The European potato market has been in turmoil since the beginning of summer, with participants unable to agree on what to expect from the main potato season of 2024/25. Issues with seed potatoes and adverse weather conditions this summer are juxtaposed with forecasts of record expansion of potato acreage in the EU. The situation in Eastern Europe remains even more uncertain, although Ukraine has already started importing food potatoes from Lithuania and Poland in September, which is atypical for this market at this time.

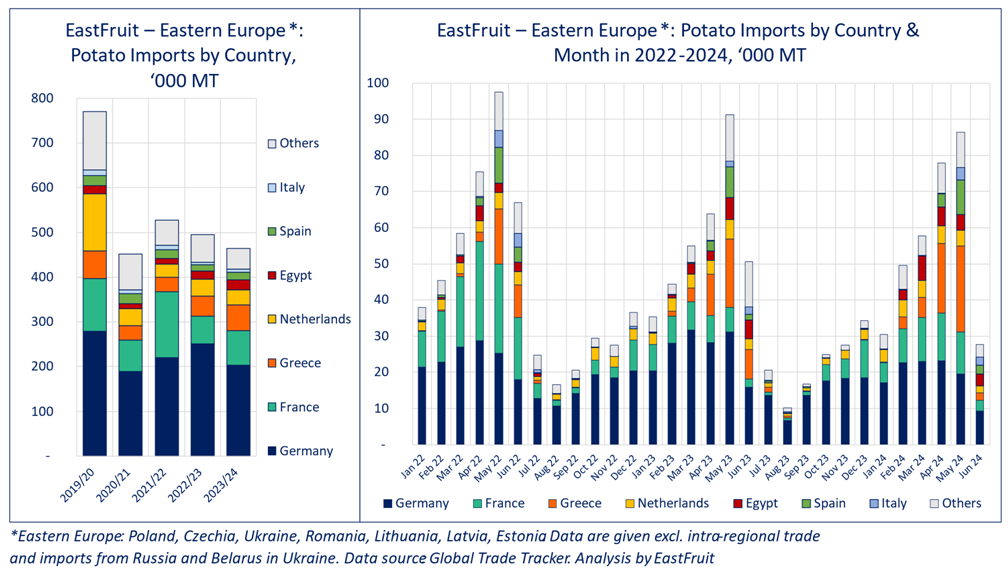

Meanwhile, suppliers from southern countries are evaluating their export prospects to the European market as the new year approaches. For instance, Egyptian exporters, according to EastFruit, managed to deliver a record volume of food potatoes to Eastern Europe in the 2023/24 season (July-June) and are keen to expand their presence in the upcoming season.

To briefly recap the chronology of events in the European potato market: In early July this year, the North-Western European Potato Growers Foundation (NEPG) reported challenging weather conditions for potato growers in the four main producing countries (Belgium, the Netherlands, France, and Germany) and significant quality issues with the produce. Nevertheless, the organization expects a substantial expansion of potato acreage in 2024, estimating a 7% increase in September, which should boost production to 22.7 million tons.

To briefly recap the chronology of events in the European potato market: In early July this year, the North-Western European Potato Growers Foundation (NEPG) reported challenging weather conditions for potato growers in the four main producing countries (Belgium, the Netherlands, France, and Germany) and significant quality issues with the produce. Nevertheless, the organization expects a substantial expansion of potato acreage in 2024, estimating a 7% increase in September, which should boost production to 22.7 million tons.

This anticipated figure is nearly a record for the past five years, indicating that Western Europe should harvest more than enough potatoes. Similarly, Poland reported an expansion of potato acreage in July, although the quality of the harvested crop remains in serious question. The negative impact of weather conditions is compounded by the delayed effects of the crisis in the seed potato market.

Thus, the main potato market in the EU faces the threat of a large supply of low-quality produce that needs to be sold quickly. Additionally, there is little hope for increased demand from potato processors – this segment has already emerged from the COVID crisis but has no further prospects for increasing processing volumes amid the stagnating EU economy.

