The apple season 2022/23 in Ukraine was perhaps one of the most difficult in the past decade. “Problems with usage and rising costs of plant protection products, fertilizers, and other inputs, lack of labor force, relatively low prices of apples for processing, no growth in fresh apple prices for most of the season, complicated exports and logistics, attacks on energy infrastructure. That is still very far from what Ukrainian fruit growers have faced during the war”, explains Yevhen Kuzin, Head of Analytics at Fruit-Inform.

What is worth noting is that EastFruit analysts described the season’s key trends right at its beginning, and they turned out to be as correct as possible. Apple harvest collapse in China, together with a decline in the US apple production, indeed allowed Ukrainian processors to set a record in apple juice concentrate exports and somewhat favored Ukrainian fresh apple exports to Southeast Asia. Ukraine also became one of the biggest suppliers of apples to Central Asia but faced strengthened competition with Moldovan apples both there and in the Middle East due to a partial ban on imports from Moldova introduced by russia.

The domestic market for fresh apples kept stagnating in Ukraine due to the russian aggression. Thus, those farmers that were unable to export their apples had to be content with low prices and lower sales volumes. Under conditions of negative price trends in the season 2020/21 and attacks on the Ukrainian energy infrastructure, these factors have only intensified the trend of uprooting apple orchards in the country. “As a result, Ukraine had to import apples at the end of the past season, although even in spring 2022, after russia had invaded, the Ukrainian market showed no demand for imported apples”, adds Yevhen Kuzin.

On the eve of the new apple season 2023/24 in Ukraine Fruit-Inform and EastFruit projects have prepared a joint analytical material, which is available below. Please note that it still lacks information about the prospects of the new apple season in other countries in the world, and they can significantly impact the Ukrainian apple exports and market. The detailed forecast with these data will be presented at the annual conference FTrade Club Apples 2023 in Dnipro, Ukraine, on August 18.

Production

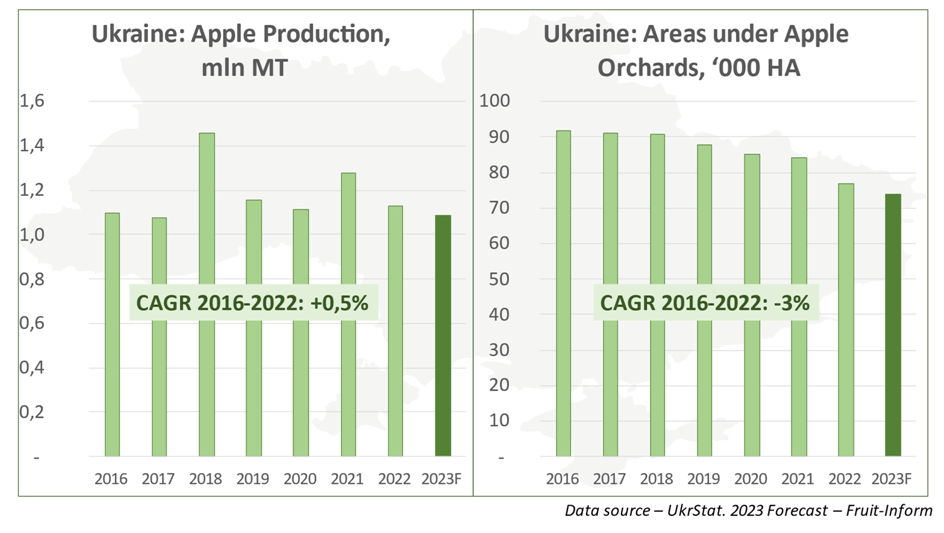

In 2023, areas under apple orchards in Ukraine will reduce again, both following the previous years’ trends and whole new factors in the country at war.

“The Ukrainian apple production sector will keep intensifying, the process of replacing old inefficient plantations with new ones, which has started long ago. Then, the Ukrainian market has lost small areas under orchards in the occupied regions, and the current market conditions are quite negative. Many growers do not plan to pick their apples due to problems with the labor force, rising costs of inputs, low purchase prices set by processors in the past season, domestic market stagnation, and a probable return of strikes on the Ukrainian energy infrastructure”, explains Yevhen Kuzin.

In that way, areas under apple orchards will reach their new low in 2023 after declining by 3% on average annually since 2016. Nevertheless, a part of those areas may well return to the Ukrainian market in case of again high demand for industrial apples shown by processors.

