According to EastFruit analysts, the 2024 blueberry season in Ukraine was not particularly successful for growers. The unusually early start of blueberry flowering, followed by frosts, led to a reduction in yield and damage to quality in some regions. However, the overall harvest volume was higher than in 2023. Despite numerous challenges with harvesting, the supply of berries increased.

Amid ongoing military aggression against Ukraine, farmers faced significant marketing challenges. One major issue is the low capacity of the domestic market. Consequently, domestic blueberry prices largely depended on export efficiency, which also faced difficulties. Only a small number of producers can gather sufficient volumes for direct exports.

Read also: Blueberry demand on the rise in the UK market

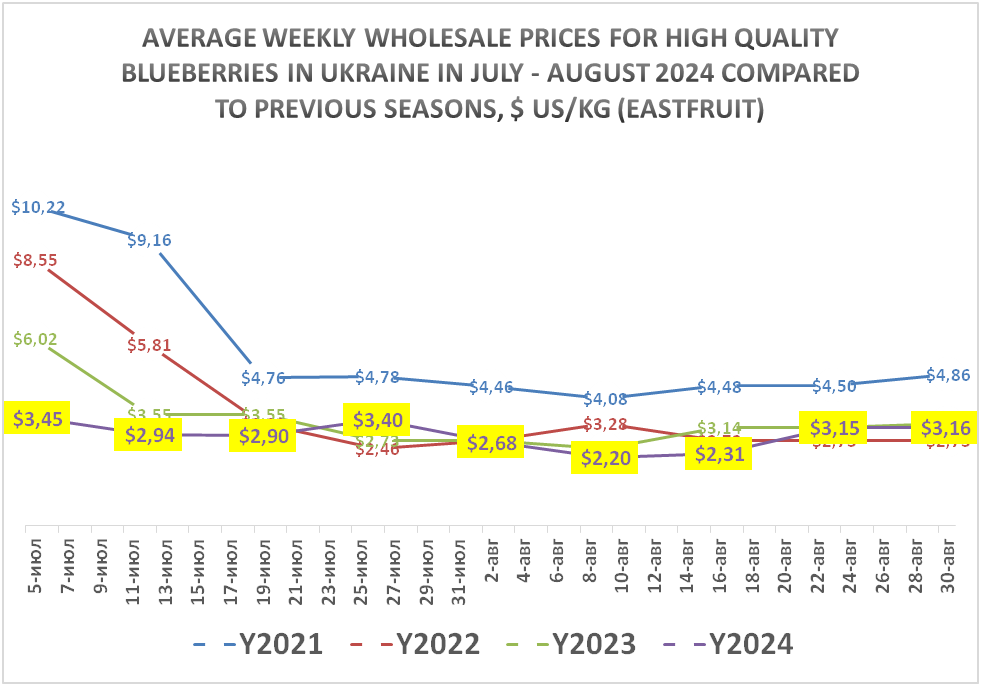

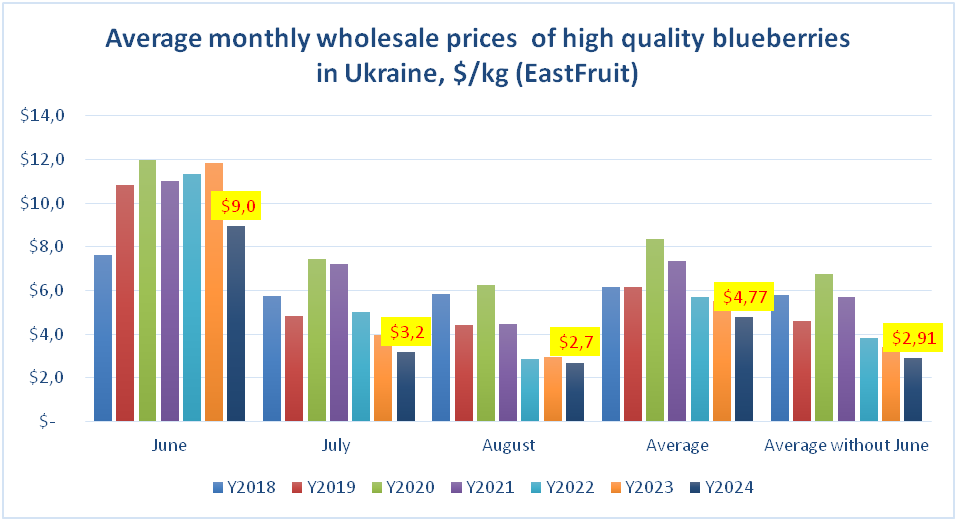

As a result, blueberry prices fell to record lows at the beginning of the season. However, this article focuses on prices for premium blueberries, which can be sold both domestically and internationally. Even for these premium berries, prices were extremely low, as shown in the graph below.

