According to EastFruit experts, pooling of folding reusable plastic containers is one of the most profitable and completely free niches both in grocery retail in general and in the fresh produce business of Georgia in particular. It allows, on the one hand, to drastically reduce both losses and costs of all market participants, and on the other hand, to reduce the negative impact on the environment, food waste, food loss and significantly improve the presentation and freshness of the products. Thus, it is an excellent example of circular economy.

After the presentations of pooling opportunities by FAO consultant Fedor Rybalko at the conferences HortiTech Georgia (video in English), HortiTech Uzbekistan (video in Russian) and HortiTech Moldova, this topic was recognized by the participants of the events as one of the most interesting and promising. It has also sparked interest of retail chains as well as growers, traders and investors in general.

What is pooling? If this word still seems unfamiliar, EastFruit experts explained in detail what pooling is in a series of publications – we strongly recommend that you familiarize yourself with all three of our longreads before reading this material further: “What is pooling, the history of pooling, the EU experience and why the countries of our region will definitely eventually adopt it ”, “Practical experience and history of pooling in Ukraine” and “History and experience of pooling systems in Turkey”.

Now, let’s review the most recent experience of our team with pooling piloting in in Georgia.

Within the framework of the “FAO/EBRD Cooperation – Climate—Smart Digital Solutions for Fruit and Vegetables Production” Project, sustainable logistics solutions were introduced for participants in the Georgian fruit and vegetable market in order to further expand these logistics solutions in other countries.

Market assessment and general conditions for the introduction of pooling in Georgia

At the preparatory stage, we analyzed market for packaging of Georgian fruits and vegetables, as well as the existing supply chain used by supermarkets and wholesale markets. We estimated that the share of retail chains in fresh fruit and vegetable trade of Georgia, depending on seasonality, regions of consumption and assortment, ranged from 15 to 20%. In the category of berries and greens, the share of supermarket chains does not exceed 10% of the total sales. At the same time, retail chains increase sales by more than 20% annually, which creates new opportunities for professional fruit and vegetable suppliers from Georgia.

In the process of analyzing the market, it became clear to us that the transition to pooling of folding reusable plastic crates or boxes would allow participants in the Georgian market to significantly reduce their costs. For example, on bananas alone, they could save up to US $2.2 million a year.

Vegetable and fruit packaging market in Georgia before the introduction of pooling

The following types of transport containers for Georgian fruits and vegetables are used on the Georgian market now:

1. A disposable plastic box, usually black, which is made from recycled polyethylene. The main dimensions are 40*30*15 cm, 50*30*20 cm, 60*40*10 cm. A disposable plastic box is also the main type of transport packaging used for the exports of Georgian fruits and vegetables. This type of transport packaging is produced at several factories in Georgia, and also enters the Georgian market as packaging for imported fruits and vegetables, mainly from Turkey and Iran. This box, despite its “disposability”, is very often reused.

In Georgia, there are several entrepreneurs in the wholesale markets who buy secondary packaging, sort it by size, form wholesale lots and sell it. The cost of a new box is $0.60 USD. The cost of recycled plastic packaging at recycling points is $0.45. There is also a practice when some retail chains in Georgia return a disposable plastic box to their suppliers of fruit and vegetable products, but in this logistic scheme there is no identification of this transport package in the accounting of the retail chain. There is only a simplified accounting of secondary packaging transferred to the supplier from the distribution center of the retail chain.

2. Pre-used banana box (disposable, of course) is also a very common type of transport packaging in the Georgian market. At the same time, it is reused in violation of all sanitary standards. The cost of a second-hand banana box in Georgia reaches $0.80 in summer, because the demand for it increases sharply, while the supply drops as fewer bananas are imported to Georgia in the summers. This type of packaging is very popular with small growers and wholesalers, because this box is more convenient to load and unload, especially when using oversized vehicles such as minibuses, trailers, small trucks. Therefore, there is always a shortage of recycled banana packaging on the market. Georgian retail chains practice returning banana boxes to suppliers, but they are constantly in short supply, because very often this transport container is sold directly from retail stores.

3. A disposable cardboard box is present in the Georgian fruit and vegetable market in very limited segments. As a rule, this is a cardboard shipping container that arrives along with imported fruits and vegetables and is also reused by market participants. The most common locally produced cardboard box is a 60*40*10 cm box, which is used by the largest Georgian greenhouse complex. The cost of such a new box is $0.90, so there is also a practice of reusing this shipping container.