The question of apple yields in Ukraine is also open so far, as weather conditions in summer and early autumn can seriously impact them. On the one hand, there were no weather disasters in Ukraine in spring and early summer. Some growers from Chernivtsi and Vinnytsia Oblasts indeed reported a probable loss of a part of their harvest due to frosts and hailstorms. There were also reports of strong winds from those regions in late July. Nevertheless, the share of such growers is not large, and such losses do not differ much from those reported in the previous seasons.

“Moreover, in 2023, as shown by our annual survey of apple growers, Ukraine will have a larger share of intensive orchards, a larger share of orchards with drip irrigation, and especially a larger share of orchards that use netting for their protection. Thus, on the one hand, yields will be seriously favored”, emphasizes Yevhen Kuzin.

On the other hand, the above-mentioned reasons (rising costs of production inputs, problems with sales and domestic market prices, etc.) can force growers to minimize again their usage of fertilizers and plant protection products, and apple yields will as well be under the negative influence in the upcoming season.

“Thus, apple yields in Ukraine are expected to remain at the level of 2022, as those negative factors indeed were present in the country last year. This means that no changes in yields will result in lower production of apples in Ukraine in 2023 under conditions of reduced areas. Our estimates show that Ukrainian apple production will almost reach its low over the past eight seasons”, summarizes Yevhen Kuzin.

Consumption, domestic market, and prices

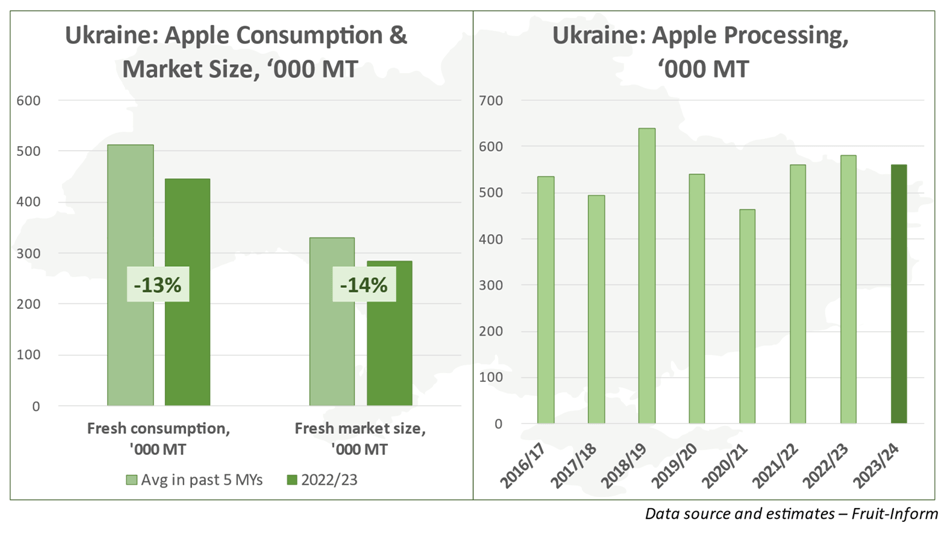

Fresh apple consumption and market size in Ukraine have been extremely negatively impacted by the outflow of main consumers (women and children) due to the war. In addition, it overlapped with a global trend of declining apple consumption in the countries, for which apples are not an exotic fruit.

“Our most optimistic estimates show that fresh apple consumption has fallen by 13%, and the market has shrunk by 14% from an average of the past five years due to the war with russia and an enormous number of refugees”, says Yevhen Kuzin. “We see no prerequisites to expect any serious growth in consumption or market size in the new season, and they will most likely continue to stagnate. Nevertheless, they will unlikely fall again, as the market has somewhat stabilized after the shock of a year and a half of the war”.

