The current landscape of raspberry production and pricing presents a nuanced picture for the United States market, reflecting fluctuations in volume and supply dynamics, FreshFruitPortal notes.

According to recent data from the USDA, the raspberry volume available in the market is notably constrained compared to previous seasons. Volume saw approximately a 25% decrease compared to last year’s statistics for week 10.

Mexico emerges as a pivotal player in supplying the U.S. raspberry market. The country contributes a significant amount of the raspberry volume necessary to meet U.S. demand. This year, weather conditions delayed onset of the Mexican season by a span of two to three weeks.

Read also: Ukraine increased exports of frozen raspberries to the USA 6-fold in 2023

Southern California falls in tandem with Mexican production. The region has traditionally been a significant raspberry producer but remains notably subdued. Despite challenges posed by fluctuating supply, raspberry demand has grown consistently in recent years. The trend relates, in part, to increased accessibility of the fruit.

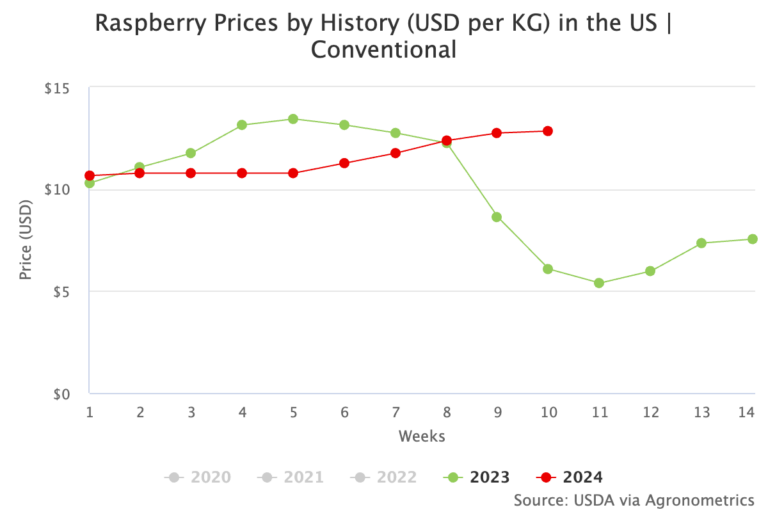

The prevailing scenario of constrained supply has translated into stronger pricing trends, with prices remaining elevated over the past three to four weeks.

Week 10 saw pricing at $12.84 per kg, more than double the pricing of the same period in 2023. A gradual shift in pricing dynamics is expected as the spring crop gains momentum. Increased volumes will likely exert downward pressure on prices.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.