In an exclusive interview with EastFruit, ShotaTsukoshvili, CEO of the Georgia Blueberry Growers Association (GBGA), discusses Georgia’s strategic moves to become a top player in the blueberry industry. Tsukoshvili highlights how Georgia’s unique harvest window, expanding variety selection, and entry into European markets are reshaping the industry. With a vision for expanding cultivation into mountainous regions and tapping into processing potential, Georgia aims to secure its spot on the world’s blueberry map.

Georgia’s Blueberry Industry on the Rise: From Strategic Markets to Mountainous Expansion – An Interview with Shota Tsukoshvili, CEO of the Georgia Blueberry Growers Association

Georgia’s Blueberry Industry on the Rise: From Strategic Markets to Mountainous Expansion – An Interview with Shota Tsukoshvili, CEO of the Georgia Blueberry Growers Association

EastFruit: Which countries do you consider your main competitors in the blueberry market?

Tsukoshvili: Over the past couple of years, Georgia has become an important player globally among blueberry producing countries. The appealing harvesting season from May to July and congenial geographic location to export blueberries in EU and far east make commercial blueberry production interesting investment opportunity. The global blueberry industry is not stable due to climate change that causes overlapping of seasons in different producing areas. Georgia doesn’t have direct competitors on blueberry market as during the normal season, Spain and Morocco end their production before Georgia begins. Serbia and Romania are 2-3 weeks later on the market than Georgia so whenever there is a gap on blueberry supply, Georgia has competitive advantage on a global blueberry market. However, fluctuating climate conditions in Southern and Northern hemisphere causes overlapping of seasons sometimes resulting in oversupplying at the end of May. Warmer climate in Northern Europe can create earlier harvest of blueberries creating challenges for Georgia during the peak season in June. Georgia’s geographic location enables farmers to export blueberry in Asia, EU and Gulf countries efficiently to avoid hyper-competition in the market.

Growing Variety: The Shift Toward High-Quality Blueberries in Georgia

Growing Variety: The Shift Toward High-Quality Blueberries in Georgia

EastFruit: Which blueberry varieties are the most popular in Georgia, and why?