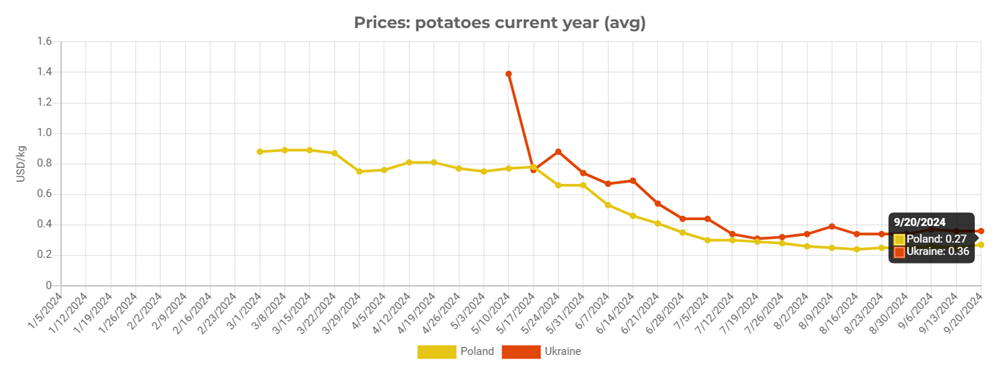

This situation may explain the initial attempts to quickly export potatoes to the Ukrainian market, where weather conditions were also far from ideal, and industry representatives began raising concerns in the summer. Whether there is indeed a catastrophe in potato production in Ukraine will only become clear over time, as the harvest campaign continues. However, the prevailing supply of cheaper potatoes in Western European countries is likely to increase here over time. For example, currently, potatoes in Ukraine are on average a third more expensive than in Poland.

This creates rather uncertain market prospects for the second half of the season in Northern European countries. On one hand, demand for imported potatoes in many countries (Ukraine, Romania, Czech Republic, etc.) is expected to remain high. On the other hand, much of this demand will be met by last year’s harvest from Western EU countries, leaving less room for maneuver for exporters of the new crop (Greece, Spain, Italy, Egypt, etc.).

This creates rather uncertain market prospects for the second half of the season in Northern European countries. On one hand, demand for imported potatoes in many countries (Ukraine, Romania, Czech Republic, etc.) is expected to remain high. On the other hand, much of this demand will be met by last year’s harvest from Western EU countries, leaving less room for maneuver for exporters of the new crop (Greece, Spain, Italy, Egypt, etc.).

In the last season (July 2023 – June 2024), Egypt exported a record 23.4 thousand tons of potatoes to major Eastern European countries. Egyptian exporters either set records or came close to them in the Czech Republic, Lithuania, Estonia, Latvia, Poland, and Romania, and in Ukraine, they were second only to the 2019/20 season in terms of volume. Moreover, Egyptian produce, albeit in smaller volumes, was present in Eastern Europe even before the record last season, with exports ranging from 11 to 19 thousand tons.

In other words, the Eastern European market will remain attractive for Egyptian exporters in the new season, but operating conditions may become tougher due to potential increased competition from Western EU suppliers. Additionally, the seed potato market crisis has also affected Egypt, which may result in a lower supply of export-quality potatoes in the country. On the other hand, Egypt and, for example, Germany will compete in somewhat different segments in Eastern Europe, as Egyptian produce is often sold as “early” or “new” potatoes.

It is worth noting that the prospects of the Eastern European market for suppliers of vegetables, potatoes, fruits, and berries from Egypt and Morocco will be discussed in detail during the online training “Navigating the Eastern European fresh produce market. Opportunities for Egypt and Morocco.” The training will take place on October 1, and in November, a trade mission of Egyptian and Moroccan exporters will be held in Warsaw, Poland. The registration form and training program are available on the website.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.