EastFruit reports that the Georgia’s active blueberry picking season has already been over for two weeks. Farmers and experts generally assess the 2023 season as positive compared to the previous year. The weather was more favorable for blueberry harvesting, production and export increased significantly, as expected from the young industry. Additionally, prices did not experience as dramatic decline as in 2022, but the decline was still significant, and some producers spoke about price speculation on the market. Georgia exported few quantities to EU and Arabic markets, although 94% of the export was in russia.

The 2023 season started on time, right at the beginning of June, which was a promising start. Unlike the previous year, there were no extended rain periods during the main harvesting in June, but towards the end of the month, rain caused certain issues. Zviad Bobokashvili, an industry expert, pointed out that rains lasting more than two days are particularly problematic for blueberries. They can cause the berries to become overripe and soft, leading to losses since such produce is unsuitable for prolonged transportation. Additionally, these rains resulted in smaller berries during the final pickings.

Apart from rain, excessive heat is also a concern for berries. Heat can negatively affect the crop, causing the berries to ripen faster. According to Bobokashvili, there were two occasions this season in the western blueberry-growing regions of Georgia when temperatures reached 32 degrees Celsius during picking time.

Read also: Georgia’s Blueberry Boom: Record Exports and Market Expansion Signal Success

At the start of the 2023 season, the industry representatives projected blueberry production to reach 3000 tons in Georgia. The rise in production this season has served as a clear indicator to producers that competition in both local and global markets is intensifying. Due to this increased competition, Bobokashvili anticipates a decrease in the pace of planting new blueberry orchards in Georgia in the upcoming years. Instead, there will be a focus on early varieties and those with greater caliber and firmness, better suited for export.

The price of blueberries at the beginning of the season, according to EastFruit price monitoring, ranged between $7-$8 per kg, but it fell to $2.7 at the season’s peak. While some farmers expressed concerns about price speculation on the market, many expected prices to decline as the season progressed and more blueberries were sold on the market. Often small-scale producers were in unfavored conditions on the market, as they didn’t have the possibility to store the harvest in their own or rented cold storage and were forced to sell fewer quantities at less price.

Georgian blueberry exports broke records.

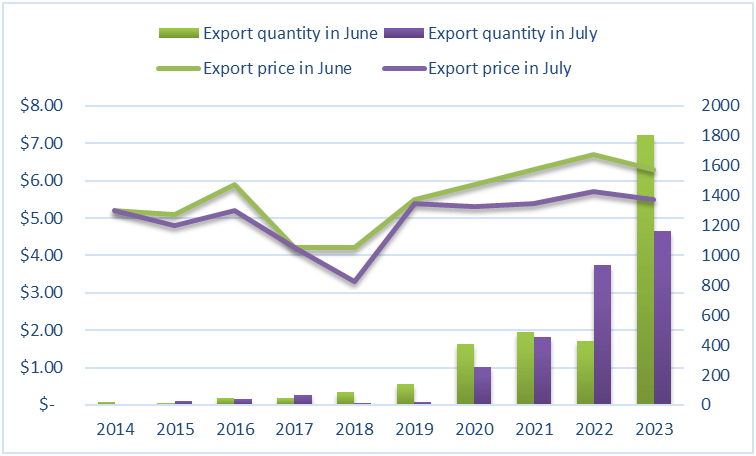

Blueberry exports from Georgia – quantities and prices

Data source: Ministry of Finance of Georgia

In 2023 Georgia didn’t have delays similar to 2022, therefore, exports were higher in June, when 1800 tons of blueberries were exported. The volume reduced approximately by 35% in July compared to June. As in previous seasons, earlier exports were valued higher. Usually, competition with belarus in the russian market increases in July. According to the official trade data, the average export price for Georgian blueberries amounted to $6.30/kg in June. The price was 13% lower in July.

Overall, Georgia exported about 2970 tons of blueberries in 2023, 2.2 times more than the previous record set in 2022. Blueberry exports in 2023 generated an income of $17.7 million, which is equal to the income from three previous seasons summed together. Of course, increased production and hence the export volumes were major factors in this, but it is worth noting that the export prices in US Dollars were the second best in Georgia’s history.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.