 2022/23 season (spanning from July to June), Egypt made a remarkable entry into the ranks of major suppliers of fresh strawberries to Kazakhstan, securing the third spot, as reported by EastFruit. Furthermore, the current trends of the 2023/24 season suggest that Egypt is well-positioned not only to retain this status but also to significantly bolster its market presence in Kazakhstan.

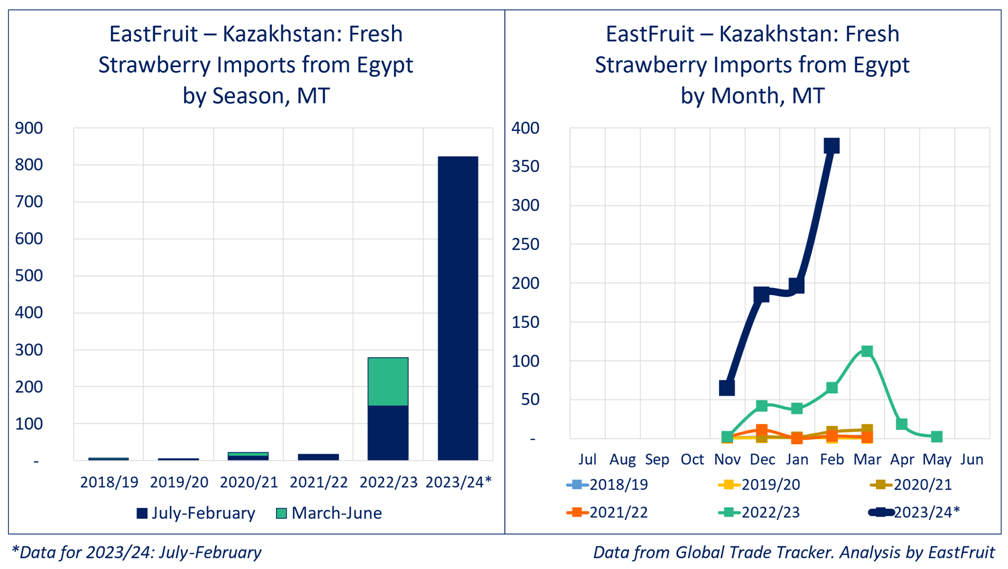

“In recent years, Egypt has devoted considerable effort to diversify its export portfolio and penetrate new markets, including Kazakhstan. While Egyptian oranges have long been a staple in Kazakhstan, the introduction of fresh strawberries is a relatively recent development. Remarkably, exports of this fruit from Egypt to Kazakhstan have nearly tripled in just the first four months of the season compared to the entire previous season. Since the 2018/19 season, exports have surged by over a hundred times”, comments Yevhen Kuzin, Fruit & Vegetable Market Analyst at EastFruit.

Read also: Egyptian fresh strawberry exports to Southeast Asia reach record high

Between November 2023 and February 2024, Kazakhstan imported 820 tons of fresh Egyptian strawberries. To put this in perspective, the total for the 2022/23 season was only 280 tons, with a previous four-season high of just 23 tons. This exponential growth in the 2022/23 season propelled Egypt into the top three exporters of fresh strawberries to Kazakhstan, trailing only behind Turkey and Azerbaijan. Given the current season’s performance, Egypt is likely to maintain or even surpass its competitors, especially considering its significant lead over Turkey in export volumes to Kazakhstan during the aforementioned period.

“Although Kazakhstan is not among the largest importers of fresh strawberries, the nation has seen a more than fourfold increase in imports over the last five seasons, reaching 1.7 thousand tons. The Kazakhstani consumer’s growing appetite for fresh berries during the off-season aligns perfectly with the availability of Egyptian strawberries, which could be in high demand during festive periods such as the New Year, St Valentine’s Day, and International Women’s Day”, notes Yevhen Kuzin.

Egypt’s primary competition is with Turkey, as Azerbaijan’s peak supply period is from April to June. Despite the greater logistical challenges, Egypt has managed to compete effectively with Turkish suppliers, as evidenced by the trade dynamics from November 2023 to February 2024.

“By the end of March this year, fresh strawberries reached prices of up to $15 per kg in Kazakhstani supermarkets. This price point facilitates successful delivery to the local market by both Turkish and Egyptian suppliers, as well as those from farther afield, buoyed by the swift rise in demand for off-season berries among local consumers”, adds Yevhen Kuzin.

Beyond direct consumption within Kazakhstan, the trade also provides access to broader regional markets. For instance, Uzbekistan often relies on Kazakhstan for its supply of various vegetables and fruits, with Magnum Cash & Carry – a leading food retailer in Kazakhstan – also operating in Uzbekistan.

“The Central Asian region, with its 80 million consumers, offers a potential market larger than that of the UK or France. Although consumption levels for many products remain modest, the region is experiencing rapid growth, particularly among its youthful population that is open to new culinary experiences. This demographic is expanding faster than in any developed economy, and the regional economy is advancing at a pace that outstrips the global average”, concludes Yevhen Kuzin.

It’s worth noting that Egyptian exporters of fresh produce have a unique opportunity to connect with key buyers of fruits and vegetables from Uzbekistan, Kazakhstan, and other countries during the Trade Mission to Tashkent (Uzbekistan) on May 22, 2024. More details about the event are available here.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.