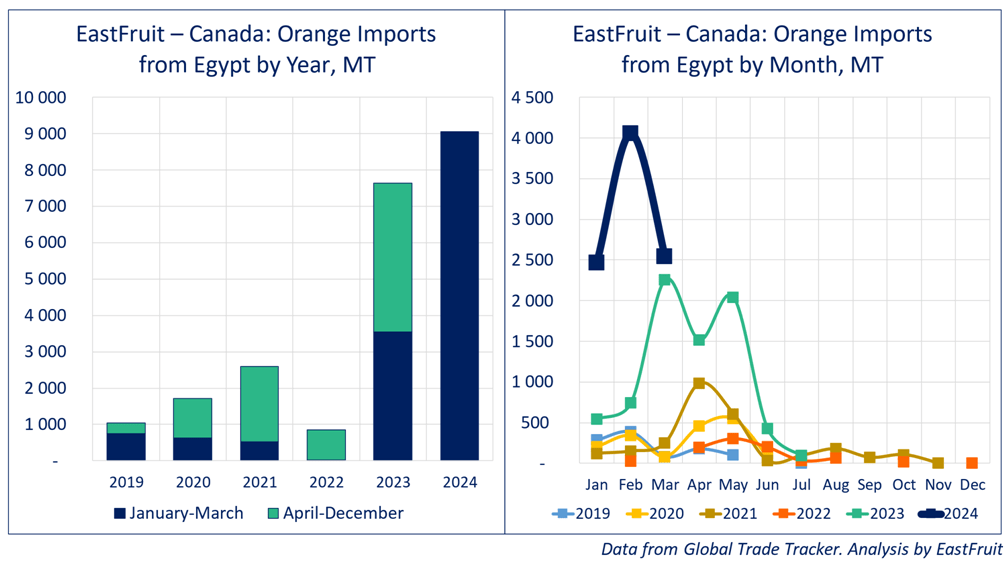

With a proactive approach to expanding its export horizons, Egypt is reshaping the dynamics of these burgeoning markets for its horticultural goods. Notably, in the first quarter of this year, Egypt’s orange exports to Canada have already surpassed the total for all of 2023, establishing a new record for market deliveries, as reported by EastFruit.

Between January and March 2024, Canadian importers have sourced 9,000 tons of oranges from Egypt, a significant increase from the slightly over 3,500 tons during the same timeframe last year. Furthermore, the import volume for the entirety of 2023 was a mere 7,600 tons. Given that Egyptian oranges typically remain available in Canada until June, the cumulative figure for this year is poised to be even more impressive.

Between January and March 2024, Canadian importers have sourced 9,000 tons of oranges from Egypt, a significant increase from the slightly over 3,500 tons during the same timeframe last year. Furthermore, the import volume for the entirety of 2023 was a mere 7,600 tons. Given that Egyptian oranges typically remain available in Canada until June, the cumulative figure for this year is poised to be even more impressive.

Read also: Egypt more than doubles fruit and veg exports to Canada in 2023

“As the world’s fourteenth largest orange importer, Canada, alongside Brazil, is becoming a pivotal market for Egyptian exports in the Americas. While shipment volumes to Canada are still modest compared to the EU, Russia, or various Asian markets, Egypt’s growing presence in Canada marks a notable triumph for its agricultural sector. Canada is recognized as one of the most lucrative global markets, offering more accessible entry conditions than, say, the USA,” remarks Yevhen Kuzin, Fruit & Vegetable Market Analyst at EastFruit.

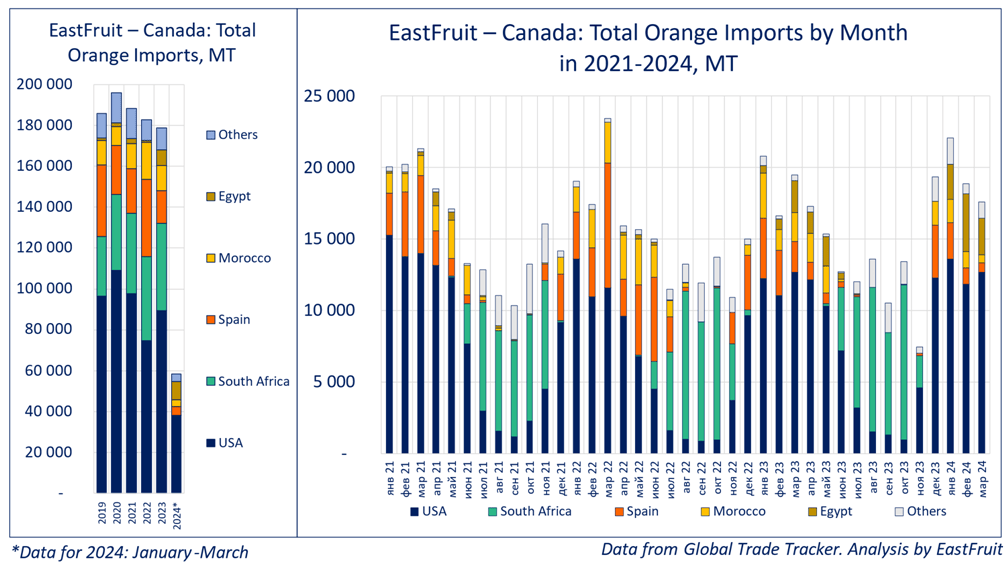

Additionally, Egypt, which ranked fourth in orange supply to Canada in 2023, is on track to claim the third spot this year, provided current trends hold, trailing only behind the USA and South Africa. Meanwhile, Spain and Morocco, Egypt’s primary rivals, have not seen comparable growth in their Canadian exports. In fact, Canadian importers have halved their imports from these two countries to 4,300 tons and 3,400 tons, respectively, in the first quarter of 2024, relative to last year.

“Logistically or seasonally, Egypt may not overtake the USA and South Africa in orange exports to Canada. However, other nations eyeing this market must brace for heightened competition from Egyptian exporters. This is particularly pertinent for Spain and Morocco, where orange cultivation is increasingly challenged by climate change. Interestingly, Egypt is also making inroads into the Spanish market for its oranges,” Kuzin adds.

“Logistically or seasonally, Egypt may not overtake the USA and South Africa in orange exports to Canada. However, other nations eyeing this market must brace for heightened competition from Egyptian exporters. This is particularly pertinent for Spain and Morocco, where orange cultivation is increasingly challenged by climate change. Interestingly, Egypt is also making inroads into the Spanish market for its oranges,” Kuzin adds.

The USA remains the sole orange supplier in the Canadian market, either through domestic production or by re-exporting Mexican or South American oranges. South Africa dominates the Canadian market in the summer and fall, while Spanish and North African suppliers vie for market share from December through spring. Recently, Turkey has emerged as a contender, exporting 2,200 tons of oranges to Canada in the first quarter of this year, up from just 1,600 tons the previous year.

“A key factor in Egypt’s Canadian market success has been its aggressive price competitiveness. For instance, orange prices in Egypt dropped to 15 cents per kilogram at the end of April. Yet, this approach is unsustainable in the long run, as prices cannot indefinitely decline. Thus, Egyptian suppliers must shift their focus from pricing to other critical sales components. While Canada ranks fourteenth globally in orange import volume, it ascends to ninth when measured in US dollars. This indicates a willingness to not only purchase substantial quantities of citrus but also to pay a premium. Egypt has made significant strides in the former, but the latter presents a less rosy picture,” Kuzin concludes.

Maintain full control over fruit and vegetable prices in Turkey, Egypt, Ukraine, Uzbekistan, Russia, Moldova and other markets subscribing to EastFruit Premium.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.