According to EastFruit analysts, onions remain one of the most dynamic positions on the fruit and vegetable market, although, thanks to the arrival of new crop onions from Uzbekistan, Tajikistan, Kyrgyzstan and Kazakhstan, the hype in the market has somewhat subsided. However, there were some unexpected trends in the previous week that cannot be overlooked.

For the purpose of market analytics, we divided all countries into two categories: these where the market is already dominated by new crop onions, and those where the local harvest of new crop onions has not yet begun or where new onions do not yet dominate the market.

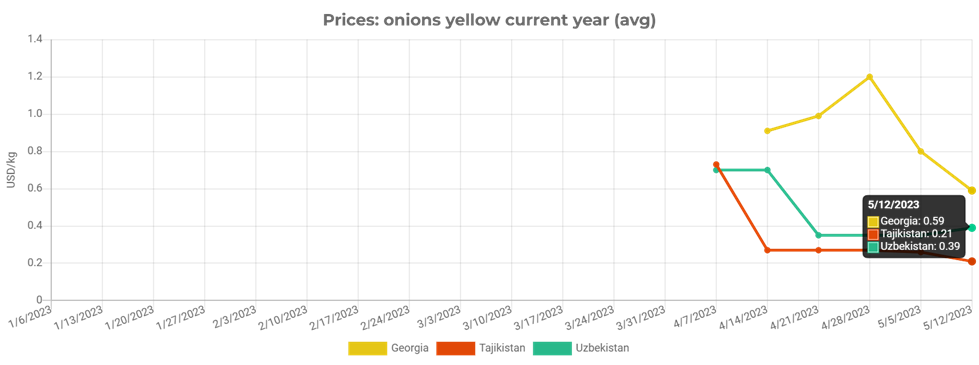

Tajikistan, Uzbekistan and Georgia fall into the first category and prices in these countries are consequently lower than in the second one.

The cheapest onions are now in Tajikistan. Over the week, wholesale prices for onions in this country decreased by another 19% and reached $0.21 per kg! Partly low onions prices are caused by the untransparent policies, as official announcement about onion export ban has not been made yet although market participants do know that onions could be exported. Thus, onions in Tajikistan are already cheaper than a year earlier. Interestingly, you can buy wholesale onions in Tajikistan five times cheaper than in Ukraine! Sounds like Tajik onions provide a good sourcing opportunity for an adventurous buyer even from the EU considering the price levels there!

The cheapest onions are now in Tajikistan. Over the week, wholesale prices for onions in this country decreased by another 19% and reached $0.21 per kg! Partly low onions prices are caused by the untransparent policies, as official announcement about onion export ban has not been made yet although market participants do know that onions could be exported. Thus, onions in Tajikistan are already cheaper than a year earlier. Interestingly, you can buy wholesale onions in Tajikistan five times cheaper than in Ukraine! Sounds like Tajik onions provide a good sourcing opportunity for an adventurous buyer even from the EU considering the price levels there!

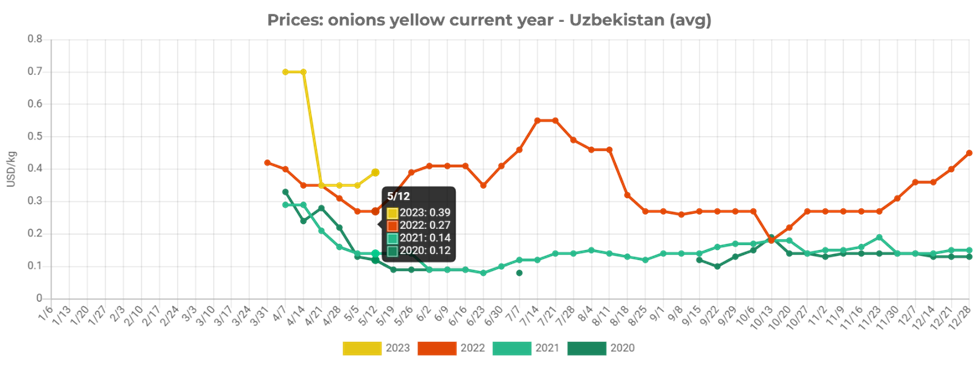

Onion prices in Uzbekistan have unexpectedly grown during the past week, after two weeks of stability. Now high-quality onions in Uzbekistan are already sold in bulk at $0.39 per kg, and this is an all-time record price for onions for this period of time. Onions are now 44% higher than in 2022 at the same time and approximately twice the usual price for the first half of May.

