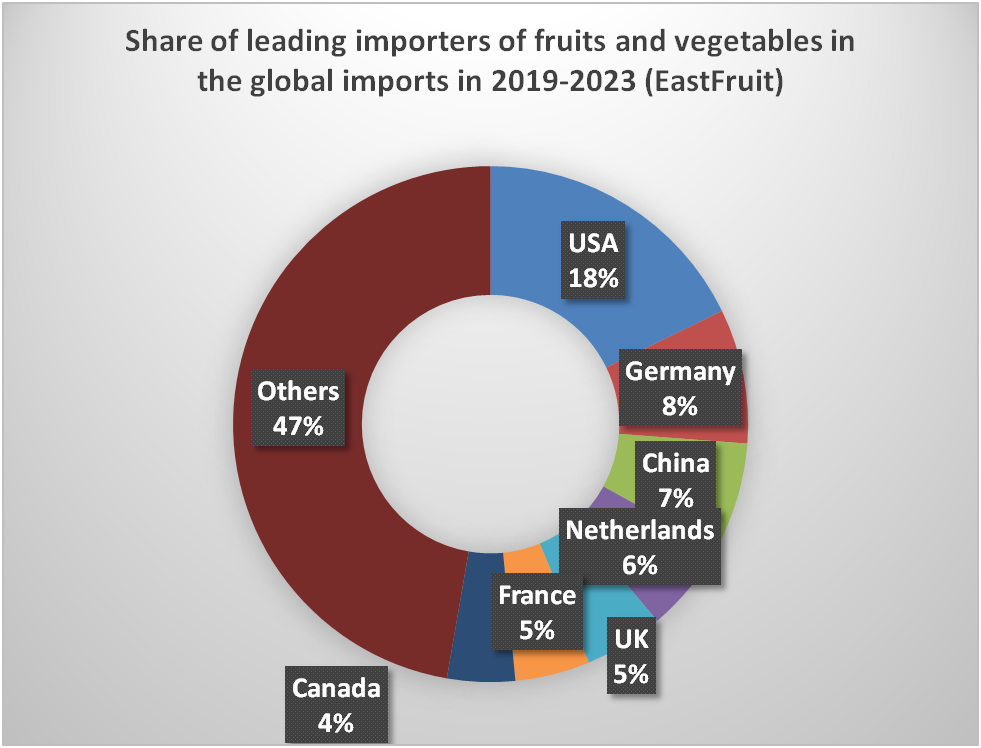

EastFruit analysts have updated the ranking of the largest fruit importing countries, as well as trade trends by these countries for a recent five-year period, namely from 2019 to 2023 inclusive. This ranking contains a number of surprises. So, let’s dive into these exciting produce analytics.

The first surprise is that China is now among the top-3 largest global importers of fresh produce, while previously it has always been known as one of the global leaders in exports. However, there is no need to rush into Chinese market – the increase in imports to this country is largely due to exotic durian and cherries, which are supplied mainly by one country – Chile.

The first surprise is that China is now among the top-3 largest global importers of fresh produce, while previously it has always been known as one of the global leaders in exports. However, there is no need to rush into Chinese market – the increase in imports to this country is largely due to exotic durian and cherries, which are supplied mainly by one country – Chile.

The second surprise is the sharp loss of positions by Great Britain, which faced difficulties in finding fruit suppliers and maintaining business relations with them after Brexit. As a result, shelves in the fruit and vegetable departments of UK supermarkets were often empty.

The third surprise, which is not really all that surprising, is a sharp drop in Russia’s position in the importers rating. At the end of 2023, this country was already on the verge of falling out of the top 10, since the purchasing power of the Russian population, as well as the size of the population continued to steadily decline.

However, there were more surprises in trends of fresh produce trade.

“It is important for fruit and vegetable exporters to understand not only the nominal volume of imports, but also trends in the volumes. It is usually easier to find market opportunities in the countries which are increasing imports fast. If a country reduces import volumes, then there is often a threat of losing the market share and it is necessary to make additional efforts to maintain it or to assess the economic and strategic feasibility of such efforts,” says Andriy Yarmak, an economist at the Investment Centre of the Food and Agriculture Organization of the United Nations (FAO).

