EastFruit analysts note that Georgia is importing increasingly more strawberries. In January and February 2023, the country imported 420 tonnes of fresh strawberries – 3 times more than in the same months last year.

Georgian strawberry season peaks in May and June then the supply falls off quickly. In the current off-season, strawberry import volumes are record-breaking so far.

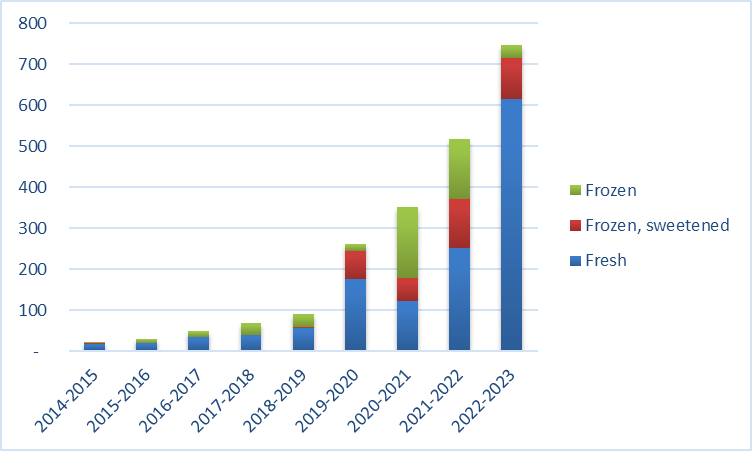

Imports of strawberries from August to February by season, in tonnes

Data source: Ministry of Finance of Georgia

Total imports from August 2022 to February 2023, a month with the latest available trade data, Georgia has imported 750 tonnes of strawberries. This is 44% more than in the same period the year before. Such a huge jump in year-on-year terms is attributed to the growth of local demand from the influx of Russian citizens and the economy recovering from the pandemic.

Strawberry imports in the reviewed months have grown by roughly 85 tonnes a year in the last 9 years. Generally, rising imports are linked with a drop in local production, and the growth of the HoReCa sector and supermarket chains. According to GeoStat, Georgia produced 5 300 tonnes of strawberries in 2016-2017, but then in the next 4 years, total production amounted to only 5 000 tonnes.

82% of strawberries imported from August 2022 to February 2023 were fresh, the rest were frozen, either sweetened or not. Imports of frozen strawberries are more random and volatile, while imports of fresh strawberries are showing stable growth.

Latest import prices (CIF):

- 260 tonnes of fresh strawberries were imported at $0.26/kg in February 2023, while there were no imports of frozen strawberries this month. Local greenhouses cannot compete with cheap imports;

- The most recent sweetened frozen strawberry import was in January, a kilogram was imported for $0.45/kg, $0.16 more than the fresh strawberry import price in that month – import volume constituted 100 tonnes. Sweetened strawberries are commonly used as a raw material for jam production;

- Frozen unsweetened strawberry imports have been very low in the current offseason, monthly average prices exceed $2.00/kg but we don’t view these prices as wholesale prices as the volumes are not big – in the previous season, when imports volumes were high, import price for a kilogram was around $0.45/kg.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.