The Egyptian onion exports to the EU have more than doubled in the MY 2022/23, reports EastFruit. Furthermore, their volumes have reached their 4-year high!

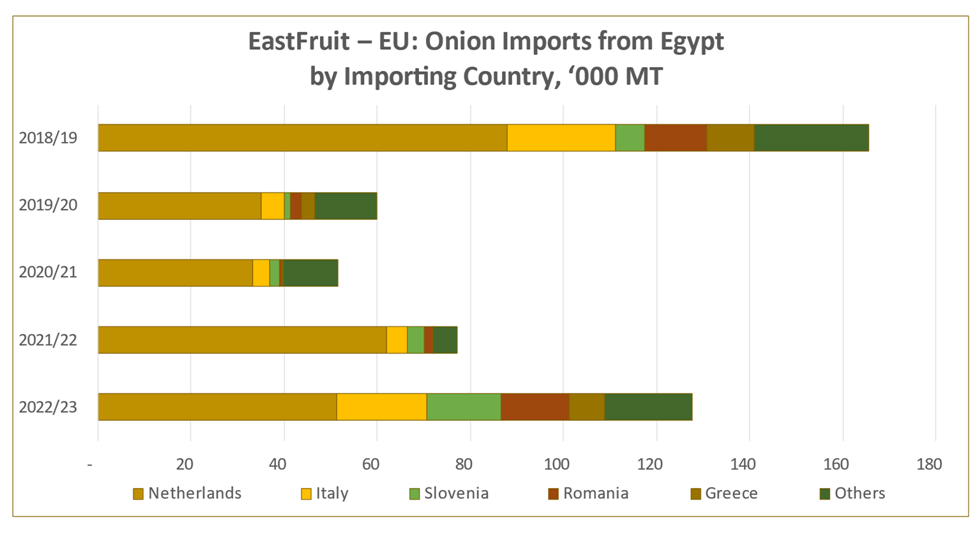

In total, in the period between July 2022 and June 2023, Egypt has shipped 128,000 tonnes of onions to the EU market. For comparison, the Egyptian export volumes did not exceed 60,000 tonnes annually during the previous three marketing years. Nevertheless, current volumes are still lower than a record figure of 165,000 tonnes exported from Egypt to the EU in the MY 2018/19.

The main reason for such a sharp rise in European importers’ demand for Egyptian onions was the onion crop failure in the EU due to drought in summer last year. Local farmers’ stocks were rapidly depleting, and Egypt started increasing its supplies to the EU in spring 2023. In addition, the devaluation of the Egyptian pound made products from Egypt more competitive in price in the global market.

The Netherlands remained the key importer of onions from Egypt in the MY 2022/23 and used them mostly for re-export to other countries. Nevertheless, the Netherlands had the lowest share in the Egyptian onion export structure in the MY 2022/23: it stood at just 40%, while previously it had varied between 53-64% and reached 80% in the MY 2021/22.

See also: Egyptian potato exports to EU to reach at least 3-year high in 2023

In such a way, Egypt has successfully increased the share of direct consumers of its onions in the export structure. The group of the top-five largest importers of Egyptian onions in the EU also included Italy, Slovenia, Romania, and Greece. The four countries cumulatively imported almost 60,000 tonnes of onions from Egypt, or 45% of its total export volumes to the EU.

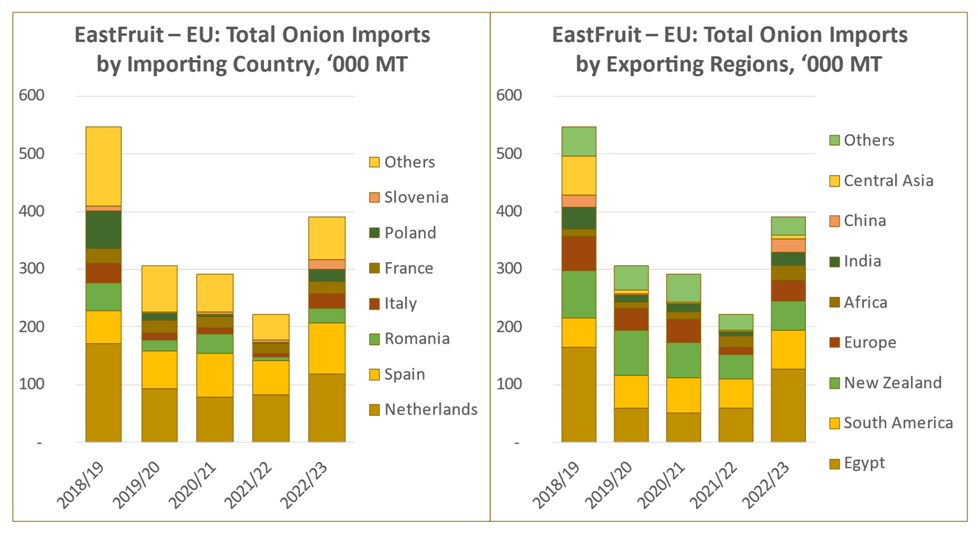

In total, the EU imported almost 400,000 tonnes of onions from all non-EU countries in the MY 2022/23, an increase of 76% year-over-year but still lower than in the MY 2018/19 (550,000 tonnes). The most active demand for imported onions in the EU is registered right during the peak of the Egyptian exports and shipments from other supplying countries with available volumes of new crop.

That is exactly why such countries account for the largest share in the EU onion import structure. Egypt is the leading supplier, and its share reached 33% in the MY 2022/23. New Zealand ranked second with the volumes of 52,000 tonnes, and South America (Peru, Chile, Argentina, etc.) exported 66,000 tonnes of onions to the EU.

Serbia (14,300 tonnes) was the leading supplier among non-EU European countries, and the key exporters from Asia were India (23,800 tonnes) and China (21,300 tonnes). Interestingly, Central Asian countries exported just 7,300 tonnes of onions to the EU, although their exports had been totaling 67,200 tonnes in the MY 2018/19. Moreover, due to weather cataclysms in January this year, for example, Uzbekistan has turned into a net importer of onions!

The Netherlands and Spain were the key importers of onions in the EU and jointly account for more than a half of the total onion imports in the EU. Romania (26,000 tonnes), Italy (25,000 tonnes), and France (22,000 tonnes) were also among the top importing members of the EU.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.