According to EastFruit analysts, wholesale prices for apples in Ukraine are currently more than twice as high as at the same of 2022. Ukraine’ s apple harvest in 2022 was good and many wonder why did prices increase so much? Also, are there good opportunities for apple exporters from Poland and other countries at the Ukrainian apple market now?

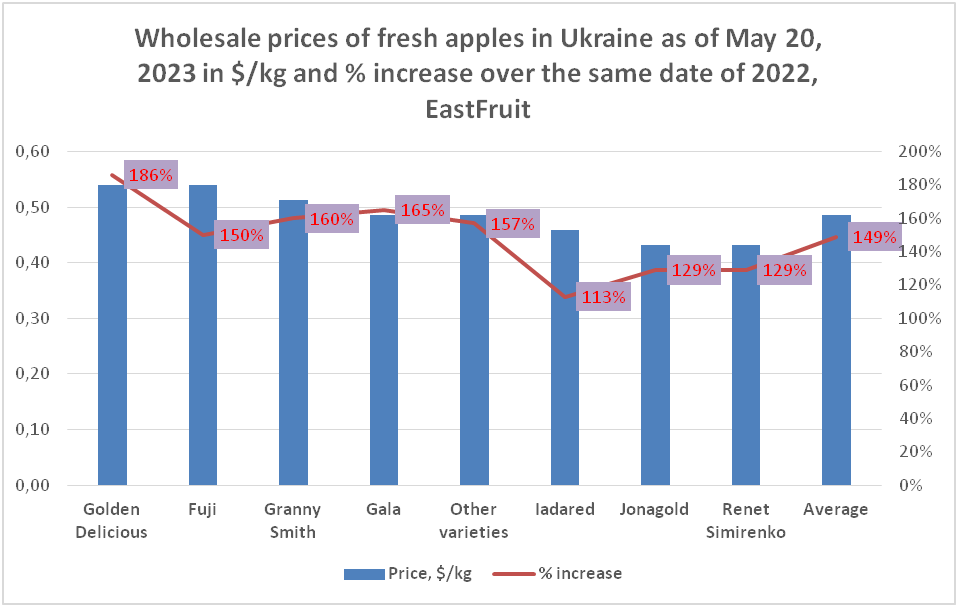

First of all, despite a good apple harvest in 2022, Ukrainian market is experiencing an increase in apple imports, especially in the segment of medium and high-quality produce. Wholesale apple prices in Ukraine are presently 149% higher than at the same time of 2022.

Prices for which apple varieties are the highest and what was the price change on a year? See the following chart for the analyses of top 7 apple varieties in Ukraine. While on the market you could still find around 20 varieties of apples, most of the leading supermarket chains as well as growers presently have two varieties for sure: Gala and Golden Delicious.

Granny Smith in Ukraine competes with local variety Renet Simirenko, which is much tastier but does not look as good as Granny and has many other issues from the production and logistics point of view.

In terms of wholesale prices, Golden Delicious and Fuji stand out among the popular varieties – they are sold at an average of 20 UAH/kg wholesale, which is around US $0.54-0.55 per kg. Jonagold and Renet Simirenko are the cheapest apples among the top 7 varieties and are sold at US $0.43 per kg on average.

In terms of wholesale prices, Golden Delicious and Fuji stand out among the popular varieties – they are sold at an average of 20 UAH/kg wholesale, which is around US $0.54-0.55 per kg. Jonagold and Renet Simirenko are the cheapest apples among the top 7 varieties and are sold at US $0.43 per kg on average.

The prices for the Golden Delicious apple rose the most sharply – almost three times compared to last year. Also, Gala and Granny Smith went up in price by more than 2.5 times. But Idared grew in price the least – 2.1 times. This indicates consumer preferences for different varieties and is also associated with the peculiarities of storing different varieties of apples.

Read also: Cheap Golden – apple prices in Poland, Ukraine and Moldova remain critically low

