Today EastFruit reported about a recent ban on all fresh apple imports to Kazakhstan until the end of 2024. What does this decision mean for the regional and global apple market?

Kazakhstan in the recent years imported on average about 100 thousand tons of apples annually, being one of the 20-25 largest apple importers globally, EastFruit informs. Poland remained the main supplier of fresh apples to Kazakhstan over these years, accounting for more than half of the country’s total imports.

At the same time, it was no secret to any market participants that the bulk of apples imported from Poland to Kazakhstan were actually intended for the Russian market. EastFruit analysts have written about this many times before.

In 2024 unfavorable weather conditions have sharply reduced the apple harvest prospects in Russia and Belarus and created a threat of historical price records for apples in these countries. Considering that the economies of the aggressor countries are already suffering from a sharp increase in inflation, the prospect of such a significant increase in prices for the main fruit forces them to look for opportunities to purchase cheap apples, even if they have to turn a blind eye to their origin from the so-called “unfriendly countries”, which, by the way, they have been doing for many years in a row.

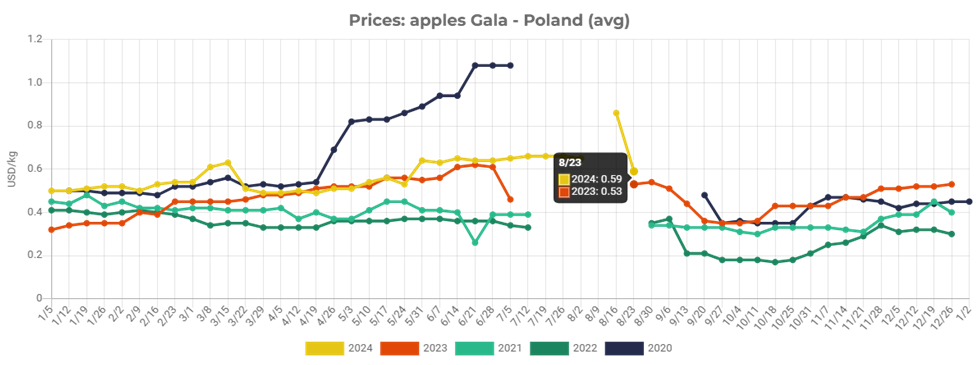

However, here too, they ran into a trouble – the apple harvest in the EU and Eastern European countries may also be too low, so analysts expect very high prices for fresh apples in the EU during the season 2024/25. The new apple season in Poland began with record high prices, and although prices are now seasonally decreasing, this is happening exclusively due to the sale of apples that cannot be stored. Therefore, by the end of the harvesting, apple prices may rise significantly.

Accordingly, Kazakhstan’s decision actually closes one of the last semi-legal windows for apple deliveries from the EU to the Russian market, and precisely at the time when it would still be possible to buy apples at a more or less acceptable price.

Interestingly, in Russia itself, apple prices are already approaching record high for this period of the year. Therefore, the prospects for very expensive apples on the Russian market in 2024/25 are now even higher.

Read also: Many Polish traders and even farmers who were in the trade with Egypt have left the business

As for Poland, the loss of the Kazakhstan’s market is also a very painful blow, because this market is consistently in the top 3/top 4 most important for Polish traders. For them the Kazakh market is as important as the market of Egypt or Romania, and even despite the decline in the apple harvest in this country, the loss of such an important market with a not so high level of quality requirements as the EU countries, is an unpleasant and tangible blow.

However, it should be recalled that, for now, Kazakhstan’s decision is valid only until the end of 2024. In our opinion, it is unlikely to be extended beyond that date. In addition, it is also impossible to rule out the cancellation of this decision earlier under pressure from Russia.

Maintain full control over fruit and vegetable prices in Turkey, Egypt, Ukraine, Uzbekistan, Russia, Moldova and other markets subscribing to EastFruit Premium.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.