4. Reusable plastic packaging is used by all retail chains in Georgia, but with different economic efficiency. The most common is a green plastic box measuring 60*40*17cm. Now there are two logistical schemes for the use of these reusable plastic containers. In the first logistic scheme, plastic containers are used as a trade showcase and are permanently located at the trade facility. When a new batch of fruit and vegetable products arrives, store employees pour products from different types of transport packaging into plastic boxes that are on the display case. This logistics scheme is inefficient, as it leads to additional labor costs and mechanical damage to products.

The second logistics scheme, which was introduced in 2020 by the Orinabiji retail chain, involves the use of reusable plastic containers throughout the supply chain of fruits and vegetables as a single logistical standard. In such a scheme, fruits and vegetables in transport containers are moved from the supplier to the retail store and are put directly on the display in transport containers, which made it possible to reduce costs along the supply chain. The Ori Nabiji retail chain has acquired reusable plastic boxes, the boxes are provided to suppliers free of charge, but by providing transport packaging to suppliers, the retail chain receives an average discount of about $0.03 per kilogram of fruits and vegetables.

The second logistics scheme, which was introduced in 2020 by the Orinabiji retail chain, involves the use of reusable plastic containers throughout the supply chain of fruits and vegetables as a single logistical standard. In such a scheme, fruits and vegetables in transport containers are moved from the supplier to the retail store and are put directly on the display in transport containers, which made it possible to reduce costs along the supply chain. The Ori Nabiji retail chain has acquired reusable plastic boxes, the boxes are provided to suppliers free of charge, but by providing transport packaging to suppliers, the retail chain receives an average discount of about $0.03 per kilogram of fruits and vegetables.

Despite the rather high efficiency of this logistics scheme, there are several disadvantages, because, firstly, the retail chain uses old models of reusable plastic containers that have been operating in the market of developed countries for more than 50 years and are obsolete. These models occupy 100% of the volume of return transport, which leads to additional costs for suppliers, since they use hired transport in the vast majority of cases. Secondly, plastic containers of this model take up a lot of space in the distribution center and in retail stores, where every additional square meter counts. Thirdly, suppliers take empty containers from the distribution center of the retail network without order confirmation, which ultimately creates constant demand and leads to a shortage of reusable containers, especially in the summer, when sales of fruits and vegetables increase significantly and therefore suppliers are forced to use more expensive single-use plastic containers. Fourthly, suppliers do not wash plastic containers after each delivery, which ultimately negatively affects the quality and appearance of the storefront, significantly increases the product spoilage, and leads to additional risks for buyers. Other retail chains also do not wash recycled plastic containers that come from fruit and vegetable suppliers, but this problem is not so visible due to re-packaging in the fresh produce departments. Fifthly, the retail network is forced to constantly invest additional money in plastic containers, which stays outside the retail network.

Given the diversity and versatility of the existing systems for the use of boxes in retail chains and in the fresh produce business overall, in order to successfully launch a pooling pilot project in Georgia, we had to adhere to several important principles, which we will describe below.

Demonstration of best practices

At the end of 2022, the FAO/EBRD Project organized a study tour to Turkey to study Turkish fruit and vegetable logistics, where representatives of Georgian retailers managed to see how pooling works in Turkey. As a result of this trip, two voluminous materials were published: “Studying specifics of fruit and vegetable trade in Turkey” and “Secrets of Turkey’s success in fruit and vegetable trade.”

Also, within the framework of the Project, the participants of the Georgian fruit and vegetable market were presented with the existing pooling business models in Ukraine, in the Baltic countries and in other EU countries, links to which we provided above.

Using global experience, taking into account the specifics of the Georgian market

Providing market participants global industry information, financial models and existing logistics schemes was necessary to demonstrate the value of introducing pooling in Georgia. However, it is not enough to simply show how pooling works in the EU, Turkey or Ukraine, because the local financial model had to be localized, taking reflecting Georgian conditions, such as the size of Georgian farmers and suppliers, the assortment of fruits and vegetables, seasonality, the size of losses in the supply chain, the share of supplies of fruits and vegetables through the distribution centers of Georgian retail chains, planograms of fruit and vegetable departments.

A detailed reflection of the local market specifics always increases the confidence of the participants in the introduction of new technologies, therefore, access to high-quality market information, which was obtained within the Project, is always very important. It was Fedir Rybalko, the head of the project’s pooling component, who was engaged in the study of this specificity and work with chains.

Who can become the “pioneer” of pooling in Georgia?

The pooling pilot project was supposed to demonstrate sustainable logistics solutions for all participants in the Georgian fruit and vegetable market, so the selection of a reputable market leader for a pilot test was highly desirable. Thus, the key selection factors were as following: reputation, openness for new things, large market share, developed logistics infrastructure and the pace of development.