By the way, according to market participants, during just the first 10 days of May 2023, Uzbekistan has exported 48 thousand tons of onions, which is almost 5 thousand tons of exports each day! Therefore, it is not at all surprising that onion prices remain high and continue to rise supported by the robust external demand. What really surprising is that in the neighboring Tajikistan onions are sold almost twice as cheap as in Uzbekistan.

By the way, according to market participants, during just the first 10 days of May 2023, Uzbekistan has exported 48 thousand tons of onions, which is almost 5 thousand tons of exports each day! Therefore, it is not at all surprising that onion prices remain high and continue to rise supported by the robust external demand. What really surprising is that in the neighboring Tajikistan onions are sold almost twice as cheap as in Uzbekistan.

Considering that frosts have damaged part of the winter onion crop in Uzbekistan, the situation on the market may turn out to be extremely interesting. Given the very rapid pace of onion exports, the country may again face a situation where the domestic market may become the main driver of price growth for onions.

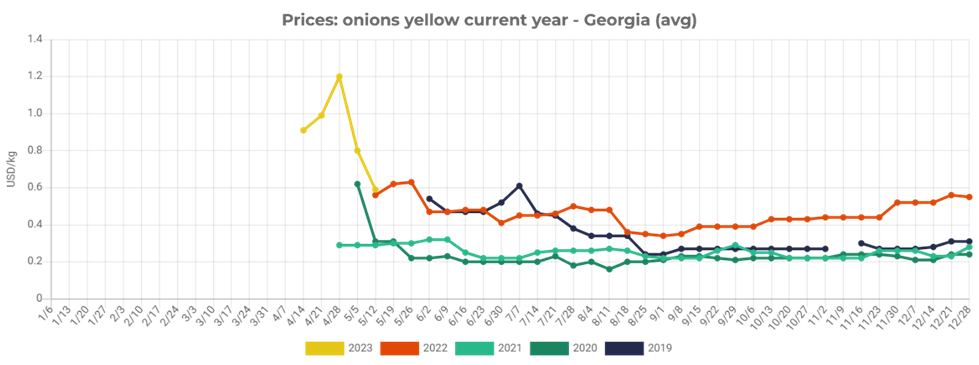

The situation with onion prices in Georgia is developing very unevenly. At the end of April, an unexpected shortage of onions formed on the market, and traders tried to sharply increase prices for it to $1.2 per kg and more. There were even high-quality onion offers on the market at two dollars per kg, but this led to a sharp decrease in sales and an increase in imports. Thus, prices fell sharply the next week, and by May 12 they were already lower than in 2022 in local currency and amounted to about $0.59 per kg.

The sharp revaluation of the Georgian Lari in 2023 continues to favor imports of onions. Moreover, in 2023 local growers have expanded area planted to onions, including early varieties. Consequently, price trends in Georgia may remain rather dynamic in the upcoming 4-6 weeks.

The sharp revaluation of the Georgian Lari in 2023 continues to favor imports of onions. Moreover, in 2023 local growers have expanded area planted to onions, including early varieties. Consequently, price trends in Georgia may remain rather dynamic in the upcoming 4-6 weeks.