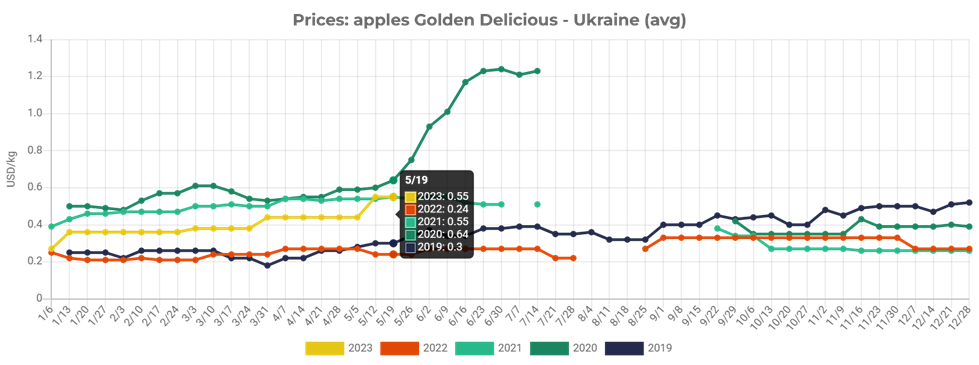

In particular, the Golden variety is very sensitive to even slight fluctuations in air temperature in the fruit storage, while Idared reacts much less to these “shakes”. Since from fall to spring Ukraine lived in the conditions of constant Russian terrorist attacks on civilian infrastructure, namely on the country’s energy supply system, it was quite difficult to store all apples, and some varieties in particular.

In the 2022/23 season, Ukrainian producers were forced to rush to sell apples from storage because they were not sure of the possibility of maintaining their quality, given the “heroic” battle of the Russian army with Ukrainian energy system. Since the Ukrainian energy system won this war, those farmers who decided to keep the apples until May were able to make good money.

Well, the wholesale apple price of 55 US cents for May is rather typical for Ukraine but it is still good for these who managed to store apples this long as in some years it has been significantly lower in May.

Why are we talking about a more than twofold increase in the price of an apple in Ukraine? Indeed, last year during this period there was already a Russian war in Ukraine, but prices were much lower than today.

Why are we talking about a more than twofold increase in the price of an apple in Ukraine? Indeed, last year during this period there was already a Russian war in Ukraine, but prices were much lower than today.

It’s all about the base for comparison – in 2022, apple prices were low and even began to decline by May, since new logistics routes had not yet been worked out, and Ukrainian ports were blocked by Russian aggressors. This led to the need to sell the apples at the lowest possible prices as the season was ending. That’s why the increase in prices seems so sharp.

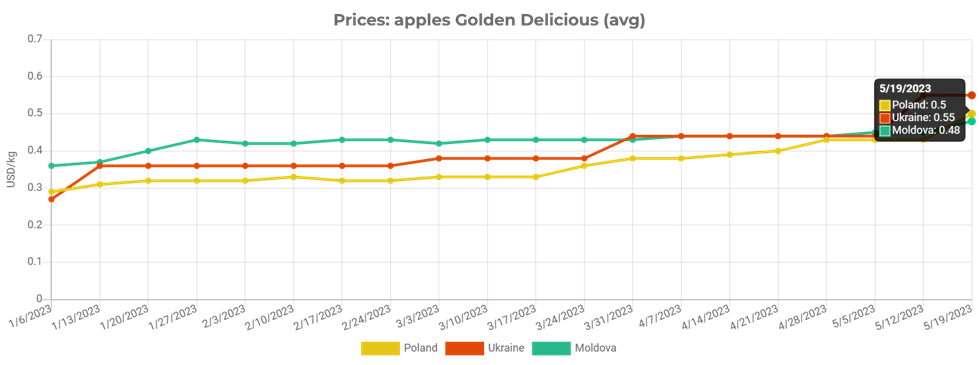

However, if we compared prices for apples in Ukraine with prices in Poland or Moldova, we’d see that there is no significant difference for all key varieties.

Just in the recent week apple prices in Ukraine became higher than in Poland but incentive to import remains rather low unless we are talking about the premium segment.

By the way, Ukrainian growers and traders developed alternative logistics solutions very fast. Consequently, in the 2022/23 season the UAE became the main buyer of fresh apples from Ukraine – it is expected that about 10 thousand tons of Ukrainian apples this season will be sent to Dubai. Another country where shipments are only possible via the seaport, Iraq, was the second largest importer of Ukraine’s apples.

We also note significant volumes of apple exports from Ukraine to Turkey. It is obvious that Turkey has become a hub for the re-exports of Ukrainian apples to countries where Ukraine cannot directly supply due to various limitations. Otherwise, one cannot explain apple exports to Turkey from Ukraine as Turkey, for example, is the largest exporter of apples to India, and India is one of the world’s main importers of apples.

The ranking of the largest buyers of Ukrainian apples also included such countries as France, Sweden, Saudi Arabia, Romania, Armenia, Georgia, and Uzbekistan.

It is also interesting to note that apple imports to Ukraine remained relatively low until April 2023, and not Poland, but Croatia was the main supplier.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.