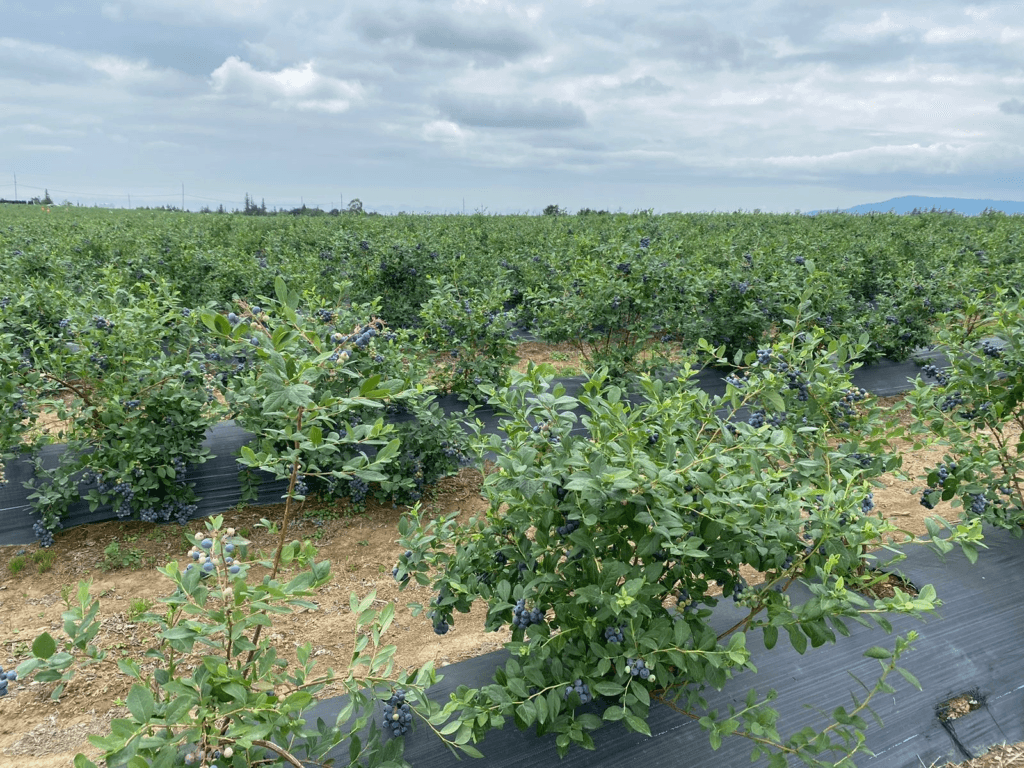

Tsukoshvili: Blueberry is a new crop for Georgia with cultivation of commercial orchards accelerating after COVID-19 pandemic. New mid and high chill varieties from Fall Creek (Suziblue, Miss Alice Mae, Miss Jackie, Blue Ribbon, Top Shelf), Fall Creek collection and Sekoya Club varieties are most popular in Georgia. In addition to that, the recent trials in Georgia of low-chill blueberry varieties under tunnels offer opportunity for the country to further diversify product line and make Georgia one of the few countries offering low, mid and high chill blueberry varieties ripening from Mid-May to end of July. Consumer preferences toward blueberries have shifted toward crunchier and tastier blueberries with improved flavor that make blueberries superfruits and puts it in snacking category in many countries. Therefore, adhering global industry trends and changing varieties is also a challenge in Georgia’s relatively new blueberry industry because majority of small and mid-scale orchards cultivated 5-10 years ago are comprised with old varieties such as O Neal, Blue Gold, Blue Crop, etc.

Reducing Overdependency: New Markets for Georgian Blueberries

EastFruit: Do you see high dependence on a single market as a challenge for the industry?

Tsukoshvili: The overdependency on the Russian market has historically been challenge for Georgia’s blueberry industry with 90%+ of exports going to a single market. The foundation of Georgia Blueberry Growers Association and core purpose of this organization is to diversify export markets to new Asian and EU countries and as a result diminish Russian market dependency.

In 2023 and 2024, GBGA members have managed to open up EU market for Georgian growers with historic exports volume happening during 2024 season with 500+ tons export to Germany, Poland and UK.

GBGA’s goal is to explore high value markets in EU and Asia to enable Georgian growers to enter the new markets with superior quality fruit. Association’s vision is to put Georgia on a map of blueberry producing countries and improve technical knowledge in the field locally.

A Milestone Year for Exports: Breaking into European Markets in 2024

A Milestone Year for Exports: Breaking into European Markets in 2024

EastFruit: In 2024, there was a significant breakthrough in the export of Georgian blueberries to European markets. What contributed to this success, and do you expect the export volumes to continue growing?

Tsukoshvili: The establishment of Georgia Blueberry Growers Association as an organization acting in the interest of growers enabled farmers to make the breakthrough in exports in 2024. GBGA management efficaciously coordinated 2024 exports by making information flow in the industry transparent and fast process. The centralized system for sales and logistics planning contributed to the success. The strong collaboration with Georgian state projects and USAID agricultural programs played a meaningful role in this success. From the customer’s side, the wide range of different varieties of blueberries that meet global standard of crunchiness, shelf-life, taste and flavor have created opportunity to market penetration in EU. GBGA member orchards expect to double export volumes annually over next 3 years with 1000 tons in 2025 and reaching 10,000+ tons by 2028. Country will produce 25 000 tons for 2028. 10 000 will be only association member’s production and export.

Adding Value to Second-Grade Berries: Georgia’s Growing Processing Industry

Adding Value to Second-Grade Berries: Georgia’s Growing Processing Industry

EastFruit: With the increase in production, the amount of substandard berries also rises. Is the blueberry processing industry developing in Georgia, and if so, what types of processing are being implemented?