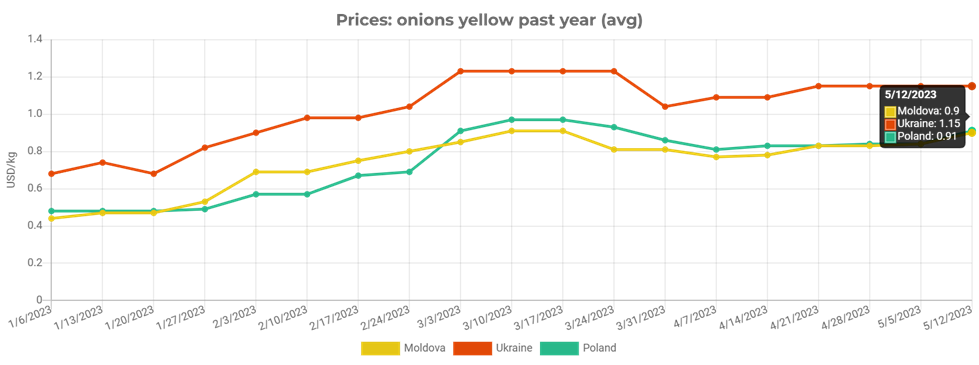

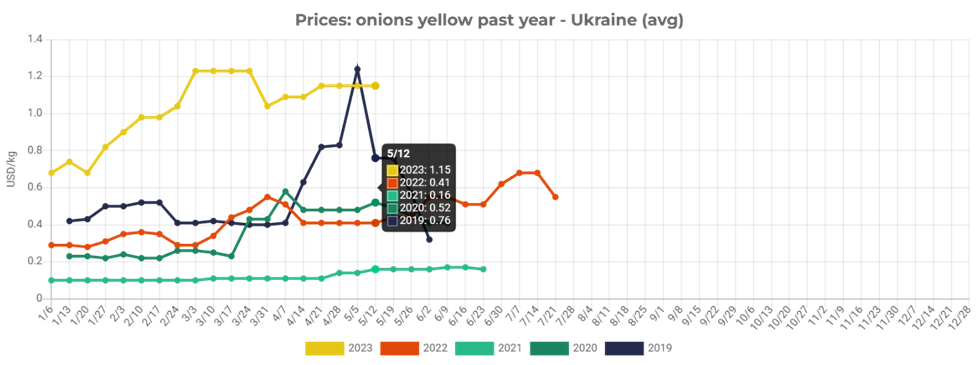

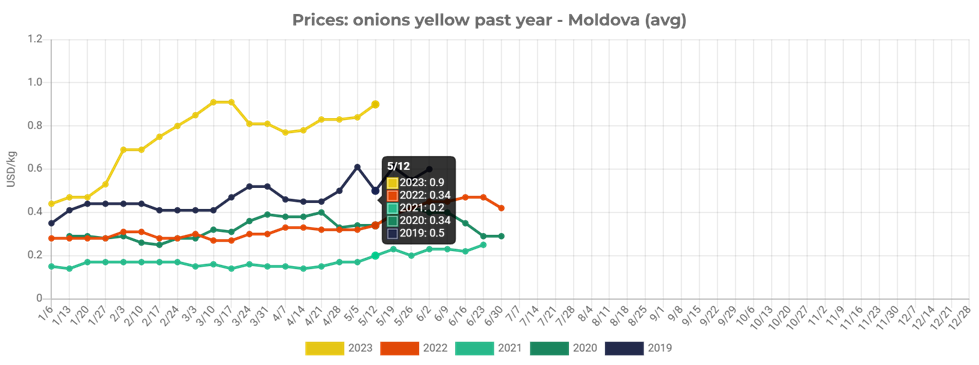

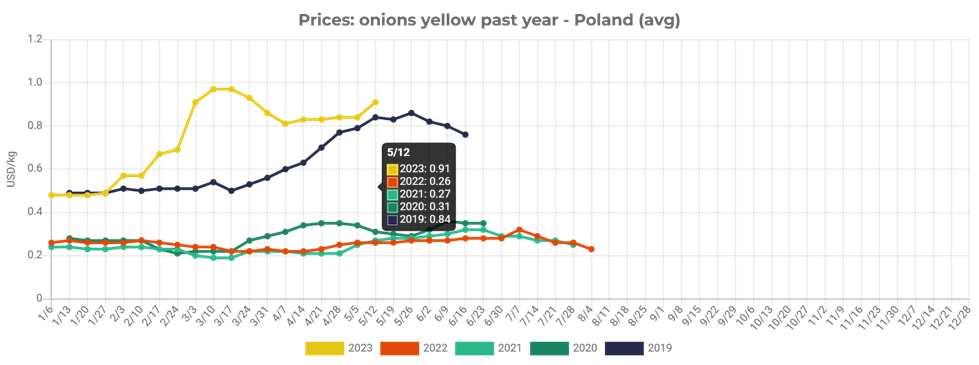

In the meantime, onion prices in countries where the new crop does not yet dominate the market: Ukraine, Moldova, and Poland, remain historically high. Moreover, despite the arrival of a new crop of onions from warmer countries, prices have not decreased significantly, in, and in some countries, they even resumed their growth recently.

Ukraine is the undoubted leader here – the wholesale prices for fresh onions here been stable at around $1.15 US dollars per kg and are not decreasing despite large imports. Spring is rather cold and the traditional production area of early onions in the south of Kherson region remains under occupation o the Russian aggressors, so a new harvest of locally grown onions on the market should not be expected for a long time yet. Last year at this time, despite the cut off supplies from the Kherson region, onion prices in Ukraine were almost three times lower than today.

Ukraine is the undoubted leader here – the wholesale prices for fresh onions here been stable at around $1.15 US dollars per kg and are not decreasing despite large imports. Spring is rather cold and the traditional production area of early onions in the south of Kherson region remains under occupation o the Russian aggressors, so a new harvest of locally grown onions on the market should not be expected for a long time yet. Last year at this time, despite the cut off supplies from the Kherson region, onion prices in Ukraine were almost three times lower than today.

Nevertheless, there is potential for a reduction in the onion prices in Ukraine, given the massive shipments of products from Central Asia and even despite rather expensive logistics. Although, given the situation with high export volumes of early onions from Uzbekistan and losses of part of the crop at the beginning of the year due to frost, it is possible that prices in that region will also strengthen somewhat.

Nevertheless, there is potential for a reduction in the onion prices in Ukraine, given the massive shipments of products from Central Asia and even despite rather expensive logistics. Although, given the situation with high export volumes of early onions from Uzbekistan and losses of part of the crop at the beginning of the year due to frost, it is possible that prices in that region will also strengthen somewhat.

