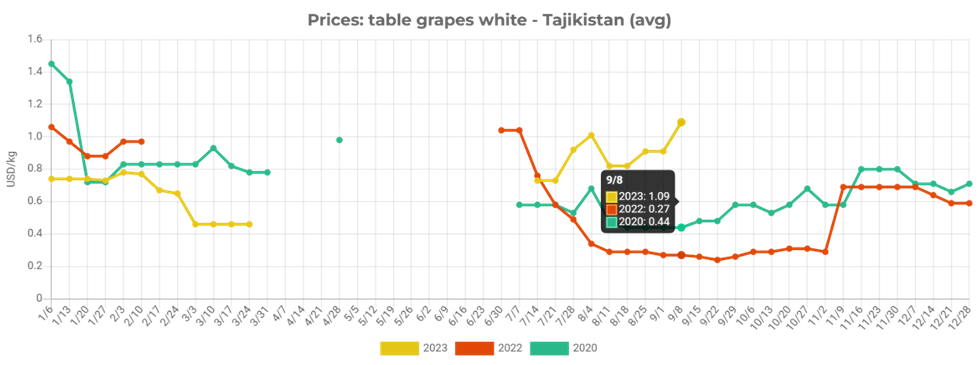

Table grape prices skyrocket in Tajikistan and Uzbekistan due to frost damage. The table grape market in Tajikistan and Uzbekistan is facing a shock as wholesale prices for the most popular varieties have soared to unprecedented levels. EastFruit analysts report that the current prices are several times higher than the usual ones for this season.

The main reason for this situation is the severe winter frost that devastated the vineyards in both countries, as we have previously reported. Table grapes, which are normally the cheapest fruits in Tajikistan at this time of the year, are now scarce and expensive.

“The only grapes that are available on the wholesale market are mostly the late Toifi variety, or small quantities of other varieties such as Husaini, “Lady’s finger” and “Pobeda”. Unlike previous years, when grape prices dropped in September, this year they are already increasing,” says Bakhtiyor Abduvokhidov, an international consultant for FAO.

Tajikistan has even started to import table grapes from Uzbekistan. Small trucks carry grapes from the Fergana region to the Sughd region of Tajikistan, which borders Uzbekistan. There, small wholesalers buy the grapes and transport them 500 km to Dushanbe. However, since the grapes are already expensive, intermediaries cut costs by not pre-cooling them and using vehicles without refrigeration, which affects the quality of the products. As a result, grape prices in Dushanbe are much higher than in Khujand.

“Grape traders expect that prices will continue to rise, and maybe even larger-scale imports from other countries will become profitable before the new year. Exports are out of the question now,” Bakhtiyor Abduvokhidov says.

He also notes that it will take at least three years for Tajikistan to recover its table grape production to last year’s level.

Frost damage to grapes will cost Tajikistan and Uzbekistan millions in export revenue. The frost that damaged the table grape production in Tajikistan and Uzbekistan will also have a significant impact on their export earnings. Table grapes and raisins are major sources of income for both countries in the fruit sector.

“Fresh table grapes and raisins are the second largest source of export revenue in the fruit segment for Tajikistan, after dried apricots. Therefore, the country’s annual loss of export revenue from frosts will amount to $10 to $15 million in the grape segment alone in the coming years,” says Andriy Yarmak, economist at the Investment Centre of the Food and Agriculture Organization of the United Nations (FAO).