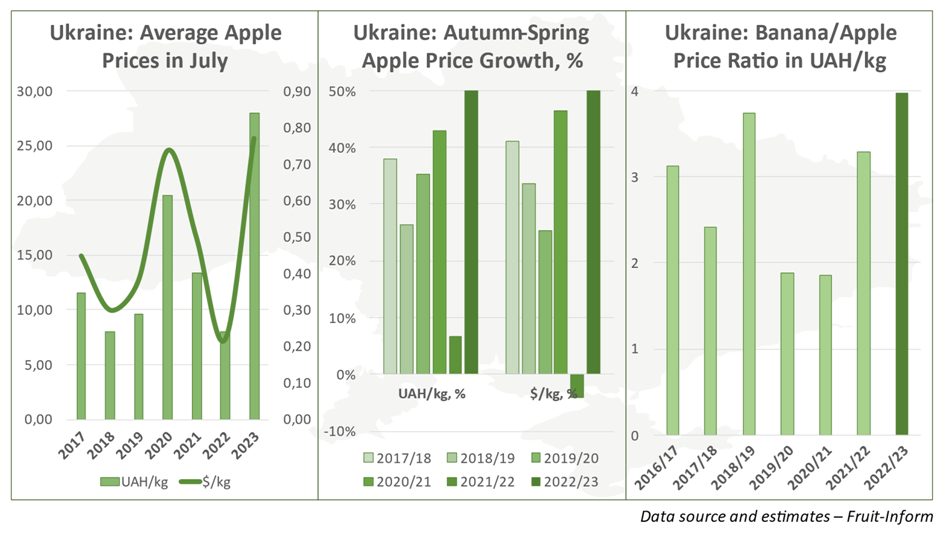

On the one hand, the main outflow of fruit consumers has already occurred, and some refugees have even returned to Ukraine. Moreover, the prices of bananas, the main competitor to apples, reached their record high in the national currency, and they were averagely four times as expensive as apples!

On the other hand, prices of last year’s apples have also reached record high over the past five years in Ukraine by July both in the national currency and the US dollars. The first summer varieties are also offered at high prices in Ukraine, and these prices have already caused a negative reaction from local consumers, as they are forced to pay premium prices for produce that are often not of premium quality.

Most growers also had almost no benefits from high prices at the end of the season. Firstly, prices started actively growing only in spring, when stored volumes had been already sold. Secondly, the Ukrainian fresh market size has reached its record low, and growers did not have many opportunities to sell apples at higher prices. Thirdly, supermarket chains, the main sales channel for apples in Ukraine, tried to switch to imported apples of higher quality in spring.

As only some companies were able to export their apples, many farmers had only sales for processing as their alternative channel. Given a fall in production in China and the USA, growers expected prices of industrial apples to somewhat grow, but the reality was quite the opposite.

“Large supply of low-quality fruits due to problems with the usage of plant protection products and fertilizers, many farmers’ unwillingness to store their harvest due to lack of price growth a season before, and apple juice concentrate trade specifics resulted in prices of industrial apples going down to as low as $0,05/kg in autumn 2022. Thus, farmers with apples for processing received no benefits from the global market situation in the past season”, highlights Yevhen Kuzin.

Processing

As regards apples for processing in the new season 2023/24, here everything will again depend on the situation in other countries of the world, but we still have no reliable information on prospects there. As of today, apple processing volumes will most likely decline in Ukraine and go down to the level of the season 2021/22. Nevertheless, because of continuous problems with orchard works, apple processing will remain rather high in Ukraine, unless there would be some global turmoil. In addition, apple processing can for the first time exceed a half of total apple production in Ukraine under conditions of fresh market stagnation and a decline in apple harvest!

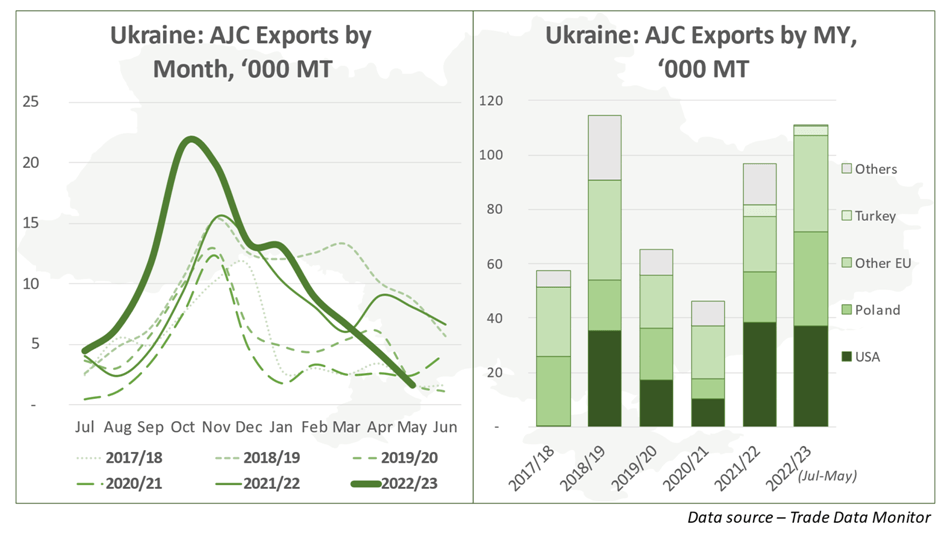

It is also worth noting that in the season 2022/23 apple juice concentrate exports are expected to at least reach the level of the season 2018/19, or even slightly exceed it. AJC exports peaked in the first half of the season, as processors did not want to take risks connected with the long-term storage of their products, and then came the attacks on the Ukrainian energy sector.