The early start of harvesting also led to an early end of the mass season. By mid-August, the season had ended for most farmers, allowing blueberry prices to recover somewhat and even slightly exceed 2022 levels. However, the average prices for July and August 2024, when up to 90% of the crop is harvested, were the lowest for all years.

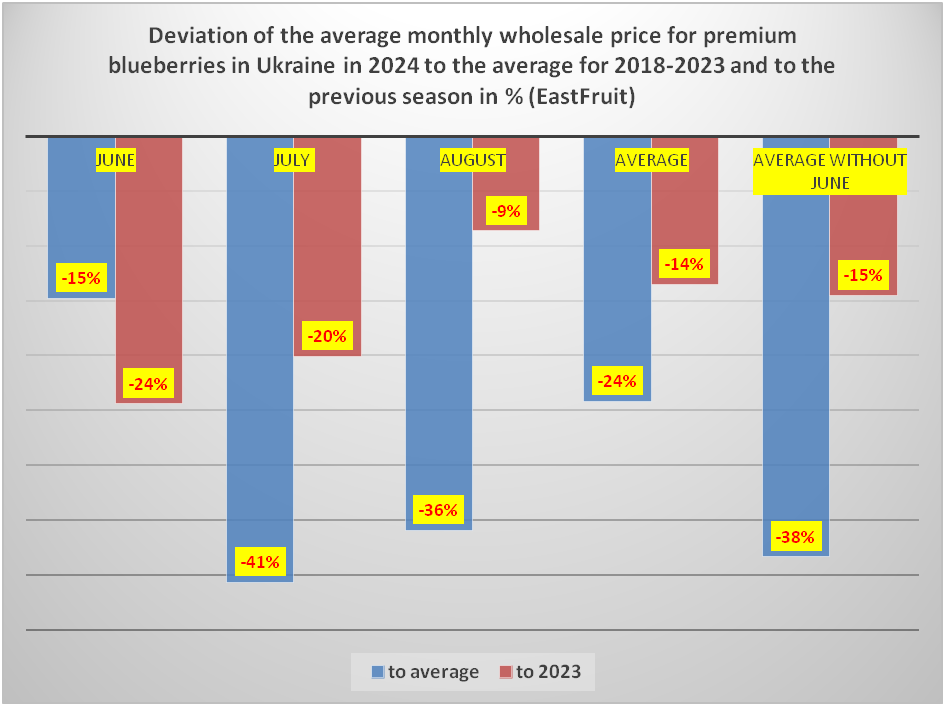

The following graph clearly demonstrates the fall in blueberry prices in Ukraine. The average wholesale price for premium blueberries during the peak months was 39% lower than the average for the six previous seasons (2018-2023) and 15% lower than in the not very successful season of 2023. The sharpest price drop occurred in July, when the bulk of the crop is harvested.

The following graph clearly demonstrates the fall in blueberry prices in Ukraine. The average wholesale price for premium blueberries during the peak months was 39% lower than the average for the six previous seasons (2018-2023) and 15% lower than in the not very successful season of 2023. The sharpest price drop occurred in July, when the bulk of the crop is harvested.

“To assess the significance of the price decline for farmers, several additional factors should be considered. First, inflation, which was significant even for the US dollar, means that each year’s price reduction needs to be adjusted down by another 4-5 percentage points for a real comparable figure. Second, the growth of plantations’ productivity among most blueberry producers in Ukraine has somewhat increased production efficiency, partially compensating for losses from price reductions. Most blueberry plantations in Ukraine are only just entering full fruiting. However, it is already clear that further price declines will make cultivation much less profitable for small farms that cannot directly access foreign markets and could even force some of them out of business”, says Andriy Yarmak, Economist of the FAO Investment Centre.

Although the blueberry season is not yet completely over, as Ukraine continues to export and sell berries domestically in September and even some volumes in October, the interim results of the season will be very close to the final ones. This year, prices in September and October may be quite high because, despite the recovery of blueberry production in Peru, mass shipments from this country to Europe will be delayed. However, blueberry production in Europe and competition from third countries such as Morocco, Georgia, and even African countries continue to grow, which will keep pressure on prices in the long run.

Maintain full control over fruit and vegetable prices in Turkey, Egypt, Ukraine, Uzbekistan, Russia, Moldova and other markets subscribing to EastFruit Premium.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.