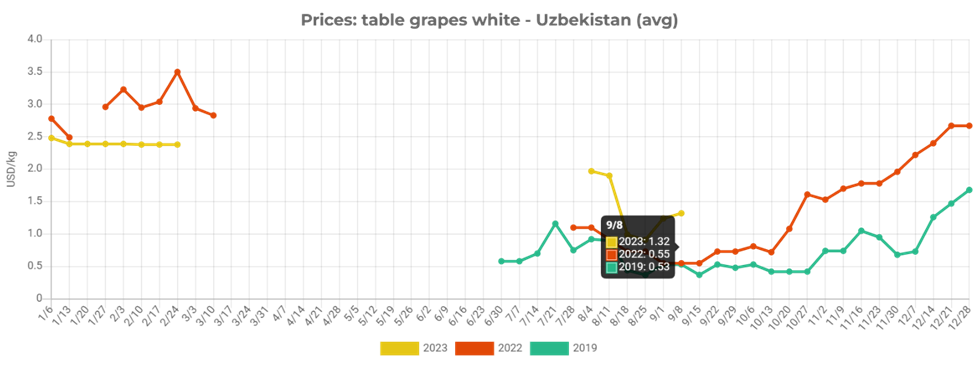

Uzbekistan, which is now supplying table grapes to Tajikistan, also suffered from severe frosts in winter. Prices for grapes in Uzbekistan are much higher than usual. The situation is very similar to that in Tajikistan. Prices are at record levels and are rising.

“It should be noted that Uzbekistan is usually among the world’s largest exporters of table grapes and raisins, ranking 11-14th in the world in this category. Exports of fresh and dried grapes are the leading source of export revenue for the fruit and vegetable sector of Uzbekistan, which brings this Central Asian country from US $180 million to US $280 million per annum – i.e. almost 20 times more than for Tajikistan. Therefore, losses from the frosts for Uzbekistan, even though they managed to better preserve some vineyards, will be much larger than in Tajikistan. This will also negatively affect the exports of other dried fruits and mixtures,” says Andriy Yarmak.

Experts also predict that grape prices in Uzbekistan and Tajikistan will reach record levels in the winter, which could boost prices for other types of fruits, as many consumers will have to look for alternatives.

Grape shortage will affect fruit consumption and imports in Uzbekistan and Tajikistan. The shortage of table grapes in Uzbekistan and Tajikistan will also have an effect on the fruit consumption and imports in both countries. Table grapes are usually a cheap and popular fruit in these markets, but now consumers will have to pay more or switch to other fruits.

“We have repeatedly said that prices for grapes in Uzbekistan in winter and spring are abnormally high, for a country that grows and exports such significant volumes. The main reason for this is the lack of storage infrastructure and the low level of grape growing technologies for long storage. Therefore, in my opinion, the largest decrease in grape consumption will occur from September to December, and it is this window that importers can use to increase shipments of alternative fruits, such as bananas, oranges, mandarins, apples, and pears,” says Andriy Yarmak.

The expert also expects a significant increase in grape imports to Uzbekistan from the countries of the Southern Hemisphere in the winter-spring period. Moreover, he thinks that Uzbekistan may make the first direct purchases from South Africa, Chile, or Peru, and not through intermediaries from Russia, as was usually the case in previous years. He also does not rule out that imported grapes from India will enter the market of Central Asian countries this season.

In addition to the huge losses from exports of grapes and raisins, which may exceed hundreds of millions of dollars for both countries, we must also consider consumer losses, which will be much higher. The population of Uzbekistan is about 35 million people, and Tajikistan has about 10 million. Already now, consumers overpay for grapes on average at least 30-50 US cents per kilogram. Table grapes and raisins are widely consumed in these markets, but now consumers will have to spend more and/or reduce their consumption.

According to the most conservative estimates, the average consumption of fresh grapes and raisins in fresh equivalent is about 20-25 kg per person per year, although some sources put the figure at 35 kg. However, we will take a lower threshold of 20 kg, since some of these grapes are probably consumed within the producers’ families and do not pass through the market. It is also obvious that consumption will be lower this season. Even with these estimates, consumers in Tajikistan and Uzbekistan will “overpay” and spend $300-350 million more on grapes than usual in this season alone.

Therefore, if it takes up to three years to restore production volumes, the countries will incur such losses annually. However, this could also be a good opportunity to rethink approaches to growing grapes in the region, because the varietal composition of grapes in Central Asia is currently so outdated, that it is considered by experts as a dead end.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.