“An increase in the share of final consumers of Ukrainian apple juice concentrate is one of the most important outcomes of the past season. Although Poland remained one of the key re-exporters and transshipment bases for Ukrainian concentrate, the EU and the USA accounted for the largest part of the Ukrainian exports”, adds Yevhen Kuzin.

Although it is still too early to forecast apple juice concentrate exports in the new season, as it needs the information about apple production in importing countries and competitors of Ukraine, we can nevertheless make some conclusions.

Apple juice concentrate will most likely be exported from Ukraine mostly in the first half of the season, as the Ukrainian energy infrastructure is again expected to be hit by russians. This will allow apple growers to count on Ukrainian processors in summer and autumn again. Nevertheless, it is still too early to expect high prices for industrial apples.

Firstly, processors will again prefer to transfer their risks to suppliers of apples for processing. For example, even under conditions of the previous season with the global market revived from the pandemic and lack of apple juice concentrate from China, farmers were not pleased with the prices of industrial apples. Secondly, stagnating fresh market and problems with the quality of apples will most likely keep the supply of apples for processing high.

At the same time, prices can somewhat grow compared with a year before, as processors’ stocks of apple juice concentrate have been fully exhausted by the end of spring. In addition, many farmers will face serious problems with picking campaign due to active mobilization in Ukraine, which has already caused a sharp shortage of labor force in many regions.

External trade in fresh apples

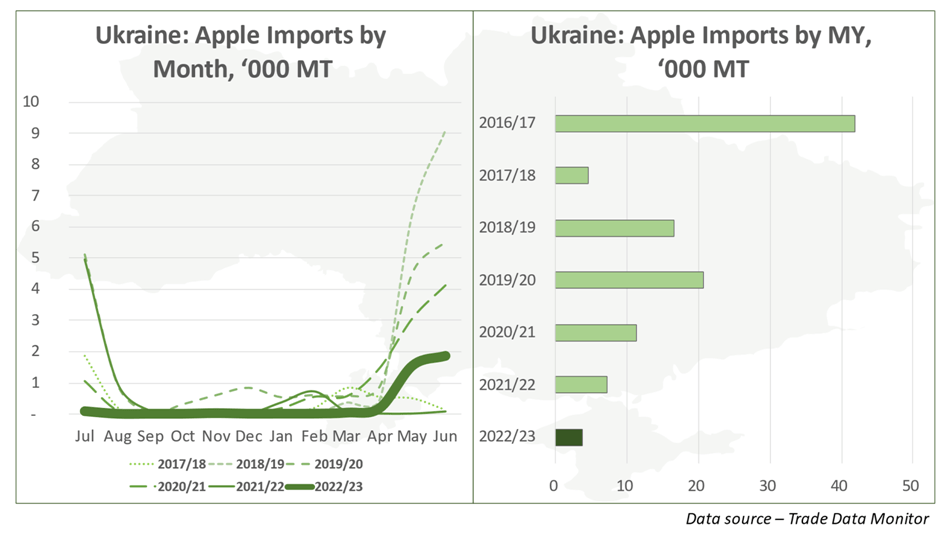

The Ukrainian market indeed showed the demand for apple imports in the season 2022/23. Nevertheless, the import volumes of 4,200 tonnes were the lowest over the past decade, or even longer. Moreover, apples were imported to Ukraine just for current sales, and the previously popular scenario of imports from Poland for long-term storage had lost its relevance for the Ukrainian market.

The new season will unlikely change the situation with imports. Under conditions of an expected decline in Ukrainian apple production, imports may somewhat grow compared with the previous season. Nevertheless, there are no prerequisites to expect a serious increase in imports, although the situation can change during the winter and due to probable attacks on the energy sector.