As a result, after a detailed analysis of the Georgian retail fruit and vegetable market, the retail chain Nikora Trade (Nikora) was selected for the pilot in August 2022, which has been one of the leaders in the Georgian retail market for several years. Despite the leadership in retail trade, this retail chain was not a leader in the fruit and vegetable segment, yielding in terms of assortment, prices, and quality, to non-chain retail, which is very widely represented in the Georgian market. In general, our audits of the fruit and vegetable departments of supermarkets showed that the chains have room to grow in terms of fruit and vegetable trade, which, as we have repeatedly proven, is the most important success factor in grocery retail.

Perhaps for this reason, the company’s management was open to experiments in the fruit and vegetable segment, which would increase the economic efficiency in this area. Therefore, in addition to participating in the pooling pilot project, Nikora Trade also agreed to take part in an in-depth audit of the fruit and vegetable business of the chains, which made it possible to quickly identify existing problems and develop strategic recommendations for the development of the fruit and vegetable business. Although the Nikora Trade retail chain met most of the criteria required to participate in the pilot, there were several problematic issues that hindered the rapid launch of the pilot project, for example:

- The logistics infrastructure of the company in 2022 acted beyond its capabilities. The existing area of the distribution center in Tbilisi was sorely lacking, there was no necessary temperature regime, which led to significant losses in the further distribution of products. Launching a pilot under such conditions was not feasible, but already in April 2023, the company decided to invest in a new distribution center with an area of about 6,000 m2, which covers all existing needs and allows for the active development of the fruit and vegetable segment in the next few years.

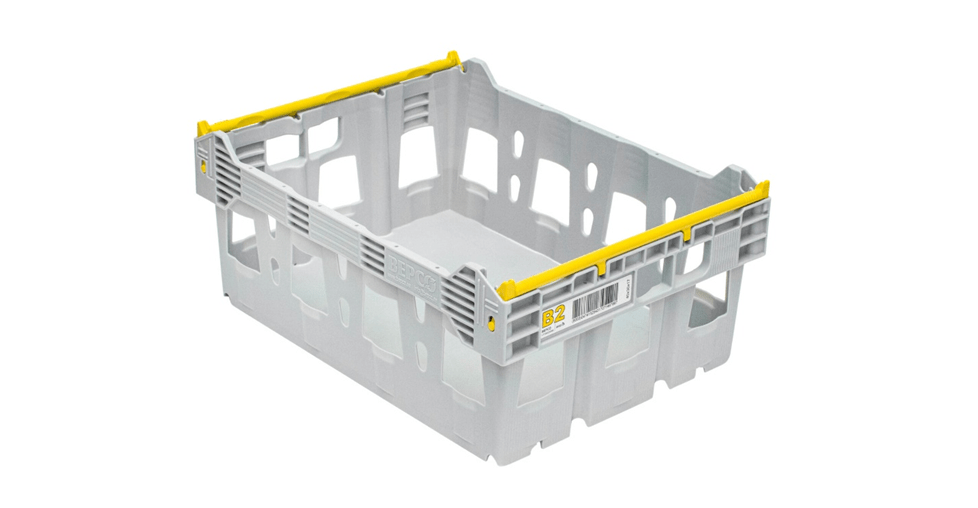

- The choice of the type of plastic containers is always a difficult issue, because the commercial department, logistics and operational departments have different, sometimes conflicting KPIs and perceive the business process of supplying fruits and vegetables differently. The commercial department is primarily interested in reducing purchase prices, the logistics department is interested in the maximum cost reduction in the distribution of products. The operations department is most concerned about the low level of write-offs in retail sales of fruits and vegetables. Initially, when choosing the type of plastic reusable packaging, it was taken into account that the box should be strong and durable. It was also decided to use such a box model, which is currently used in the EU countries, so it was decided to use the box of the international pooling operator “BEPCO OU”, which is actively developing in Estonia, Latvia, Lithuania and Bulgaria. Considering that most Nikora stores have a narrow assortment of fruits and vegetables, and there is a shortage of retail space for placing fruit and vegetable products, it was decided to use a gray box B2 40 * 30 * 17 cm, equipped with two RFID tags (Radio Frequency Identification). This box has a suitable size for planograms of produce departments in small stores, which make up more than 80% of all retail stores in Georgia. Integration of box B2 with planograms of fresh produce departments allows to reduce costs in the distribution center for the formation of orders, because in this logistic scheme the formation of an order is tied to a logistic unit, which in this case will be a box. Therefore, the supplier loads the products into the box B2 with a fixed weight, then the boxes arrive to the distribution center, where orders from stores are formed based on an indication of the required number of logistics units or boxes instead of kgs. In terms of increasing the efficiency of the pooling business, pooling operators tend to use fewer types of containers. At the same time, a wider range is needed for the small Georgian market.