Onion prices in Moldova have been on the rise since mid-April. They have already almost returned to the level of mid-March when the historical price record was reached and are now about $0.90 per kg. A year earlier, onions in Moldova at that time sold almost three times cheaper. However, in mid-June – early July, when the harvesting of local early onions begins, price trends are going to be most exciting as the onion planted area has been significantly expanded in 2023 on one hand, but on the other hand there will be no early onion coming from Ukraine.

In Poland onion prices are the same as in Moldova – $0.90 per kg, and the price trends are absolutely identical here: onion prices in Poland are gradually increasing. They are also at their all-time highs for this period of the year, although they are now lower than they were in mid-March 2023.

In Poland onion prices are the same as in Moldova – $0.90 per kg, and the price trends are absolutely identical here: onion prices in Poland are gradually increasing. They are also at their all-time highs for this period of the year, although they are now lower than they were in mid-March 2023.

In Poland, local onions will appear on the market even later than in Moldova. Thus, there is still a month and a half ahead for selling the onion stocks of the 2022 harvest and imported onions of 2023 harvest. It is possible that Poland will purchase quite significant volumes of onions from Central Asian countries this year, just like in the spring of 2019, when onions were actively imported from Kazakhstan, Uzbekistan, Kyrgyzstan, and Tajikistan.

In Poland, local onions will appear on the market even later than in Moldova. Thus, there is still a month and a half ahead for selling the onion stocks of the 2022 harvest and imported onions of 2023 harvest. It is possible that Poland will purchase quite significant volumes of onions from Central Asian countries this year, just like in the spring of 2019, when onions were actively imported from Kazakhstan, Uzbekistan, Kyrgyzstan, and Tajikistan.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.