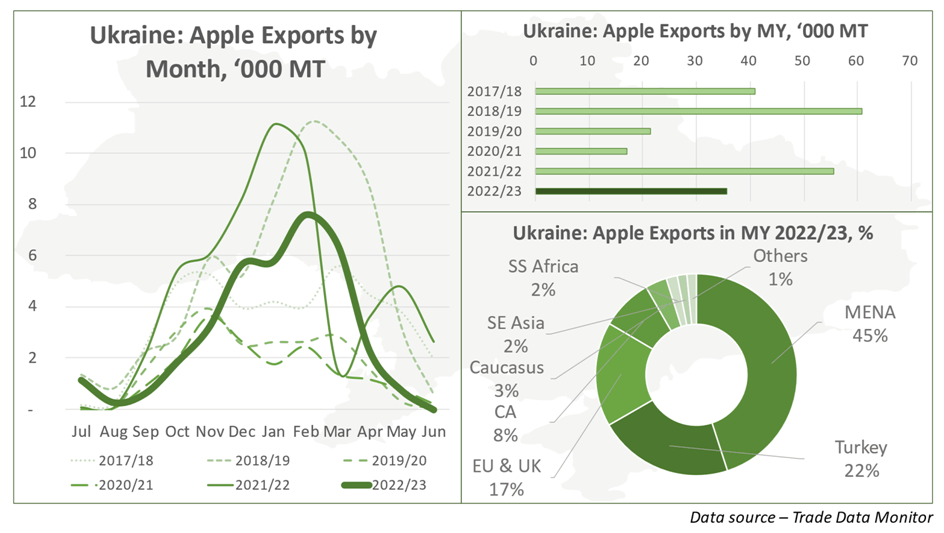

As regards apple exports from Ukraine, the most important achievement is that the country has held its position on the markets chosen after the russian embargo. The key markets for the Ukrainian apple exports in the season 2023/24 included the Middle East (the UAE, Iraq, Saudi Arabia, Kuwait, Qatar, Oman), followed by the EU (Sweden, France, Romania, the Netherlands, etc.), Caucasus and Central Asia (Uzbekistan, Georgia, Armenia), as well as Malaysia and Sub-Saharan Africa.

In total, Ukraine exported almost 36,000 tonnes of apples in the season 2022/23, which is lower than a season before but not a record low. It is worth noting that there were almost no export-quality apples in the country by the mid-spring due to growers’ unwillingness to take risks connected with long-term storage and a general decline in the quality of apples in the past season.

High dependence on some re-exporting countries was also one of the negative moments in exports. In the season 2019/20 it was Belarus, and in the past season it was replaced by Turkey. Turkey accounted for more than a fifth of Ukrainian apple exports, and almost all those volumes were intended for further reselling, depriving Ukrainian farmers of a part of their margin.

“The upcoming Ukrainian season will a lot depend on the situation in other markets, but it is already obvious that the Ukrainian apple exports may somewhat fall. Firstly, the country has almost no transit stocks of export-quality apples; therefore, exports will step up only in September-October. Secondly, total production of apples in Ukraine is also expected to decrease”, highlights Yevhen Kuzin.

The Ukrainian market development scenario in the season 2023/24

As of today, the upcoming season will most likely develop in a way similar to the previous one, with several important changes. Transit stocks of last year’s apples have seriously shrunk by the end of spring, and current prices of new apple crop are almost record-breaking.

These factors mean the start of the new season with higher prices, which may fall considerably by the middle of autumn due to the ongoing harvesting campaign. Nevertheless, a further increase in apple prices in Ukraine can be expected no earlier than in spring 2024, as in the previous season. However, this will of course be under the impact of many other factors: exporters’ activity, the course of military operations, and the situation with prices and production in other countries of the world.

Everything will also depend on the accuracy of our estimations. If our estimates of a reduction of areas under apple orchards were incorrect, and uprooting rates were more rapid, then production would fall lower than expected. This would drive prices up and create some problems with the availability of industrial apples in the country. Nevertheless, the prices of apples for processing will mainly depend on the prices of final products (apple juice concentrate) in the global market, and now there are no reasons for their growth.

Meanwhile, if our yield forecast was underestimated, and positive factors will overcome negative ones, production would remain at the previous year’s level or even go up. In its turn, this will put pressure on prices both in the fresh and industrial segments.

At the same time, the lowest variability is seen in the external trade in apples. Ukraine will unlikely return to the import volumes of the season 2016/17 (more than 40,000 tonnes), and the export volumes will somewhat go down. Nevertheless, exports will not be the lowest over the past years, as Ukrainian farmers will still need to export apples to reduce pressure from the stagnating domestic market.