- Accounting for returnable packaging is a huge challenge for retail chains in Georgia. The most difficult part of the supply chain is accounting for returnable packaging after it has been used in retail stores. Despite the well-developed IT infrastructure at Nikora Trade, there was no module in the accounting program for accounting for reusable boxes. Therefore, for the implementation of the pilot, it was decided to use the state IT infrastructure. Fortunately, in Georgia it is mandatory for all market participants to register an electronic tax invoice on the state website when selling products. The template of the electronic invoice on the website has a mandatory section “Returnable packaging”, which the company decided to use to organize accounting for pooling boxes. A little later in the company’s accounting, a special code was assigned to box B2, which allowed the retailer to create an additional SCU for more complete control of returnable pooling packaging.

Another problem is the practical application of RFID tags on boxes and RFID scanners in the distribution center. Nikora Trade company purchased several RFID scanners that were able to optimize costs in the warehouse in other product categories, but practice has shown that in order to optimize accounting at the distribution of the fresh produce warehouse more extensive use of returnable packaging with RFID tags is needed. Also, significant increase in the wages of warehouse employees would be required to assure successful implementation of this new process. - Cost-efficiency for most retailers in Georgia is a key issue when deciding whether to innovate and abandon the existing logistics scheme. The current low-quality standards for transport packaging in the Georgian retail market requires a more aggressive pricing policy on the part of international pooling companies to enter the market, because at the moment retail chains approach this issue linearly, comparing pooling costs with the cost of secondary packaging, excluding optimization of labor costs in the distribution center and in retail stores. As a result, it was necessary to solve a difficult task so that the cost of one cycle for the supplier would not exceed $0.15, while in the EU countries one cycle costs from 0.30 to 0.50 euros. Therefore, in order for international pooling operators to enter the Georgian market, a scale of at least 1 million boxes is needed, which the local retail market will probably not be able to absorb in the next 5 years.

Accordingly, presently there is only one option for the development of this logistics service – via local logistical companies. Local companies, however, have certain objective difficulties, such as the high cost of money, the inability to use reusable plastic containers as a collateral, high risks of losing reusable containers, lack of necessary knowledge among most market participants, and a high degree of mistrust. Despite all of the difficulties, at the moment there is a market niche that, under certain conditions, will be supported by international donors, the state, and in the near future also by banks interested in providing “green” loans and investments in resource-efficient green digital technologies, which can significantly increase the economic efficiency of pooling implementation in the long term. - Professional year-round suppliers of fruits and vegetables represent a very important element of a successful pooling launch. The fastest and highest quality post-harvest or pre-sale preparation is the key to successful delivery, preservation of freshness and quick and successful sale of fresh produce. At the same time, the purchasing policy of Nikora was based on a daily tender, where the supplier who offered the product at the lowest price had to deliver it the next morning. Thus, the company worked “on wheels”, constantly changing suppliers. This business model made it much more difficult to introduce a pilot for reusable containers.

The only exception was the apple supplier, which had its own commercial size production, the necessary storage infrastructure, a sorting line, and its own transportation. Therefore, using all these advantages, it was decided to launch a pilot project with the supplier of apples – the Tirifoni Fruit company. An attempt was also made to start pooling with tomato suppliers, but small Georgian producers believe that the best packaging for tomatoes is a secondary banana box, and company managers will need more time to convince them.

At the same time, box B2 is well suited for nectarine and peach suppliers. Presently small Georgian growers are mainly focused on the wholesale market, so they are very reluctant to accept any innovations. But the purchasing power of Georgian retail chains is growing every year, and will soon allow to convince suppliers to use the correct boxes and pallets, but also to fix the weight of each box. - Selection of stores to participate in the pilot project. The pilot involved retail chain’s stores, where there is a stable logistics of fruits and vegetables from the distribution center, as well as reverse logistics of returnable packaging. More than 350 stores of the company, which were served from the distribution center in Tbilisi, met these requirements. The existing fruit and vegetable logistics in Western Georgia does not allow stores located in this region to take part in the pilot. Thus, in June 2023, the pilot was launched in 350 Nikora Trade stores, which include Nikora, Nikora XL and Libre supermarkets. Fruit and vegetable suppliers currently use 5,500 crates.

Over the next 3 months, Nikora will analyze the efficiency of the new logistics and then decide on the scaling of the business model that will work in the future.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.