According to EastFruit analysts, global prices for apple juice concentrate continue to rise, stimulating processors to increase procurement prices for industrial apples. This, in turn, leads to an increased shortage of apples of low and medium quality in the markets of Eastern Europe. It should be noted that low-price segments still prevail in countries of this region.

“In our opinion, the global market for apple juice concentrate is still far from overheating and saturation. However, such a rapid rise in prices may lead to the fact that already in 2024 producers of juices and juice-containing drinks will begin to look for a partial replacement for apple juice concentrate in their recipes. This year, such a replacement will be extremely difficult to implement, because there are simply no cheap mass-produced alternatives – orange juice concentrate is also now unprecedentedly expensive due to the sharp decline in the global orange production,” says Andriy Yarmak, economist at the Investment Centre of the Food and Agriculture Organization of the United Nations (FAO).

A little earlier, we forecasted a steady increase in prices for industrial apples and apple concentrate in the material “Reincarnation of apple concentrate or “long live the low-quality apple”.” However, now the growth rate is slightly higher than the expectations of market participants.

It is interesting to note that in Poland prices for industrial apples have already exceeded the psychological threshold of 20 US cents per kg. At the same time, wholesale prices for apples for the fresh market of non-export varieties are only twice as expensive. Typically, the price ratio between industrial apples and apples for the fresh market is in the range of 1 to 5 to 1 to 10.

At the same time, prices for industrial apples in Ukraine are noticeably lower, and in Austria and Germany – higher than in Poland. As a result, Ukraine now exports not only high-quality apples for the fresh market, but also quite large volumes of industrial apples. Mostly apples for processing from Ukraine are sent to the Austrian market.

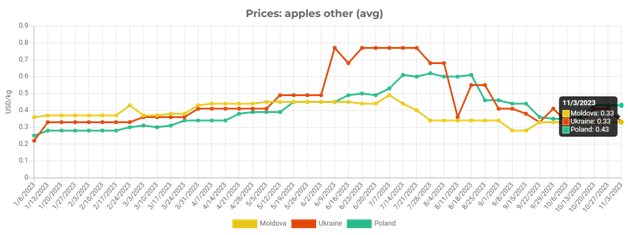

Read also: How Moldova’s apple prices compare to neighboring countries, and what factors affect them

In Ukraine suppliers can get up to 16-18 US cents per kg, provided there is a large volume of 100 tons or more. For smaller volumes, prices offered by buyers are significantly lower. By the way, in Ukraine the price ratio between industrial apples and apples for the fresh market is currently also identical to that which can be observed on the Polish market.

If the situation on the apple juice concentrate market continues to heat up, this could accelerate the increase in apple prices on the fresh market, especially after the onset of frosts in Ukraine and Poland. As a rule, this coincides with the end of the marketing of apples that are not subject to long-term storage, which reduces supply in the lower price segment of the apple market. This also means that only apples rejected during sorting for the fresh market are supplied to processors, which means that in this segment there is a sharp decrease in supply.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.