The Egyptian Ministry of Agriculture and Land Reclamation recently heralded the advent of two novel export destinations for its domestic producers. The Moroccan National Office of Food Safety has sanctioned the importation of Egyptian potatoes, while Egyptian officials have fine-tuned the export protocols for fresh strawberries destined for Canada.

Industry specialists from EastFruit posit that these nascent markets pose considerable challenges due to their unique market dynamics. Notably, the nascent potato trade with Morocco is anticipated to commence with modest volumes. Concurrently, the exportation of fresh strawberries to Canada is expected to encounter robust competition from geographically proximate suppliers. These developments merit a detailed examination.

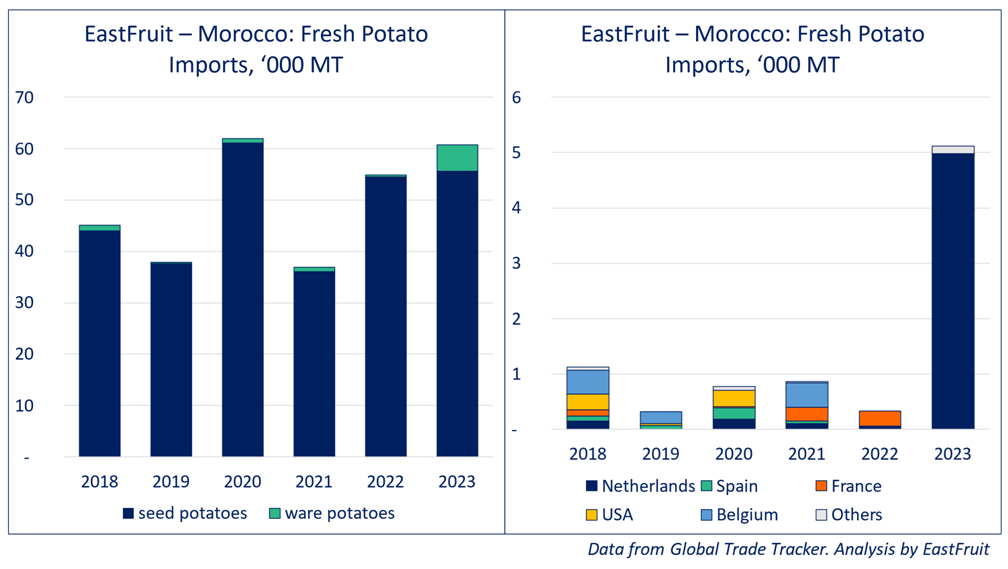

Historically, Morocco’s importation of fresh potatoes has been moderate, with annual fluctuations ranging from 37 to 62 thousand tons over the past six years. Both Morocco and Egypt predominantly import seed potatoes to cultivate the crop for domestic consumption and export. Furthermore, Morocco plays a pivotal role in the Sahel region’s potato market, exporting food staples to nations such as Mauritania, Mali, Burkina Faso, Niger, Senegal, among others.

Regarding the import of ware potatoes, the figures have seldom surpassed a thousand tons between 2018 and 2022. In the wake of a severe drought in 2023, the Moroccan government curtailed potato exports in an effort to stabilize escalating domestic prices. Nevertheless, the total imports of ware potatoes scarcely exceeded 5 thousand tons for the year, predominantly sourced from the Netherlands.

Consequently, Egypt’s entry into the Moroccan market is confined to a select few niches, primarily the premium segment of consumable potatoes. Here, Egyptian exporters will vie with established European suppliers from the Netherlands, Spain, France, Belgium, and others. Theoretically, this niche could facilitate the export of several hundred tons of Egyptian potatoes to Morocco, contingent upon meeting the importers’ stringent quality standards. Drought conditions could potentially amplify this volume to a few thousand tons, albeit still a fractional component of Egypt’s overall export figures.

Furthermore, accessing the Moroccan market could serve as a strategic springboard for Egypt into the broader Sahel region. However, this prospect is shrouded in uncertainty, as it would necessitate a viable margin for Moroccan re-exporters, thereby diminishing returns for Egyptian sellers. Furthermore, Egypt retains the option to forge direct logistical links to Sahel nations via maritime routes.

Let’s turn to fresh strawberries in Canada, which, by the way, is renowned as the world’s third-largest importer of them. Canada also consistently procures between 100 and 120 thousand tons of these berries each year. Notably, the vast majority – over 99% – of this import volume is sourced from the United States and Mexico, which either supply directly or via the United States.

While other nations contribute to Canada’s strawberry imports, their combined volumes are relatively minimal, not surpassing 140 tons. South Korea stands out as the most significant of these countries, with annual exports to Canada reaching up to 80 tons. Since 2021, Spain has also carved out a presence in the market, alongside occasional contributions from Turkey, Peru, New Zealand, and a few other supplying countries.

The advent of the Canadian market presents Egyptian suppliers of fresh strawberries with an opportunity to export several hundred tons of this coveted fruit. Success hinges on their ability to outcompete geographically nearer suppliers such as Mexico or even Spain. Nevertheless, Egyptian exporters have already showcased their competitive prowess in other global regions, like Central Asia, where they hold their own against Turkish suppliers.

Conclusions

While the introduction of new markets such as Morocco or Canada may not seem transformative for Egyptian exports when viewed in isolation, the cumulative effect of these openings is significant. Government-led initiatives are providing Egyptian exporters with invaluable support, enabling them to diversify their trade portfolio, explore entirely new export avenues, bolster foreign currency earnings for the national economy, enhance the global presence of Egyptian produce, and affirm Egypt’s position as a preeminent exporter of agricultural goods.

It’s worth noting that Egyptian and Moroccan exporters of fresh produce have a unique opportunity to connect with key buyers of fruits and vegetables from Uzbekistan, Kazakhstan, and other countries during the Trade Mission to Tashkent (Uzbekistan) on May 22, 2024. More details about the event are available here.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.