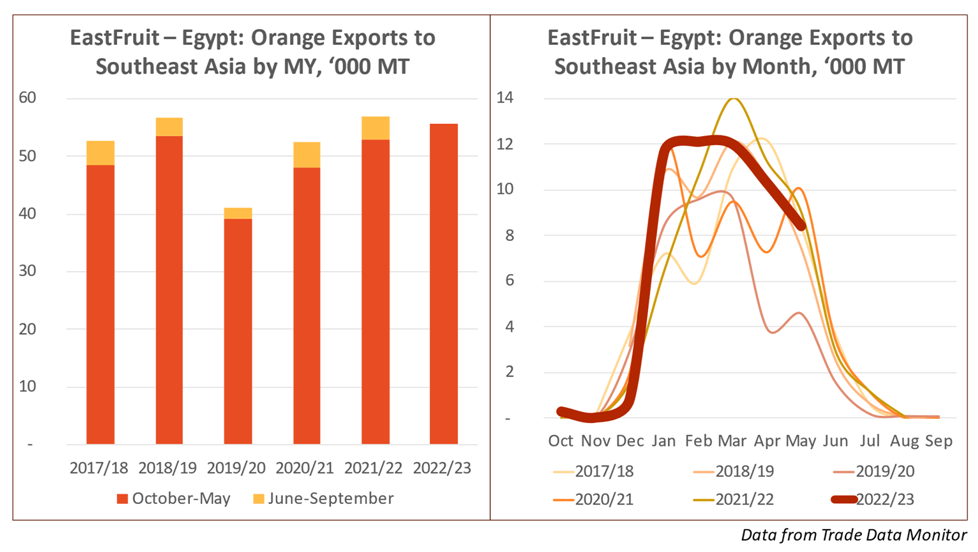

The Egyptian orange exports to the Southeast Asian countries continue setting new records, as reported by EastFruit. Considering such developments, the final result of the current MY 2022/23 (October-September) will most likely reach its record high.

Egypt remains the largest supplier of oranges to Southeast Asia and has already exported 55,600 tonnes of oranges to Indonesia, Malaysia, Singapore, Cambodia, and several other countries in the period between October 2022 and May 2023. The previous record of 53,500 tonnes of exports in this period was set back in the MY 2018/19. Thus, considering the peak of the Egyptian orange exports to Southeast Asia in January-May, the final result of the MY 2023/24 will at least be close to record-breaking!

Egypt remains the largest supplier of oranges to Southeast Asia and has already exported 55,600 tonnes of oranges to Indonesia, Malaysia, Singapore, Cambodia, and several other countries in the period between October 2022 and May 2023. The previous record of 53,500 tonnes of exports in this period was set back in the MY 2018/19. Thus, considering the peak of the Egyptian orange exports to Southeast Asia in January-May, the final result of the MY 2023/24 will at least be close to record-breaking!

Malaysia is the key Southeast Asian country for Egyptian exporters of oranges, with a share of 72% in total exports over the first eight months of the current MY. Shipments to Singapore and Indonesia are much lower: 12,000 tonnes and 3,200 tonnes, respectively. Other Southeast Asian countries imported less than 1,000 tonnes of oranges from Egypt in total.

Read also: Egypt strengthening its position in the Dutch sweet potato market

Southeast Asia is also one of the key markets for Egyptian oranges but still yields to several other regions. For example, India annually imported 80,000-100,000 tonnes of oranges from Egypt in the past two seasons, while exports to Saudi Arabia and the Netherlands could reach 300,000 tonnes and 170,000 tonnes, respectively.

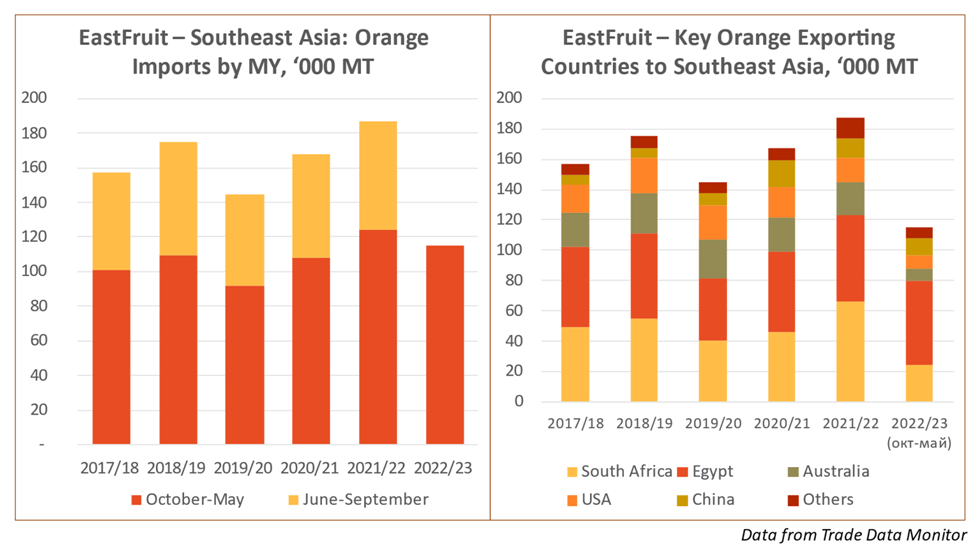

The total imports of oranges in Southeast Asia (Malaysia, Indonesia, Singapore, Thailand, Cambodia) amount to 150,000-180,000 tonnes every marketing year. Egypt remains the key supplier of these fruits from the Northern Hemisphere, and the devaluation of the Egyptian pound will only strengthen the position of Egypt in the region.

The total imports of oranges in Southeast Asia (Malaysia, Indonesia, Singapore, Thailand, Cambodia) amount to 150,000-180,000 tonnes every marketing year. Egypt remains the key supplier of these fruits from the Northern Hemisphere, and the devaluation of the Egyptian pound will only strengthen the position of Egypt in the region.

In addition, Egypt faces almost no competition with other countries in the period of the most active exports. The USA has been annually decreasing its orange exports to Southeast Asia, while the share of China is still rather low (7-11%). Meanwhile, South Africa maintains its leading position, but it is present in the Southeast Asian market in the period between July and October when imports from Egypt are the lowest.