Tsukoshvili: The blueberry processing industry is on the rise in Georgia with association, donor organizations and government agencies cooperating to find an effective value-chain solution for second class blueberries suitable for processing. The specific details about the types of processing are still under development, however, the industry expects to introduce several different value-added products in the future with effective business models to enable farmers sell second class blueberries at European level market price. These products will help reduce waste and utilize substandard berries that may not be suitable for fresh export markets. We are in the process of finding partners and have already held meetings with Chilean and European companies in the same sector to discuss potential cooperation.

Investing in the Future: Expanding Georgia’s Blueberry Production to New Regions

Investing in the Future: Expanding Georgia’s Blueberry Production to New Regions

EastFruit: Is the trend of increasing plantation areas continuing, and how many new hectares are being planted annually?

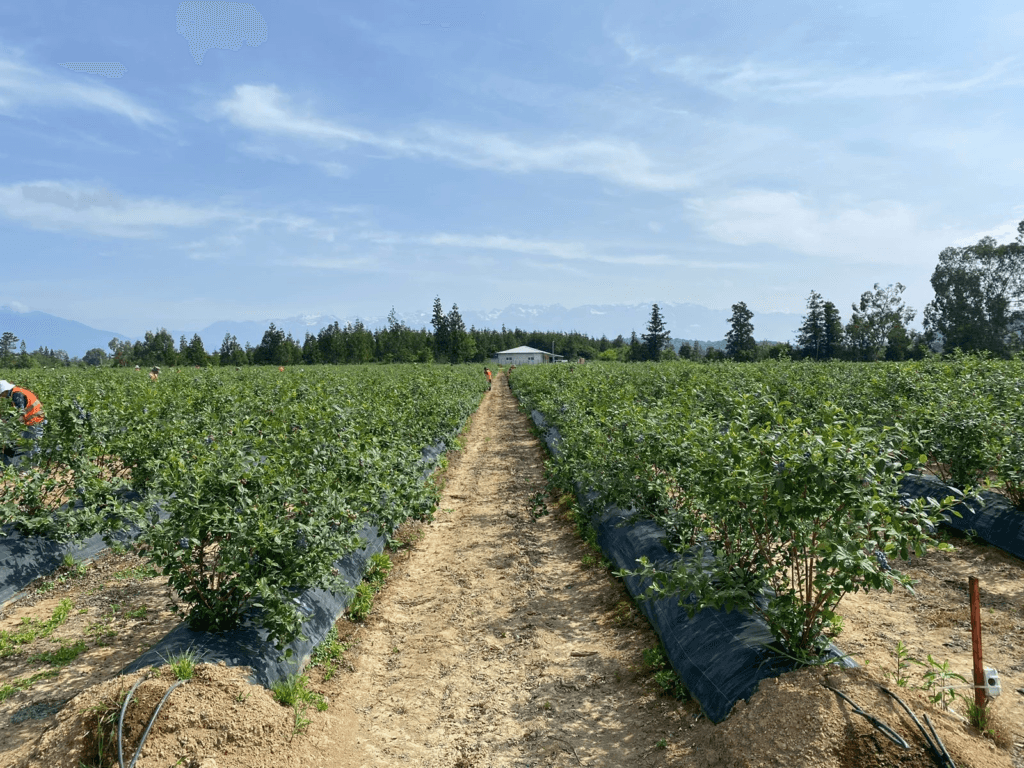

Tsukoshvili: Blueberries are regarded as high value superfruits in Georgia and an appealing investment opportunity as Government Subsidy Loans, grants and USAID programs are all supporting agribusiness in this direction. Georgia has already surpassed 3,000 hectares milestone in terms of cultivated area, however, the investment in blueberry orchards hasn’t decelerated. Around 300 hectares of new plantations are added annually. GBGA management sees further expansion opportunities for Georgia blueberry industry by expanding the production into mountainous areas with different harvest window. Currently, blueberries are grown in three coastal regions in Georgia. The major challenge for Georgia’s blueberry industry is a short 2 months season from mid-May to sometimes mid-July. Georgia has opportunity to expand production in eastern part of the country and into mountainous regions to expand the harvesting season to early September. The rising global consumer demand and introduction of blueberries into non-traditional markets such as India, South Korea, Vietnam, etc. make blueberry farming interesting opportunity for investments.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.