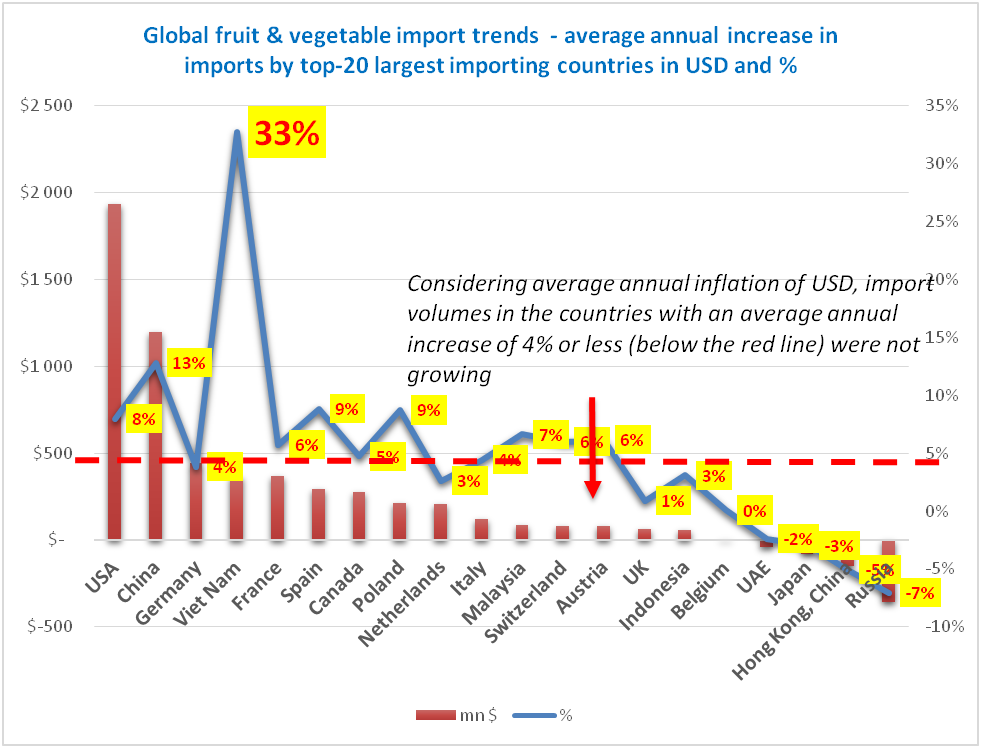

So, which country, out of the 20 largest global importers, is the most desirable market now? Which county is increasing the volumes of fruit and vegetable imports fastest in relative and nominal terms? Before answering this question, it should be noted that global fruit and vegetable imports in dollar terms are growing by 4.2% per year, which is equivalent to $5.8 billion US dollars. What does this mean? Is the global produce market growing fast or is it growing slowly?

In our opinion, this means that the global international produce trade is currently not growing at all!

The fact is that these growth rates are approximately consistent with the official average annual dollar inflation for the same period. This is an alarming indicator that may mean a slowdown in the global economy, because in the previous five-year period, the growth rate of fruit and vegetable imports outpaced the inflation rate by at least 3 percentage points per year. Fruits and vegetables are not the most important elements of the diet and are not nearly as critical as cereals, dairy, eggs or meat. Thus, if consumers have less money, they cut out the consumption of non-critical products first.

Essentially it means that countries whose produce imports grew by 4 percent or less per year in 2019-2023 either did not increase or decreased their import volumes. Therefore, we must take this adjustment into account when analyzing trends.

Nevertheless, back to the trends by country, which can be considered in absolute and relative terms. Both of these options are shown in the graph below.

One of the peaks on the graph immediately attracts attention – this is a country that annually increases imports by 33% and, based on the results of 5 years and it has just entered the top-4 largest global importers in terms of nominal import growth! In terms of relative growth, this country simply has no equal – the second place is 20 percentage points behind. The name of this country is Vietnam. Such a rapid growth in imports is due to the liberalization of foreign trade, which for many years was limited by prohibitive trade barriers.

One of the peaks on the graph immediately attracts attention – this is a country that annually increases imports by 33% and, based on the results of 5 years and it has just entered the top-4 largest global importers in terms of nominal import growth! In terms of relative growth, this country simply has no equal – the second place is 20 percentage points behind. The name of this country is Vietnam. Such a rapid growth in imports is due to the liberalization of foreign trade, which for many years was limited by prohibitive trade barriers.

Let us recall that the population of this country has almost reached 100 million people, and it is rapidly increasing its income levels. The annual GDP growth rate in Vietnam reaches 8%, which makes this market very attractive for all suppliers without exception.

The main suppliers of fruit and vegetable products to the Vietnamese market are China, New Zealand, the USA, Australia, South Africa, India and South Korea. Among European suppliers, France is in the lead by a wide margin.

The list of the main positions of produce imports in Vietnam will definitely surprise you! It would seem that the residents of this tropical country should be interested in fruits that are exotic to consumers in the northern countries, but no – Vietnam’s main import item are fresh apples! Vietnam spends the most money on fresh apple imports. Next come: table grapes, tangerines, onions, garlic, different types of cabbage, table potatoes, carrots and melons.

Therefore, Vietnam is of interest to most of the leading global fruit suppliers.

In the top 5, US remains the most important and interesting market with an annual growth of 8% or almost $2 billion US dollars. We mentioned China earlier, but Germany is showing signs of import stagnation, because the growth is below inflation rates. France closes the top five with a growth rate of 6% per year, which only slightly exceeds the inflation.

Further on the list, a number of countries have import growth rates below 4%, basically showing a market decline. Those who do increase imports faster than 4% per year, namely Spain and Poland, are now becoming re-exporters of produce and the increase in their imports isn’t necessarily designed for the local consumption.

On the right side of the graph there are several countries that are reducing imports. In addition to the already mentioned Russia, which is reducing imports by 7% or $0.4 billion US dollars per year, Hong Kong, Japan, the UAE, Belgium, Indonesia and the UK are also buying less fruits and vegetables from foreign suppliers.

It is especially worth dwelling on the UAE, which has become the most important market for fruit suppliers from Ukraine and that’s the market where apple exporters from Moldova are now actively trying to sell. It is obvious that the potential of this market is currently almost exhausted and the competition there is already too high, which leads to a decrease in the margins of suppliers.

At the same time, the reduction in imports to the United Arab Emirates, which we see in the statistics, is partly due to a decrease in prices caused by a very high level of competition rather than due to lower import volumes. Accordingly, in order to find promising markets for vegetables and fruits, it will be necessary to turn to a longer list of importers, and it will be important to consider not the largest and most well-known countries, which make the work of traders harder and more expensive in the long run.

Maintain full control over fruit and vegetable prices in Turkey, Egypt, Ukraine, Uzbekistan, Russia, Moldova and other markets subscribing to EastFruit Premium.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.